Introduction

In the world of auto insurance, one often overlooked aspect is Uninsured/Underinsured Motorist Coverage. This type of coverage isn’t always regarded as an important one, yet its impact should not go unnoticed for any smart driver.

What is Uninsured/Underinsured Motorist Coverage?

This coverage provides protection to the policyholder when involved in accidents caused by a motorist who has no insurance or inadequate insurance to cover the damages. It’s like having a safety net when the guilty driver’s policy fails to come to the rescue.

Why is Uninsured/Underinsured Motorist Coverage important?

For those unfortunate moments when one crosses paths with an inadequately insured driver, this coverage turns out to be a savior. It ensures that the victimized drivers are not left footing huge repair or medical bills, hence offering financial security.

Overview of the blog post sections

In this article, we’ll delve deeper into what Uninsured/Underinsured Motorist Coverage encompasses, its significance, and reasons behind its importance in car insurance policy. While the concept may feel daunting, understanding this coverage might just be the key to avoiding financial distress caused by others’ negligence.

Understanding Uninsured Motorists

Uninsured motorists are drivers who traverse byways and highways without adequate insurance coverage, a worrisome phenomenon. Appallingly, about 1 in 8 drivers in the United States is uninsured, a startling statistic that brings to light the unnerving reality.

Definition and statistics of uninsured motorists

An uninsured driver is someone who does not possess any auto insurance, in blatant defiance of state law. A staggeringly high number continues to cruise roads in the US without insurance, which is unsettling.

Consequences of being involved in an accident with an uninsured driver

If you happen to have an unfortunate encounter with an uninsured driver, the ripple effects can be draining emotionally and financially. The fallout often leaves you grappling with medical bills and repair costs.

Importance of Uninsured Motorist Coverage

To mitigate these unforeseen complications, Uninsured Motorist Coverage (UMC) becomes integral to your insurance plan. UMC provides a safety net against potential unimaginable distress, ensuring your peace of mind while on the road.

Understanding Underinsured Motorists

Underinsured motorists are causes for concern for any driver on the road. They’re people who, although have basic insurance, their coverage falls short of the total cost of damages incurred in an accident.

Definition and Statistics of Underinsured Motorists

A concerning 14% of U.S drivers are undaunted by the possible financial fallout of accidents, choosing to drive underinsured.

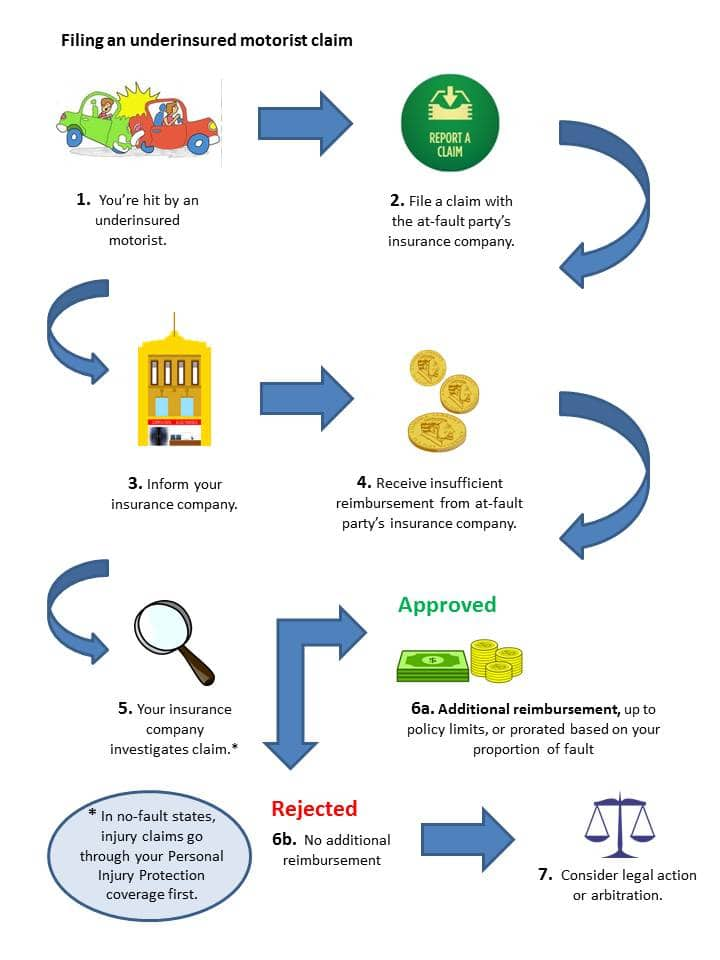

Consequences of being involved in an Accident with an Underinsured Driver

Financial loss is incredibly common in such encounters, especially when the underinsured motorist’s policy fails to cover all incurred costs.

Importance of Underinsured Motorist Coverage

Underinsured Motorist Coverage provides peace of mind, covering the gap the underinsured party’s insurance can’t. With this kind of protection, accident victims sidestep financial burdens they shouldn’t have to bear.

The Benefits of Uninsured/Underinsured Motorist Coverage

Car accidents are unexpected events that could lead to immense financial burden, particularly if the at-fault driver lacks adequate insurance. The core remedy for such situations lies within Uninsured/Underinsured Motorist Coverage, a form of protection that plays an imperative role in security.

Financial protection in the event of an accident

Unforeseen incidents can result in hefty repair costs. With uninsured/underinsured coverage, an individual can get necessary financial aid for vehicle repair or replacement.

Coverage for medical expenses and lost wages

After an accident, medical bills and lost wages can escalate rapidly. This coverage can also provide financial aid to handle these issues, ensuring that routine life continues with minimal disruption.

Compensation for pain and suffering

Beyond tangible expenses, accidents can lead to physical trauma or emotional distress. This coverage can also provide compensation for these non-economic harms, ensuring holistic recovery.

How to Obtain Uninsured/Underinsured Motorist Coverage

Protecting one’s self on the road is crucial. Having an uninsured/underinsured motorist coverage can act as a safety buffer in unexpected situations.

Options for purchasing coverage

Many auto insurance companies offer uninsured/underinsured motorist coverage. Before buying, consider exploring and comparing different providers for the best packages to suit your needs.

Evaluating coverage limits and deductibles

The coverage limits and deductibles should be evaluated carefully to ensure all potential risks are correctly covered.

Other considerations when choosing coverage

Also, it’s essential to be mindful of legal requirements, coverage costs, and personal risk tolerance while choosing your coverage.

Common Myths and Misconceptions about Uninsured/Underinsured Motorist Coverage

Myth: I don’t need Uninsured/Underinsured Motorist Coverage if I have health insurance

There’s an assumption that having health insurance eliminates the need for Uninsured/Underinsured Motorist Coverage. However, this often overlooks the potential complications that could arise from accidents involving uninsured or underinsured drivers.

Myth: Uninsured/Underinsured Motorist Coverage is too expensive

When it comes to the cost been considered, the truth is, the cost-benefit analysis of subscribing to such coverage leans heavily in your favor considering potential out-of-pocket expenses from a mishap.

Dispelling myths and highlighting the importance of coverage

Uninsured/Underinsured Motorist Coverage doesn’t just provide financial protection; it grants invaluable peace of mind. It protects not only your health but also your assets in the unforeseen event of an accident with an uninsured or underinsured motorist.