Introduction to Marine Insurance

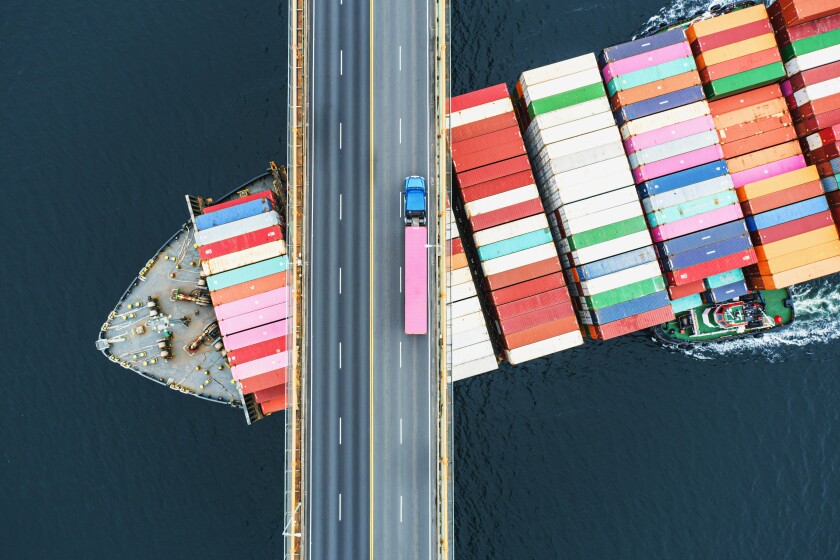

Marine insurance may seem like a complex concept, but it plays a crucial role in protecting businesses involved in import/export, shipping, and other marine-related activities. Understanding the basics of marine insurance is essential for any business operating in this industry.

Understanding the Basics of Marine Insurance

Marine insurance provides coverage for ships, cargo, and various marine liabilities. There are different types of marine insurance policies, including hull insurance, cargo insurance, and protection and indemnity (P&I) insurance. These policies protect businesses from financial losses in the event of accidents, natural disasters, piracy, theft, or other risks associated with marine activities.

The Importance of Marine Insurance for Businesses

Marine insurance is vital for businesses involved in maritime trade. Here are some key reasons why businesses should consider investing in marine insurance:

- Risk Mitigation: Marine activities are inherently risky. Marine insurance provides financial protection against potential losses, giving businesses peace of mind.

- Legal Compliance: In many cases, marine insurance is required by law. Ensuring your business is adequately insured can help you comply with legal regulations.

- Customer Confidence: Having marine insurance demonstrates your commitment to protecting your clients’ cargo and investments. It enhances your reputation and instills trust among customers.

- Business Continuity: In the event of accidents, marine insurance helps businesses recover and resume operations without significant financial burdens.

By understanding the basics of marine insurance and recognizing its importance, businesses operating in the maritime industry can navigate the complexities and protect themselves from potential risks and losses.

Types of Marine Insurance

Different Types of Marine Insurance Policies

There are several types of marine insurance policies that cater to the specific needs of businesses involved in marine activities. These policies include:

- Hull and Machinery Insurance: This type of insurance provides coverage for damage to the vessel’s hull, machinery, and equipment. It protects against risks such as collisions, fires, and natural disasters.

- Cargo Insurance: Cargo insurance covers the cargo carried by vessels and provides protection against risks like theft, damage, and loss during transportation.

- Liability Insurance: Liability insurance protects the insured against claims arising from third-party bodily injury, property damage, or pollution caused by the insured vessel.

- Freight Insurance: Freight insurance safeguards the freight owner or transporter against financial loss if the cargo is damaged or lost during transit.

Key Features of Hull and Machinery Insurance

Hull and Machinery insurance is vital for shipowners and operators. Here are some key features of this type of marine insurance policy:

- All-Risk Coverage: Hull and Machinery insurance offers coverage for various risks, including collisions, grounding, and machinery breakdown.

- Repair and Replacement: In the event of damage, the policy covers the cost of repairs or replacement of damaged parts or equipment.

- Protection and Indemnity (P&I) Club Membership: P&I Club membership is often included in Hull and Machinery insurance policies, providing additional liability coverage for the shipowner.

- Survey and Inspection: Regular surveys and inspections may be required to ensure the vessel’s seaworthiness and compliance with safety standards.

Understanding the different types of marine insurance policies, such as Hull and Machinery insurance, is crucial for businesses operating in the maritime industry. By choosing the right insurance coverage, businesses can mitigate risks, protect their assets, and ensure smooth operations.

The Process of Insuring Maritime Risks

Understanding Underwriting in Marine Insurance

When it comes to insuring maritime risks, underwriting plays a crucial role. Underwriting involves assessing the risks associated with insuring a vessel or cargo and determining the terms and conditions of coverage. Insurers evaluate factors such as the vessel’s condition, the crew’s experience, and the nature of the cargo. Based on this analysis, they determine the premium to be charged and the scope of coverage. Underwriting ensures that the insured and the insurer have a clear understanding of the risks involved and the protection provided.

Claims Handling and Settlement in Marine Insurance

In the event of a loss or damage to the insured vessel or cargo, the claims handling and settlement process comes into play. Prompt reporting of the incident is crucial, followed by a thorough investigation by the insurer. The insurer reviews the policy and determines whether the claim is valid, assessing the extent of the loss or damage. Once the claim is approved, the insurer provides compensation according to the terms of the policy. Efficient claims handling and settlement are crucial to minimizing disruptions to maritime businesses and ensuring a smooth resolution of insurance claims.

By understanding the underwriting process and the claims handling and settlement procedures in marine insurance, businesses can navigate the complexity of insuring maritime risks and protect their assets effectively.

Factors Affecting Marine Insurance Premiums

Assessing Risks in Marine Insurance

When it comes to marine insurance, there are several factors that insurers take into account to assess the risks involved. These include the type and value of the vessel, the nature of the cargo being transported, the geographic area of operation, and the experience and track record of the insured.

Insurers evaluate potential risks such as accidents, theft, natural disasters, and even piracy. They also consider the vessel’s condition and safety measures in place, as well as the crew’s qualifications and training.

Calculating Premiums for Marine Insurance

Once the risks are assessed, insurers use this information to calculate the premiums for marine insurance. Premiums are typically based on factors like the insured value of the vessel and cargo, the deductible chosen, and any additional coverage requested.

Insurers also take into account the loss history of the insured, ensuring that those with a good track record are rewarded with lower premiums. Similarly, vessels equipped with safety features and measures may also receive discounted premiums.

It’s important for business owners and ship operators to understand these factors and work with insurers who specialize in marine insurance. This ensures that they have the appropriate coverage in place to protect their vessels, cargo, and operations.

By properly assessing risks and calculating premiums, both insurers and insured parties can navigate the complex world of marine insurance with confidence.

Special Considerations in Marine Insurance

When it comes to protecting valuable cargo and ships, marine insurance plays a vital role. Understanding the complexities of marine insurance can help businesses navigate the risks involved in maritime operations. Here are two key considerations in marine insurance:

Marine Insurance for Cargo

Shipping cargo internationally comes with inherent risks, such as damage, loss, or theft. Marine insurance for cargo provides coverage against these risks. Companies need to carefully assess the type of insurance needed, whether it’s specific to a particular shipment or an open policy that covers multiple shipments over a specified period.

Protection and Indemnity Insurance for Shipowners

Shipowners face a wide range of risks, including collisions, pollution, and personal injury claims. This is where Protection and Indemnity (P&I) insurance comes into play. P&I insurance provides coverage for liabilities arising from ship operation, cargo damage, crew injuries, and pollution incidents. Shipowners should carefully consider their liabilities and select a P&I policy that provides comprehensive coverage.

Navigating the complexities of marine insurance requires a deep understanding of the risks involved in maritime operations. By having appropriate insurance coverage in place, businesses can protect their assets, mitigate financial loss, and ensure smooth operations in the unpredictable and challenging world of maritime trade.

Emerging Trends in Marine Insurance

Marine insurance may seem like a complex subject, but it plays a crucial role in ensuring the smooth functioning of the global trade industry. To unravel this complexity, it is essential to understand the emerging trends that are shaping the marine insurance landscape.

The Impact of Technology on Marine Insurance

Advancements in technology have significantly impacted the marine insurance industry. From the use of drones for risk assessment to the implementation of blockchain for secure transactions, technology has revolutionized the way insurers operate. Automation and data analytics have also improved underwriting processes, facilitating faster and more accurate policy issuance and claims settlement.

Sustainable Practices in Marine Insurance

In recent years, sustainable practices have gained prominence in the marine insurance sector. Insurers are increasingly focusing on reducing the environmental impact of the shipping industry. This includes promoting energy-efficient vessel designs, supporting alternative fuels, and incorporating sustainability criteria into underwriting decisions. By encouraging sustainable practices, marine insurers are not only protecting the environment but also promoting a more resilient and sustainable future for the industry.

As the marine insurance industry continues to evolve, staying informed about these emerging trends is crucial for both insurers and policyholders. Embracing technology and sustainable practices can lead to more efficient and responsible marine insurance solutions.

Conclusion

Marine insurance plays a vital role in mitigating the risks faced by businesses in the maritime industry. Understanding the complexities of marine insurance is crucial for ship owners, cargo owners, and other stakeholders involved in international trade.

Importance of Marine Insurance in Risk Management

Marine insurance provides financial protection against a range of risks, including damage to the vessel, loss or damage to cargo, and liability for third-party claims. It helps businesses manage the uncertainties associated with maritime operations and ensures smooth operations even in the face of unforeseen events.

Key Takeaways in Understanding Marine Insurance

- Types of Coverage: Marine insurance encompasses various policies such as hull insurance, cargo insurance, protection and indemnity (P&I) insurance, and marine liability insurance. Each type of coverage serves different purposes and addresses specific risks.

- Policy Limits and Exclusions: It is important to carefully review the terms, conditions, and exclusions of a marine insurance policy. Understanding the limits of coverage and any exclusions can help businesses make informed decisions and assess their risk exposure accurately.

- Claims Process: Familiarize yourself with the claims process and requirements of your marine insurance policy. Promptly reporting any incidents or losses and maintaining proper documentation is essential to ensure a smooth claims settlement process.

- Working with an Experienced Broker: A reputable marine insurance broker can provide valuable guidance and help businesses navigate the complexities of marine insurance. They can help assess risk exposures, customize insurance solutions, and negotiate favorable terms on behalf of their clients.

It is important for businesses involved in maritime activities to consult with insurance professionals who specialize in marine insurance and have a thorough understanding of the specific challenges and risks faced in this industry.