Introduction

When it comes to protecting your assets and ensuring peace of mind, comprehensive insurance coverage is an invaluable tool. This type of insurance goes beyond the basics and offers broader protection for a wide range of risks and situations. Understanding the importance of comprehensive insurance coverage and the benefits it provides is essential for individuals and businesses alike.

Understanding the importance of comprehensive insurance coverage

Comprehensive insurance coverage provides a higher level of protection compared to standard insurance policies. It covers a wide array of risks, including damage to your property or vehicle, theft, vandalism, natural disasters, and more. By having comprehensive coverage, you can protect yourself from unforeseen events and minimize your financial burden in case of a loss.

Benefits of having comprehensive insurance

- Peace of mind: Comprehensive insurance coverage gives you peace of mind, knowing that you are protected against various risks and potential financial losses.

- Protection for valuable assets: Whether it’s your home, vehicle, or business property, comprehensive coverage ensures that your valuable assets are well protected.

- Financial security: In the event of a covered loss, comprehensive insurance coverage can help you avoid significant financial setbacks.

- Flexibility: Comprehensive insurance policies can be tailored to your specific needs, allowing you to choose the coverage that best suits your requirements.

By investing in comprehensive insurance coverage, you can safeguard your assets and enjoy the peace of mind that comes with knowing you are protected against various risks and uncertainties. So, don’t underestimate the value of comprehensive insurance when it comes to protecting what matters most to you.

Types of Coverage

Property coverage: Protecting your assets

Comprehensive insurance coverage is essential for any business. One of the key types of coverage is property coverage, which protects your physical assets. This includes your building, equipment, inventory, and other property. With property coverage, you can have peace of mind knowing that if your assets are damaged or destroyed due to events like fire, theft, or natural disasters, your insurance will help with the costs of repair or replacement. It’s important to carefully evaluate the value of your property and choose coverage that adequately protects your assets.

Liability coverage: Safeguarding against financial risks

Another important type of coverage is liability coverage. This protects your business against financial risks arising from claims of property damage, bodily injury, or personal injury caused by your business activities. If someone sues your business for damages, your liability coverage can help cover legal fees, settlements, and other expenses. It’s crucial to assess the potential risks your business may face and choose liability coverage that provides sufficient protection. Without proper liability coverage, a lawsuit could lead to significant financial strain or even bankruptcy.

Auto Insurance

Comprehensive coverage for vehicles: What it includes

When it comes to protecting your vehicle, comprehensive coverage is an essential part of your auto insurance policy. It provides coverage for damages to your vehicle that are not caused by collisions. This can include theft, vandalism, fire, natural disasters, and more. Comprehensive coverage ensures that you are financially protected from unexpected events that can result in costly repairs or even the loss of your vehicle.

Additional coverage options for automobiles

In addition to comprehensive coverage, there are other additional coverage options that you may want to consider for your automobile insurance. These options can provide extra protection and peace of mind in different situations.

- Collision coverage: This coverage helps pay for damages to your vehicle that occur as a result of a collision, regardless of fault. It can cover the cost of repairs or even the replacement of your vehicle.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It can help cover medical expenses, property damage, and other losses.

- Rental car coverage: If your car is being repaired after an accident, rental car coverage can provide reimbursement for the cost of renting a vehicle while yours is out of commission.

Having a comprehensive insurance coverage not only safeguards your vehicle but also provides valuable protection against unforeseen events. Make sure to review your policy and consider these additional coverage options to ensure that you have the right level of protection for your automobile.

Home Insurance

Comprehensive coverage for homeowners: What it covers

Comprehensive coverage for homeowners’ insurance provides financial protection against various risks that may damage or destroy your home. This includes coverage for damage caused by natural disasters, fire, theft, vandalism, and liability for accidents that occur on your property. Additionally, comprehensive coverage often includes coverage for personal belongings such as furniture, electronics, and clothing. It’s important to review your policy to understand the specific coverage limits and any exclusions.

Additional coverage options for home insurance

In addition to the basic coverage provided by comprehensive home insurance, there are several additional coverage options you may consider. These options include:

- Valuable items coverage: This provides additional coverage for valuable items such as jewelry, artwork, and collectibles that may exceed the limits of your standard policy.

- Flood insurance: Flood damage is typically not covered by standard home insurance policies, so it’s important to consider adding flood insurance if you live in a flood-prone area.

- Earthquake insurance: If you live in an area prone to earthquakes, it’s wise to consider adding earthquake insurance to your policy.

- Home business coverage: If you run a business from your home, you may need to add additional coverage to protect your business property and liability.

By understanding the true value of a comprehensive home insurance coverage and considering additional coverage options, you can ensure that your home and belongings are protected against potential risks and provide yourself with peace of mind.

Health Insurance

Comprehensive health insurance: Ensuring comprehensive medical coverage

When it comes to protecting your health and finances, comprehensive health insurance is essential. This type of coverage provides a wide range of medical benefits that go beyond basic hospital visits. With comprehensive health insurance, you can have peace of mind knowing that you are covered for preventive care, prescription medications, specialist consultations, and much more. It offers financial protection against unexpected medical expenses and gives you access to quality healthcare when you need it the most.

Additional coverage options for health insurance

In addition to the comprehensive coverage mentioned above, many health insurance plans offer additional coverage options. These can include dental and vision care, mental health services, maternity coverage, and alternative therapies like acupuncture and chiropractic treatments. Having these additional coverage options allows you to customize your insurance policy to meet your specific needs and preferences. It ensures that you have access to the necessary healthcare services and treatments to maintain your overall well-being.

By investing in comprehensive health insurance and exploring additional coverage options, you can safeguard yourself and your family against unforeseen health issues. It provides you with the flexibility to choose the healthcare services that are most important for you, ensuring that you receive the highest level of care and support. So don’t wait any longer, prioritize your health and secure comprehensive health insurance coverage today.

Considerations

Factors to consider when choosing comprehensive insurance coverage

When deciding on comprehensive insurance coverage, it is important to consider a few key factors. Firstly, assess the value of your assets and determine the level of coverage that adequately protects your investments. Additionally, take into account the potential risks and hazards that are prevalent in your area, such as natural disasters or theft. Evaluating these factors will help you choose the right comprehensive insurance policy that provides sufficient coverage for your specific needs.

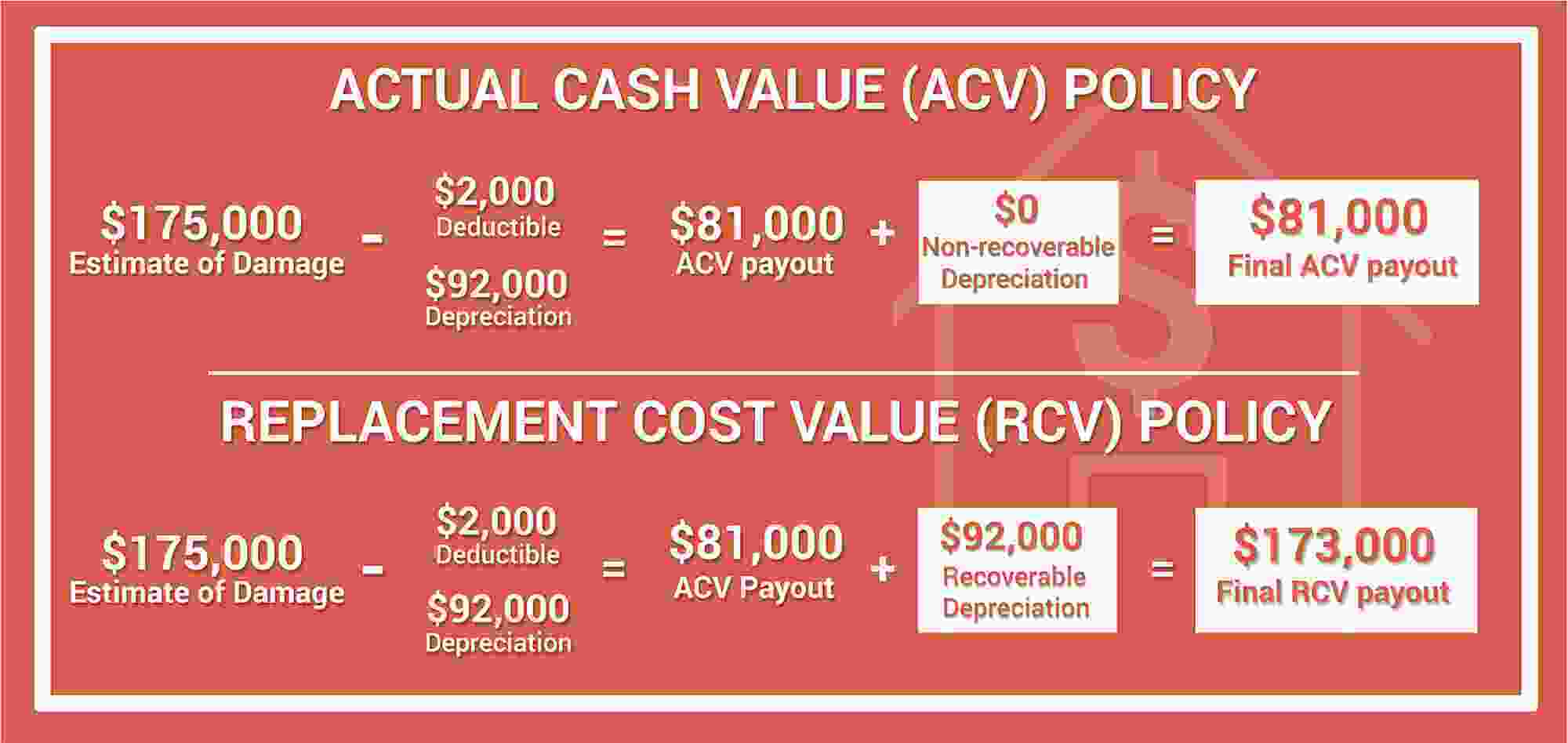

The role of deductibles in comprehensive insurance policies

Understanding the role of deductibles in comprehensive insurance policies is essential. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Higher deductibles often come with lower insurance premiums, while lower deductibles offer more immediate coverage but typically come with higher premiums. Consider your financial situation and risk tolerance when deciding on the deductible amount that works best for you.

Remember, comprehensive insurance coverage provides protection against a wide range of risks, including theft, fire, vandalism, and natural disasters. By carefully considering the factors mentioned above and understanding the role of deductibles, you can ensure that you have the right comprehensive insurance coverage to safeguard your assets and provide peace of mind.

The true value of comprehensive insurance coverage: Peace of mind and financial security

Comprehensive insurance coverage provides more than just protection for your assets. It offers peace of mind, knowing that you are financially protected in case of unexpected events such as accidents, natural disasters, or theft. With comprehensive coverage, you can rest assured that your property, vehicles, and other valuable assets are fully protected, allowing you to focus on what matters most. It provides a safety net that helps you recover and rebuild without worrying about the financial burden. Comprehensive insurance coverage is an investment in your peace of mind and long-term financial security.

Taking the necessary steps to obtain comprehensive coverage

Obtaining comprehensive insurance coverage requires a few essential steps. First, assess your insurance needs and the types of coverage you require. Then, research reputable insurance providers and compare their policies, costs, and customer reviews. Once you have selected a provider, reach out to them to discuss your specific coverage needs and obtain a customized quote. Remember to review the policy details carefully and ask any questions you may have. Finally, once you are satisfied with the coverage and terms, proceed with the application process, providing all necessary documentation and paying the required premiums. With these steps, you can obtain comprehensive insurance coverage that offers the peace of mind and financial security you deserve.