When it comes to running a successful business, one of the biggest challenges is managing cash flow. Late payments from customers can cause significant financial strain, making it difficult to cover expenses and fuel growth. That’s where factoring companies come in. In this blog post, we will explore what factoring companies are, how they can help your business, and why you should consider utilizing their services. With the power of factoring, you can unlock the funds tied up in unpaid invoices and improve your business’s financial stability. So, let’s dive in and discover how factoring companies can be a game-changer for your business.

I. Introduction to Factoring Companies

What is Factoring?

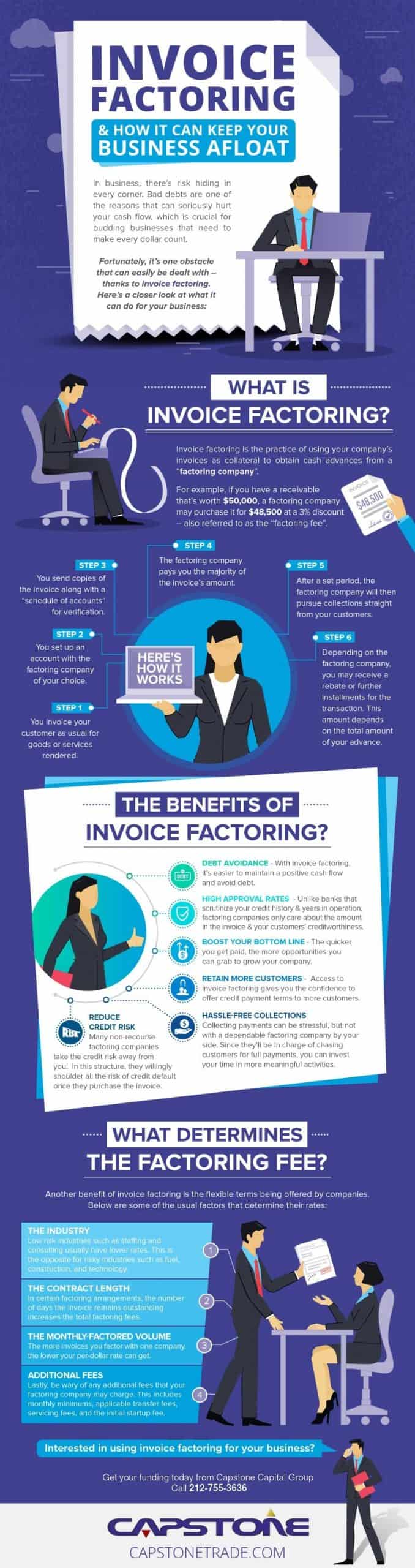

Factoring is a financial service in which a business sells its accounts receivable (invoices) to a factoring company at a discounted rate in exchange for immediate cash. The factoring company then collects the full payment from the business’s customers. This allows businesses to access cash quickly, improve their cash flow, and avoid waiting for their customers to pay their invoices. Factoring is commonly used by businesses that have long payment terms or need immediate cash for operational expenses or growth opportunities.

Here are the key points to know about factoring:

- Factoring provides immediate cash flow: By selling their invoices to a factoring company, businesses can access cash quickly instead of waiting for their customers to pay.

- It improves cash flow and working capital: Factoring can help businesses pay suppliers, cover payroll, invest in new equipment, or take advantage of growth opportunities.

- Factoring companies handle collections: Once the invoices are sold, the factoring company takes over the responsibility of collecting payment from the business’s customers.

- It can help businesses with credit challenges: Factoring is based on the creditworthiness of the business’s customers, so it can be an option for businesses with less-than-perfect credit.

- Factoring is a flexible financing solution: Unlike traditional loans, factoring doesn’t require collateral or have strict credit requirements. It is a financing option that can grow with the business.

Overall, factoring can be a valuable financial tool for businesses looking to improve their cash flow and access immediate capital. By partnering with a reputable factoring company, businesses can receive the necessary funds to support their operations and fuel growth.

Why Businesses Use Factoring Companies

Businesses use factoring companies for several reasons:

- Cash flow improvement: Factoring allows businesses to access immediate cash by selling their accounts receivable. This helps to bridge the gap between invoicing and receiving payment, providing much-needed working capital.

- Working capital flexibility: Factoring provides businesses with the flexibility to convert their outstanding invoices into cash, which can be used for various purposes such as paying suppliers, investing in growth, or covering operating expenses.

- Quick and easy access to funds: Factoring companies offer a streamlined process that allows businesses to quickly convert their invoices into cash. This eliminates the need for lengthy approval processes and provides immediate funding.

- Risk mitigation: Factoring companies typically assume the credit risk associated with the accounts receivable they purchase. This can help businesses mitigate the risk of non-payment and bad debt, allowing them to focus on their core operations.

- Access to expertise: Factoring companies often have extensive industry knowledge and expertise in credit management and collections. This can be valuable for businesses that may not have the resources or expertise to effectively manage their accounts receivable.

- Scalability: Factoring is a flexible financing option that can easily accommodate businesses’ growth. As sales increase, the available funding from factoring can also increase, providing businesses with the necessary capital to support their growth initiatives.

Here’s a list summarizing the reasons why businesses use factoring companies:

- Improve cash flow

- Gain working capital flexibility

- Access quick and easy funds

- Mitigate credit risk

- Tap into expertise

- Scale with business growth.

Benefits of Factoring Companies

Factoring companies offer a range of benefits to businesses, including:

- Improved Cash Flow: Factoring companies provide businesses with immediate access to cash by purchasing their accounts receivable. This helps businesses meet immediate financial obligations, such as paying suppliers or covering payroll.

- Faster Growth: By providing quick access to working capital, factoring companies can support business expansion and growth opportunities. Businesses can take on new projects, purchase inventory, or invest in marketing and sales initiatives.

- Reduced Risk of Bad Debts: Factoring companies take on the risk of customer non-payment, helping businesses mitigate the impact of bad debts. This allows businesses to focus on core operations and customer relationships, without the worry of late or non-payments affecting their cash flow.

- Professional Accounts Receivable Management: Factoring companies handle the collection of accounts receivable, saving businesses time and resources. They have expertise in credit management and can efficiently collect payments from customers, improving cash flow and reducing administrative burden.

- Flexibility: Factoring provides flexible financing options that grow with the business. Unlike traditional bank loans, factoring is based on the business’s sales volume, making it ideal for businesses with fluctuating revenue or seasonal sales patterns.

Here’s a summary of the benefits of factoring companies:

- Improved cash flow

- Faster growth opportunities

- Reduced risk of bad debts

- Professional accounts receivable management

- Flexible financing options

II. How Factoring Companies Work

The Factoring Process Explained

The factoring process involves a few key steps to help businesses improve their cash flow:

- Application: The business submits an application to the factoring company, including information about their outstanding invoices.

- Approval and Due Diligence: The factoring company reviews the application and conducts due diligence on the business’s customers. This step is crucial to assess the creditworthiness of the customer and determine the risk involved.

- Funding: Once approved, the factoring company advances a percentage of the invoice value, typically around 80% to 90%. The funds are usually made available within 24 to 48 hours.

- Collection: The factoring company takes over the responsibility of collecting the outstanding invoices from the business’s customers. They handle the payment collection process and ensure timely payment.

- Final Payment and Reserve Release: When the customer pays the invoice in full, the factoring company deducts their fees, typically a small percentage of the invoice value, and releases the remaining balance, known as the reserve, to the business.

It’s important to note that the factoring process can vary slightly between different factoring companies. Some companies may offer non-recourse factoring, where they assume the risk of non-payment by the customer, while others may offer recourse factoring, where the business remains responsible for any unpaid invoices.

Overall, the factoring process provides businesses with a convenient and efficient way to access immediate cash flow by leveraging their accounts receivable. It enables businesses to improve working capital, meet financial obligations, and invest in growth opportunities.

Types of Factoring Services

Factoring services come in various types, each tailored to meet specific business needs. Here are some common types of factoring services:

- Recourse Factoring: In this type, the business remains responsible for any unpaid invoices or delinquent accounts. If the customer does not pay, the business must buy back the invoice from the factoring company.

- Non-Recourse Factoring: With non-recourse factoring, the factoring company assumes the risk of non-payment. If the customer does not pay, the factoring company shoulders the loss instead of the business.

- Spot Factoring: Spot factoring allows businesses to choose which invoices they want to factor. This flexibility is useful for businesses that only require occasional or one-time access to cash.

- Invoice Discounting: Similar to factoring, invoice discounting enables businesses to access cash by selling their invoices. However, in this case, the business retains control over the collection process and remains responsible for managing their customer relationships.

- Construction Factoring: This type of factoring is specifically designed for construction companies. It takes into account the unique payment terms and challenges in the construction industry.

- International Factoring: International factoring is suitable for businesses that engage in importing or exporting goods. It helps to navigate the complexities of international trade and ease the cash flow strain caused by lengthy payment cycles.

Each type of factoring service has its advantages and considerations, making it important for businesses to carefully evaluate their needs and choose the best fit for their specific circumstances.

Eligibility Criteria for Factoring Services

When considering factoring services, it’s important to understand the eligibility criteria. Factoring companies generally look for businesses that meet certain requirements, including:

- Business Type: Factoring companies typically work with business-to-business (B2B) companies that sell products or services on credit terms. This can include industries such as manufacturing, distribution, staffing, and transportation.

- Account Receivables: Factoring companies evaluate the quality and value of your outstanding invoices. They will want to ensure that your customers have a good credit history and that the invoices are not encumbered by any legal disputes or liens.

- Sales Volume: Factoring companies may have a minimum sales volume requirement, which varies depending on the company. This is to ensure that the factoring relationship is financially viable for both parties.

- Creditworthiness: Factoring companies will also assess your business’s creditworthiness. This can include reviewing your company’s financial statements, credit history, and the creditworthiness of your customers.

- Length of Time in Business: Some factoring companies prefer to work with businesses that have been operating for a certain period of time, such as six months or one year. This requirement may vary depending on the factoring company.

- Personal Credit of Business Owners: In certain cases, factoring companies may consider the personal credit of the business owners, especially for small businesses or those with limited credit history.

It’s important to note that eligibility criteria can vary between factoring companies, so it’s essential to research and compare multiple providers to find the one that best fits your business’s needs and qualifications.

Here’s a quick summary of the eligibility criteria for factoring services:

| Eligibility Criteria |

|---|

| Business Type |

| Account Receivables |

| Sales Volume |

| Creditworthiness |

| Length of Time in Business |

| Personal Credit of Business Owners |

Ensuring that your business meets these criteria can help increase the likelihood of being approved by a factoring company and accessing the benefits of factoring services.

III. Top Factoring Companies in the Market

Company A: Overview and Services

Company A is a well-established factoring company with over 20 years of experience in the industry. They specialize in providing factoring services to businesses in various sectors, including manufacturing, distribution, and services. They offer a comprehensive range of factoring solutions, including invoice factoring, purchase order financing, and supply chain financing. With a strong network of funding sources and advanced technology, Company A is able to provide quick and reliable funding solutions to their clients. They pride themselves on their personalized approach to customer service, ensuring that each client receives tailored financial solutions to meet their specific needs. Additionally, Company A offers competitive terms and fees, making them a top choice for businesses looking to improve cash flow and accelerate growth.

Company B: Overview and Services

Company B is a leading factoring company that offers a range of services to help businesses improve their cash flow. They specialize in supporting small and medium-sized enterprises across various industries. With a strong reputation for reliability and customer satisfaction, Company B provides personalized solutions to meet each client’s unique needs. Their services include invoice factoring, credit protection, and accounts receivable management. They have a user-friendly online platform that makes it easy for clients to submit invoices and track their funding in real-time. Company B prides itself on its responsive customer support team and advanced technology, ensuring a seamless experience for their clients.

Company C: Overview and Services

Company C is a well-established factoring company with a wide range of services to meet the financing needs of businesses. They offer invoice factoring, which allows businesses to sell their unpaid invoices to the company in exchange for immediate cash. Additionally, they provide purchase order financing, enabling businesses to fulfill large orders without depleting their cash flow. With their extensive industry experience and reputation for excellent customer service, Company C is a reliable choice for businesses looking to improve their cash flow and accelerate growth.

Here’s a summary of Company C’s overview and services:

- Services: Invoice factoring, purchase order financing

- Expertise: Extensive industry experience

- Reputation: Well-established and trusted in the market

- Customer Service: Excellent customer support

- Technology: Utilizes advanced technology for seamless transactions

- Benefits: Helps businesses improve cash flow, accelerate growth, and take advantage of opportunities

- Eligibility: Works with businesses of various sizes and industries

- Terms and Fees: Competitive rates and flexible terms

- Industries Served: Wide range of industries including manufacturing, construction, and transportation

With their commitment to providing personalized financial solutions and their track record of success, Company C is a top choice for businesses seeking factoring services.

IV. Factors to Consider When Choosing a Factoring Company

Reputation and Experience

When considering factoring companies, reputation and experience are crucial factors to consider. A reputable factoring company will have a proven track record of success and a strong reputation within the industry. They should have a history of providing reliable and efficient factoring services to their clients.

Experience is also important because it often translates to expertise and knowledge in the field. An experienced factoring company will have a deep understanding of the unique challenges and needs of businesses in different industries. They will be well-equipped to handle various situations and provide tailored solutions to their clients.

When comparing different factoring companies, it is essential to consider their reputation and experience. Here’s a table comparing the reputation and experience of three factoring companies:

| Company | Reputation | Experience |

|---|---|---|

| Company A | Highly regarded in the industry | Over 20 years of experience |

| Company B | Well-known for exceptional customer service | Over 15 years of experience |

| Company C | Trusted by clients for reliability | Specializes in working with small businesses |

Choosing a factoring company with a strong reputation and extensive experience can give you peace of mind and confidence in their ability to meet your business’s factoring needs.

Terms and Fees

When considering factoring companies, it’s important to understand the terms and fees associated with their services. The terms typically include the duration of the factoring agreement, the percentage of the invoice that the company will advance, and the fee structure for their services. Fees can vary among different factoring companies, so it’s crucial to compare and evaluate them before making a decision.

Here are some key factors to consider regarding terms and fees when choosing a factoring company:

- Factoring Rate: This is the fee that the factoring company charges for their services, typically calculated as a percentage of the invoice amount. It can range from 1% to 5% or more, depending on various factors such as the industry, the creditworthiness of the customers, and the volume of invoices.

- Advance Percentage: The amount of the invoice that the factoring company will advance upfront can vary. It’s important to consider how much working capital you need immediately and choose a company that offers a satisfactory advance percentage.

- Duration of Agreement: Factoring agreements can be short-term or long-term, depending on your business needs. Short-term agreements are typically used for specific projects or periods of high growth, while long-term agreements provide ongoing funding for steady cash flow.

- Additional Fees: Some factoring companies may charge additional fees for services such as credit checks, administrative tasks, or customer notification. It’s important to clarify any potential additional fees before signing an agreement.

When comparing factoring companies, it’s recommended to request a proposal that clearly outlines the terms and fees associated with their services. This will allow you to make an informed decision based on your specific business requirements and financial goals.

Customer Support and Technology

When evaluating factoring companies, it is important to consider their customer support and technology offerings. A reputable factoring company should have robust customer support channels in place to assist their clients throughout the factoring process. This may include a dedicated account manager, a responsive customer service team, and online portals or platforms for easy access to account information.

Technology is also a key factor to consider. A factoring company that utilizes advanced technology can streamline the factoring process, making it more efficient and convenient for their clients. This may include features such as online invoice submission, automated payment notifications, and real-time reporting and analytics.

Here’s a comparison table of the customer support and technology offerings of three factoring companies:

| Company A | Company B | Company C | |

|---|---|---|---|

| Customer Support | Dedicated account manager, responsive customer service team | 24/7 customer support, online chat support | Account executives available for assistance, toll-free customer support hotline |

| Technology | Online portal for account management, real-time reporting and analytics | Mobile app for invoice submission, automated payment notifications | Advanced digital platform, integration with accounting software |

By considering the customer support and technology offerings of factoring companies, businesses can ensure that they will receive the necessary support and have access to streamlined processes that match their needs.

V. Case Studies: Success Stories of Businesses Using Factoring Companies

Company X: How Factoring Transformed Their Cash Flow

Company X, a small manufacturing business, was struggling with cash flow issues due to long payment cycles from their customers. They decided to work with a factoring company to improve their cash flow situation. By selling their accounts receivable to the factoring company, Company X was able to access immediate cash instead of waiting for their invoices to be paid.

The factoring company provided Company X with a percentage of the total invoice amount upfront, typically around 70-90%. This allowed Company X to meet their immediate financial obligations, such as paying suppliers and employees, without waiting for their customers to pay.

Not only did factoring improve Company X’s cash flow, but it also eliminated the need for them to chase after late payments. The factoring company took over the responsibility of collecting payment from the customers, freeing up valuable time and resources for Company X to focus on their business operations.

With a steady stream of cash coming in, Company X was able to take on larger orders and expand their production capacity. This ultimately led to increased revenue and growth for the company.

Overall, factoring transformed Company X’s cash flow situation and allowed them to stabilize their finances, avoid cash flow gaps, and fuel their business growth. It was a game-changer for their operations and helped them thrive in a competitive market.

Company Y: How Factoring Helped Them Expand Rapidly

Company Y, a growing business in the manufacturing industry, was able to expand rapidly with the help of a factoring company. By selling their accounts receivable to the factoring company, they were able to access immediate cash flow and use it to invest in new equipment, hire additional staff, and expand their production capabilities. The factoring company provided them with a flexible financing solution that allowed them to take advantage of new business opportunities without the need for traditional bank loans. This enabled Company Y to grow their customer base, increase sales, and ultimately achieve their expansion goals much faster than they would have been able to without the assistance of a factoring company.

| Company Y: How Factoring Helped Them Expand Rapidly |

|---|

| – Sold accounts receivable to access immediate cash flow |

| – Used funds to invest in new equipment and hire staff |

| – Expanded production capabilities and grew customer base |

Company Z: How Factoring Saved Them from Financial Crisis

Company Z: How Factoring Saved Them from Financial Crisis

Company Z, a small business in the manufacturing industry, found themselves in a financial crisis due to delayed payments from their customers. With their cash flow heavily impacted, they struggled to cover operational costs and meet their financial obligations.

In search of a solution, Company Z turned to a factoring company to help them overcome their cash flow challenges. By selling their accounts receivable to the factoring company at a discount, they were able to receive immediate funding for their outstanding invoices. This allowed them to access the working capital they needed to pay their suppliers, meet payroll, and keep their business running smoothly.

The factoring company not only provided the necessary financing, but they also took over the responsibility of managing and collecting the outstanding invoices. This alleviated the burden on Company Z’s internal resources and allowed them to focus on core business activities.

With the help of the factoring company, Company Z was able to navigate through the financial crisis and get back on track. They were able to stabilize their cash flow, improve their financial position, and regain control over their business operations.

Key Benefits:

- Immediate access to working capital

- Improved cash flow management

- Outsourced accounts receivable management

- Time and resource savings

- Ability to meet financial obligations and continue business operations

By leveraging the services of a factoring company, Company Z was able to overcome their financial crisis and position themselves for future growth and success. This success story highlights the value and importance of factoring companies in supporting businesses during challenging times.

VI. Common Misconceptions About Factoring Companies

Debunking Myths and Clarifying Facts

Debunking Myths and Clarifying Facts:

There are a few common misconceptions about factoring companies that need to be clarified:

Myth 1: Factoring is only for struggling businesses: This is not true. Factoring can be beneficial for businesses of all sizes and financial situations. It is not solely reserved for companies in financial crisis.

Myth 2: Factoring is a form of borrowing: Factoring is not a loan. It is simply an exchange of accounts receivable for immediate cash. Unlike a loan, factoring does not create debt or require repayment.

Myth 3: Factoring is only for businesses in certain industries: Factoring is not limited to specific industries. It can be beneficial for businesses across various sectors, including manufacturing, staffing, transportation, and more.

Myth 4: Factoring companies only work with large businesses: Factoring companies work with businesses of all sizes, from small startups to large corporations. The size of your business does not limit your eligibility for factoring services.

Myth 5: Factoring companies take control of your business: Factoring companies do not take control of your business. They simply provide a financial service by purchasing your accounts receivable. You retain control over your daily operations and decision-making.

By debunking these myths and clarifying the facts, businesses can better understand the benefits and potential of working with factoring companies.

VII. How to Select the Right Factoring Company for Your Business

Steps to Choosing the Best Factoring Company

When choosing the best factoring company for your business, it’s important to consider several factors:

- Determine your business needs: Identify the specific reasons why you need factoring services, such as cash flow management or expanding operations.

- Research and compare: Look for reputable factoring companies that specialize in your industry. Consider their experience, client reviews, and track record.

- Assess the services offered: Evaluate the range of factoring services provided by each company, such as recourse or non-recourse factoring, invoice management, and credit protection.

- Understand the terms and fees: Review the fees charged by each factoring company, including the discount rate, set-up fees, and any additional charges. Clarify their contract terms and conditions.

- Evaluate customer support and technology: Consider the level of customer support offered by the factoring company, including their responsiveness and availability. Assess their technological capabilities, such as online access to account information.

- Seek recommendations and referrals: Ask for recommendations from other businesses in your industry or consult with financial professionals who may have insights on reputable factoring companies.

- Schedule consultations: Arrange meetings or phone calls with potential factoring companies to discuss your specific needs and ask relevant questions. Inquire about their funding process, approval timeline, and the flexibility of their services.

- Request references: Ask for references from current or past clients of the factoring companies you are considering. This will give you an idea of their level of service and reliability.

- Review the agreement: Carefully review the factoring agreement before committing. Ensure that you understand all terms and conditions, including any termination clauses or penalties.

- Make a decision: After considering all the factors, choose the factoring company that best aligns with your business needs, offers competitive terms, and provides excellent customer support.

Remember, selecting the right factoring company requires careful consideration and research. By following these steps, you can make an informed decision that will positively impact your business’s financial health.

Questions to Ask Before Making a Decision

Before choosing a factoring company for your business, it’s important to ask the right questions to ensure they meet your needs and expectations. Here are some questions to consider:

- What is the fee structure? Ask about their rates, fees, and any additional charges to understand the cost involved.

- How long does the funding process take? Inquire about the time it takes for the factoring company to advance funds once invoices are submitted.

- What is their experience in your industry? Understanding the factoring company’s experience with businesses similar to yours can indicate their ability to handle your specific needs.

- What services do they offer? Ask about any additional services provided by the factoring company, such as credit checks, collections, or online account access.

- What are their customer support options? Inquire about the availability of customer support and the methods of communication that the factoring company offers.

- What technology or software do they use? Understanding the technology or software that the factoring company utilizes can help determine how efficiently they manage the factoring process.

- Do they have any minimum volume requirements? Some factoring companies may have minimum volume requirements, so make sure to inquire about these if they apply.

- What is their reputation in the industry? Research the factoring company’s reputation by reading reviews and testimonials or reaching out to their current clients for feedback.

- Are they members of any industry associations? Membership in reputable industry associations can signify the factoring company’s commitment to best practices and professional standards.

- Can they provide references from current or past clients? Requesting references can help you gain insights from other businesses that have worked with the factoring company before making a decision.

Asking these questions will provide you with a clearer understanding of the factoring company’s services, fees, reputation, and compatibility with your business needs. It’s essential to choose a factoring company that aligns with your objectives and contributes to the growth and success of your business.

VIII. Conclusion

Recap of the Benefits of Factoring Companies

Factoring companies offer numerous benefits to businesses, including:

- Improved Cash Flow: Factoring companies provide immediate cash for outstanding invoices, allowing businesses to access funds without waiting for payment from customers.

- Increased Working Capital: By converting accounts receivable into cash, factoring companies provide businesses with working capital to cover expenses, invest in growth, and seize new opportunities.

- Reduced Administrative Burden: Factoring companies handle the tasks of invoicing, credit checks, and collections, relieving businesses of time-consuming administrative tasks and allowing them to focus on core operations.

- Flexibility and Scalability: Factoring services can be tailored to meet the specific needs of businesses, whether they need financing for a single invoice or ongoing funding for multiple invoices. This flexibility allows businesses to scale and grow without constraints.

- Access to Expertise: Factoring companies have industry knowledge and expertise in managing credit risk, collections, and credit analysis. They can provide valuable insights and support to businesses in managing their receivables.

Here’s a summary of the benefits of factoring companies:

- Improved cash flow

- Increased working capital

- Reduced administrative burden

- Flexibility and scalability

- Access to expertise

Final Thoughts and Recommendations

In conclusion, factoring companies can be a valuable resource for businesses looking to improve their cash flow and maintain a steady working capital. When choosing a factoring company, it’s important to consider the reputation, experience, terms, fees, customer support, and technology offered by each provider. Additionally, companies should evaluate their specific needs and eligibility criteria to find the best fit. Before making a decision, it’s crucial to ask the necessary questions and thoroughly understand the benefits and limitations of factoring services. By choosing the right factoring company, businesses can effectively manage their finances, seize growth opportunities, and overcome financial challenges.