Introduction

Home insurance is a crucial aspect of home ownership that often goes overlooked. It’s not just about protecting one’s investment, but also about safeguarding the memories and values that make a house a home.

Why home insurance is important

The importance of home insurance cannot be overstated. It provides financial protection against disasters, covering everything from fire to theft. It’s not just about the building, but also the possessions inside it.

Understanding the basics of home insurance

At its core, home insurance covers the cost of repairing or replacing your home and its contents in case of damage or loss. It’s a safety net that gives homeowners peace of mind, knowing they are protected against unforeseen circumstances.

Assessing Your Insurance Needs

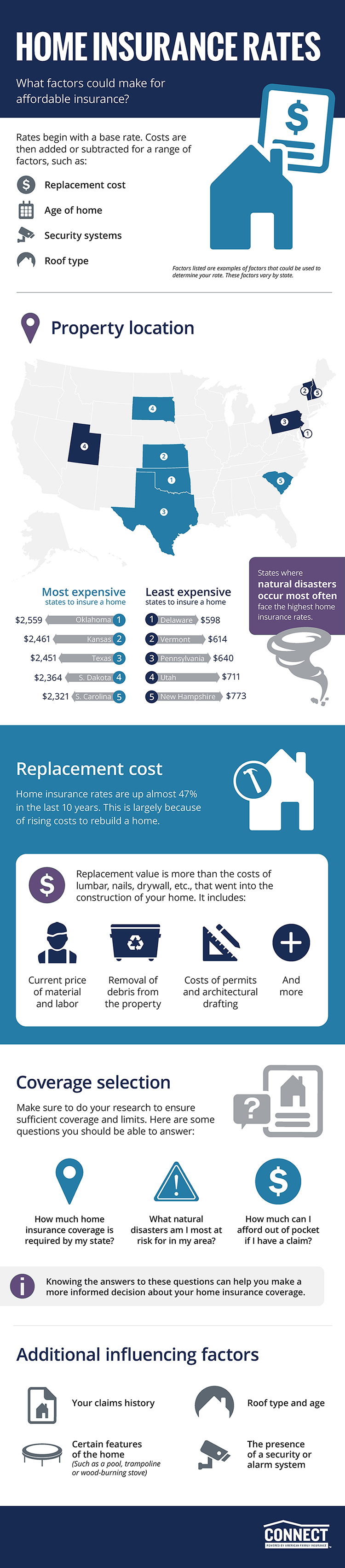

For homeowners, navigating the complex world of home insurance can be daunting. However, understanding the value of your home and belongings, and identifying potential risks and coverage gaps, is crucial.

Determining the value of your home and belongings

Know Your Worth: The first step is to accurately assess the value of your home and personal property. This includes everything from the structure itself to furniture, electronics, and personal items.

Identifying potential risks and coverage gaps

Spot The Gaps: Next, identify potential risks that could lead to loss or damage. This could range from natural disasters to theft. Then, ensure your policy covers these risks adequately. If not, you might need to adjust your coverage or consider additional policies.

In this way, homeowners can confidently navigate the world of home insurance, ensuring they are adequately protected against potential losses.

Types of Home Insurance Policies

Home insurance is a non-negotiable necessity for homeowners. It provides a safety net for your most valuable asset, your home.

Different types of home insurance policies available

There are several types of home insurance policies available, each tailored to suit different needs. These include HO-1, HO-2, HO-3, HO-5, HO-6, HO-7, and HO-8, each covering different levels of risks and damages.

Choosing the right policy for your needs

The choice of a policy depends on the homeowner’s unique needs and circumstances. For instance, if you live in an area prone to natural disasters, you might opt for a policy that offers comprehensive coverage for such events. Always remember to thoroughly read through your policy and understand what it covers before making a decision.

Coverage and Exclusions

Home insurance is a crucial aspect of homeownership. It provides a safety net for your most valuable asset, your home.

Understanding what is covered and what is not covered in your policy

Home insurance policies typically cover damage to the property and personal possessions resulting from specific events. However, it is essential to understand that not everything is covered.

Common exclusions to be aware of

There are common exclusions in most home insurance policies. These often include damage caused by floods, earthquakes, or routine wear and tear. It’s crucial to familiarize yourself with these exclusions to avoid unpleasant surprises when filing a claim.

Here’s a brief table summarizing the coverage and exclusions:

| Aspects | Explanation |

|---|---|

| Coverage | Home insurance policies typically cover damage to the property and personal possessions resulting from specific events. |

| Exclusions | Common exclusions often include damage caused by floods, earthquakes, or routine wear and tear. Familiarizing yourself with these exclusions can prevent unpleasant surprises when filing a claim. |

Additional Coverage Options

Home insurance is a complex world, but it doesn’t have to be a confusing one. With the right knowledge, homeowners can navigate this landscape with ease and confidence.

Exploring optional coverage options for added protection

Opting for additional coverage options can provide an extra layer of protection. These options could include coverage for valuable items, such as jewelry or artwork, or protection against specific risks like floods or earthquakes, which are not typically covered in standard policies.

Understanding the benefits of endorsements and riders

Endorsements and riders are amendments to the standard policy that provide additional benefits or coverage. These tools can be beneficial in customizing a policy to fit individual needs and circumstances. For instance, an endorsement could extend coverage to a home office or provide additional liability protection.

Remember, understanding your home insurance policy is crucial in ensuring you have the right coverage for your needs.