Introduction

Travel insurance is a crucial component to consider when planning a trip.

What is travel insurance and why is it important?

Travel insurance is a safety net that protects travelers from financial loss due to unforeseen circumstances. It covers a range of incidents, from minor inconveniences like lost luggage to major emergencies such as medical evacuation. Without it, travelers risk facing hefty bills that could turn an exciting adventure into a financial nightmare.

Types of Travel Insurance

Travel insurance is a crucial aspect to consider when planning a trip. It provides the necessary coverage to protect travelers from unforeseen circumstances that may disrupt their travel plans.

Different types of travel insurance policies available

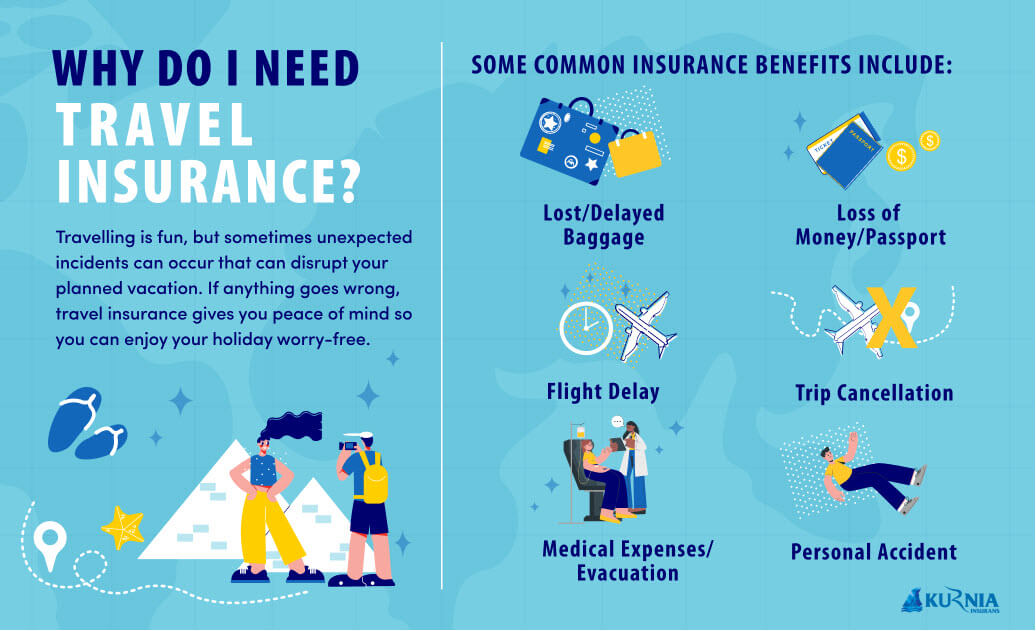

There are several types of travel insurance policies available, each designed to cover specific risks. These include trip cancellation or interruption insurance, medical insurance, baggage loss or delay insurance, and more. Choosing the right policy depends on the nature of your trip and personal requirements.

Coverage and Benefits

Travel insurance is not just an additional cost but a safety net that can save the day. It offers coverage for a myriad of unexpected situations like medical emergencies, trip cancellation, or lost luggage.

Understanding what travel insurance covers and the benefits it provides

Travel insurance provides financial protection against unforeseen travel-related incidents. It covers medical emergencies, trip cancellation, interruptions, and delays, as well as lost or stolen baggage. The benefits are immense, providing peace of mind during your travels, ensuring that unexpected hiccups don’t turn into costly nightmares.

Medical Coverage

Travel insurance is a safety net that travelers shouldn’t overlook. Among the different types of coverage it offers, medical coverage is arguably the most critical.

Importance of medical coverage in travel insurance

Medical emergencies can happen anytime, anywhere. Without travel insurance, medical costs abroad can be astronomical. Medical coverage in travel insurance ensures you’re not left stranded financially during a health crisis. It covers expenses such as hospital stays, medication, and emergency evacuation, providing peace of mind during your travels.

Trip Cancellation and Interruption Coverage

Travel insurance is a safety net that swoops in to save the day when unforeseen circumstances arise. It’s more than just a policy; it’s peace of mind.

How travel insurance protects you in case of trip cancellation or interruption

Imagine planning a dream vacation, only for it to be disrupted by an unexpected event. That’s where travel insurance comes in, offering coverage for non-refundable expenses and additional costs incurred due to trip cancellation or interruption. With this, travelers can recoup their losses and reschedule their plans without bearing the financial burden.

Baggage and Personal Belongings Coverage

Coverage for lost, stolen, or damaged baggage and personal belongings

When planning a trip, it’s important to consider the safety of your belongings. Travel insurance can provide coverage for lost, stolen, or damaged baggage and personal belongings. This coverage can help ease the financial burden and provide peace of mind while traveling. Whether it’s a lost suitcase, a stolen camera, or damaged electronics, having insurance can help you recover the value of your items. So before you embark on your next adventure, consider investing in travel insurance to protect your belongings and enjoy a worry-free trip.

Emergency Assistance Services

The importance of emergency assistance services in travel insurance

Travel insurance is often seen as an optional expense when planning a trip, but the reality is that it can provide crucial support in times of need. One of the most important aspects of travel insurance is the provision of emergency assistance services.

When you are away from home, unexpected situations can arise, such as accidents, illnesses, or natural disasters. In these situations, having access to emergency assistance services can be a lifesaver. These services typically include 24/7 helplines staffed by professionals who can provide medical advice, arrange for emergency medical evacuation, or help with other urgent needs.

The importance of emergency assistance services becomes even more evident when you consider the potential costs and complexities of dealing with emergencies abroad. Medical expenses can be exorbitant in some countries, and navigating foreign healthcare systems can be challenging. With travel insurance that includes emergency assistance services, you can have peace of mind knowing that you have professional support to guide you through these difficult situations.

Additionally, emergency assistance services can also help with non-medical emergencies. For example, if your passport gets stolen or you encounter legal issues while traveling, the helpline can provide guidance and support.

In conclusion, while travel insurance may seem like an additional expense, it is essential to consider the importance of emergency assistance services. Having access to professional help during emergencies can make a significant difference in ensuring your safety and well-being while traveling.

Cost and Considerations

Factors to consider when choosing a travel insurance policy and understanding the cost involved

When planning your next trip, you may be wondering if travel insurance is really necessary. While it’s not a legal requirement, it can provide valuable protection and peace of mind during your travels.

Here are some key factors to consider when choosing a travel insurance policy:

- Medical Coverage: Travel insurance can help cover medical expenses in case of illness or injury while traveling. This is especially important if you’re traveling to a destination with limited healthcare facilities or high medical costs.

- Trip Cancellation or Interruption: Unexpected events such as illness, natural disasters, or airline strikes can disrupt your travel plans. Travel insurance can reimburse you for non-refundable expenses like flights, accommodations, and tours.

- Luggage and Personal Belongings: Losing your luggage or having valuable items stolen can be a nightmare. Travel insurance can provide coverage for lost, stolen, or damaged belongings during your trip.

- Emergency Assistance: Travel insurance often includes 24/7 emergency assistance services. This can be invaluable if you encounter any emergencies while traveling, such as lost passports or legal assistance.

Now let’s talk about the cost involved. The price of travel insurance varies depending on factors like your age, destination, duration of the trip, and coverage limits. It’s important to compare different policies and understand what is included in each plan.

While travel insurance may add to the overall cost of your trip, it can save you from significant financial loss and stress in case of unforeseen events. Ultimately, the decision to purchase travel insurance should be based on your personal circumstances and level of comfort.

Remember, accidents and unexpected events can happen to anyone, so having travel insurance can provide valuable protection and peace of mind during your travels.

Conclusion

When it comes to travel insurance, the answer to whether you really need it is a resounding yes! It provides essential protection and peace of mind during your travels. From medical emergencies to trip cancellations, travel insurance safeguards your investment and ensures you have assistance when you need it most. Don’t leave home without it!

The importance of having travel insurance and final thoughts

Protection and Peace of Mind: Travel insurance offers coverage for unexpected events such as medical emergencies, trip cancellations, lost luggage, and more. It ensures that you are financially protected and can access assistance when facing unforeseen circumstances during your trip.

Safeguard Your Investment: Traveling can be expensive, and without insurance, you risk losing money if something goes wrong. Travel insurance helps protect your investment by reimbursing you for non-refundable expenses in case of trip cancellation or interruption.

Assistance When You Need It: In unfamiliar surroundings, having access to 24/7 emergency assistance can be invaluable. Travel insurance provides support services such as medical referrals, emergency evacuation, and travel assistance to help you navigate challenging situations.

In conclusion, travel insurance is a must-have for any traveler. It provides financial protection, peace of mind, and essential assistance when things don’t go according to plan. Don’t underestimate the value of being prepared for the unexpected.

FAQ (Frequently Asked Questions)

Q: Is travel insurance worth the cost?

A: Yes, travel insurance is worth the cost as it provides valuable coverage and peace of mind during your travels.

Q: What does travel insurance typically cover?

A: Travel insurance typically covers medical emergencies, trip cancellations or interruptions, lost luggage, travel delays, and other unforeseen events depending on the policy.

Q: Can I purchase travel insurance after booking my trip?A: Yes, you can purchase travel insurance after booking your trip, but it’s recommended to do so as early as possible to maximize coverage options.

Q: Is travel insurance necessary for domestic travel?A: While travel insurance is not mandatory for domestic travel, it can still provide valuable coverage for unexpected events and peace of mind during your trip.