Introduction

Long-term care insurance is a vital tool that often gets overlooked in retirement planning. It’s a type of coverage that provides for the cost of long-term care beyond a predetermined period.

Importance of Long-Term Care Insurance in Retirement Planning

Retirement is supposed to be a time of relaxation, not worry. However, the rising costs of healthcare can be daunting. This is where long-term care insurance comes into play. It helps cover the costs of care that Medicare, Medicaid, and traditional health insurance typically don’t cover, such as assisted living, home care, and nursing home care. Having this coverage in place can make a significant difference in the quality of life during retirement years.

Understanding Long-Term Care Insurance

Long-Term Care Insurance, an essential tool in retirement planning, is designed to cover the costs of long-term care services. These services may include assistance with routine daily activities such as bathing, dressing, and eating, or even skilled nursing care.

Definition and Purpose of Long-Term Care Insurance

This insurance product is specifically tailored to cover the costs of long-term care services that are not typically covered by traditional health insurance or Medicare. It’s a proactive approach to ensure financial stability and peace of mind during the golden years.

The Need for Long-Term Care Insurance

Long-term care insurance is a critical tool in retirement planning. It’s designed to cover the costs of long-term care services that are not typically covered by traditional health insurance or Medicare. These may include assistance with routine daily activities like bathing, dressing, or eating.

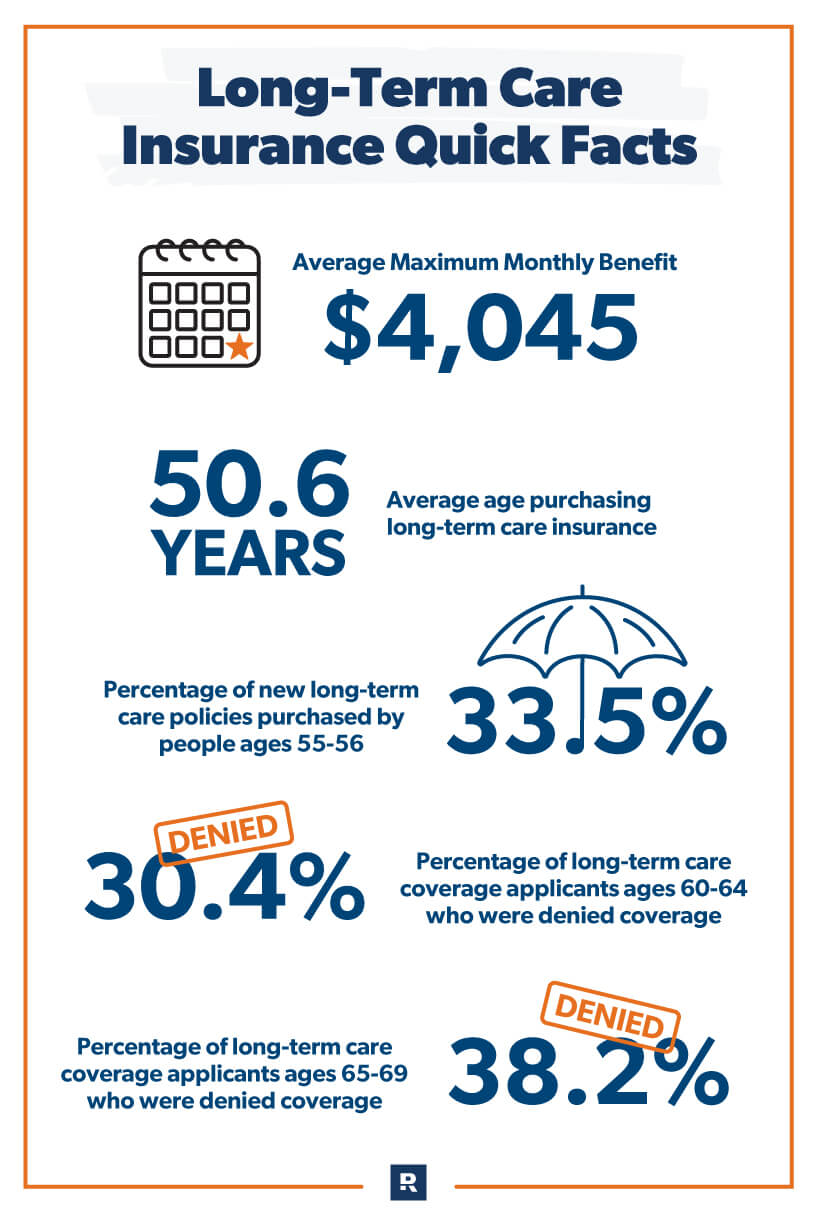

Statistics and Facts about Long-Term Care

According to statistics, about 70% of people turning age 65 can expect to use some form of long-term care during their lives. Therefore, having long-term care insurance is not just an option, but a necessity for a worry-free retirement.

Choosing the Right Long-Term Care Insurance Policy

Long-term care insurance is a crucial tool for retirement planning. It offers financial protection against the high costs of long-term care services, which could deplete a retiree’s savings.

Factors to Consider when Selecting a Policy

When choosing a policy, it’s essential to consider factors such as coverage, cost, and the insurance company’s reputation. The right policy should align with your financial goals and personal needs, ensuring you enjoy a worry-free retirement.

Key Features of Long-Term Care Insurance

Long-term care insurance is a crucial instrument for retirement planning. It provides financial assistance for individuals requiring long-term medical care, ensuring peace of mind during retirement years.

Coverage Options, Benefits, and Exclusions

It offers diverse coverage options and benefits, including nursing home care, home health care, and assisted living facilities. However, it’s essential to understand the policy’s exclusions before purchasing. For instance, some policies may not cover mental disorders or self-inflicted injuries. Therefore, carefully review the policy terms to ensure it aligns with your specific needs.

Cost of Long-Term Care Insurance

Long-term care insurance is a crucial tool for retirement planning. It provides coverage for services that aren’t typically covered by health insurance, such as assisted living, nursing home care, and home care services.

Factors Affecting Premiums and Ways to Manage Costs

The cost of long-term care insurance is influenced by several factors including age, health status, and the amount of coverage desired. To manage these costs, consider purchasing a policy at a younger age, maintaining a healthy lifestyle, and customizing your policy to fit your budget and needs.

Alternatives to Long-Term Care Insurance

Long-Term Care Insurance is a crucial tool for retirement planning, but it’s not the only option. There are alternatives that can help fund long-term care expenses.

Other Options for Funding Long-Term Care Expenses

Self-Funding: Some individuals opt to save and invest over time to cover potential long-term care costs. Government Programs, like Medicaid, can also be a viable option, but they come with strict eligibility requirements. Life Insurance Policies with long-term care riders are another alternative, allowing policyholders to draw from their death benefits for care. Lastly, Reverse Mortgages can provide seniors with the funds they need by tapping into home equity.

Planning for Long-Term Care Insurance in Retirement

Long-term care insurance is a crucial tool in retirement planning. It’s an investment that ensures financial security during the golden years, providing coverage for services like nursing homes, assisted living, or home health care.

Incorporating Long-Term Care Insurance into Financial Planning

Incorporating long-term care insurance into financial planning is a smart move. It helps to safeguard retirement savings from being depleted by high long-term care costs. It also provides peace of mind knowing that future care needs are covered. This way, one can enjoy their retirement years without financial worries.

Conclusion

In the journey of retirement planning, Long-Term Care Insurance stands as a crucial tool. It not only provides financial protection but also ensures peace of mind during the golden years.

Benefits and Considerations of Long-Term Care Insurance in Retirement Planning

This insurance covers the cost of care that is generally not covered by health insurance, Medicare, or Medicaid. However, it’s essential to consider factors like premium costs and coverage limitations before purchasing.

Frequently Asked Questions

Questions often arise regarding the necessity, benefits, and potential drawbacks of Long-Term Care Insurance. It’s recommended to consult with a financial advisor or insurance expert to make an informed decision.