Understanding Health Insurance Plans

Navigating the realm of health insurance can often seem like a complicated task.

The Basics of Health Insurance Plans

In essence, health insurance is a type of coverage that pays for medical, surgical, and sometimes dental expenses incurred by the insured.

Types of Health Insurance Plans

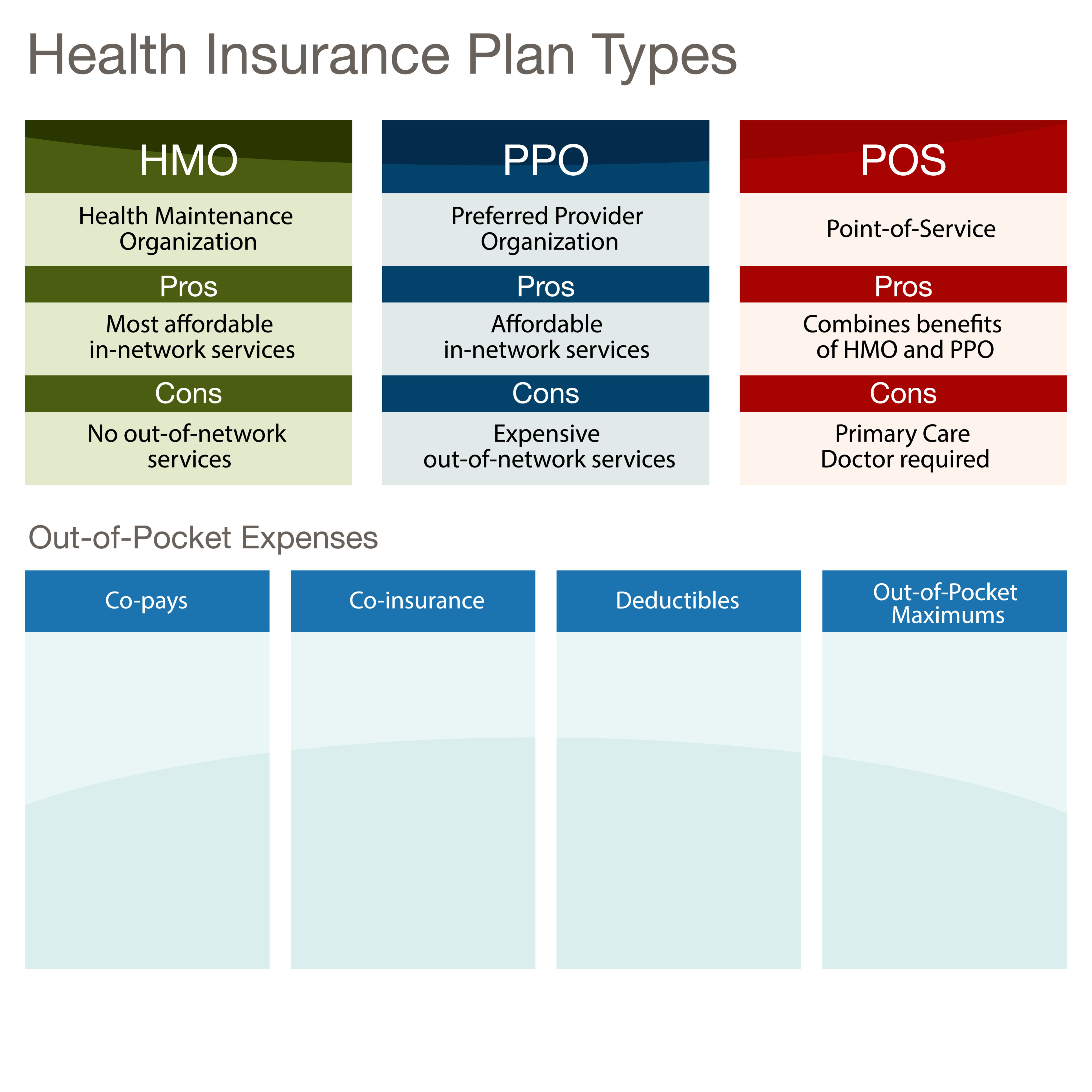

There are several types of health insurance plans that provide different levels of cover: Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Exclusive Provider Organization (EPO), among others. Selecting the right plan depends on the individual’s healthcare needs and budget.

PPO: Preferred Provider Organization

A PPO plan typically offers more flexibility when choosing health care providers. The insured is not required to choose a primary care physician, and they can see any health care provider they want without a referral, inside or outside of their network. This allows for greater choice but may result in additional fees.

Remember, understanding the nuances of each plan type is pivotal to ensuring that you make a well-informed decision.

Decoding PPO Plans

A Preferred Provider Organization (PPO), is a popular plan within the health insurance market. Intrinsically, PPO plans are all about flexibility and choice.

Benefits of PPO Plans

Freedom of Choice: PPOs permit participants to choose any health care provider, regardless of their ‘in-network’ or ‘out-network’ status. This enables members to receive medical services from their preferred doctors.

Key Features of PPO Plans

Network of Providers: PPOs feature a network of preferred providers. However, members are not restricted to this network and can go ‘out-of-network’ at their discretion.

Drawbacks of PPO Plans

Expenses: The choice and flexibility of PPOs often come with higher premiums and out-of-pocket costs. As such, members might have to pay more for the freedom to choose their health care providers, particularly if they opt for ‘out-of-network’ services.

Understanding HMO Plans

In the grand scheme of healthcare, Health Maintenance Organizations or HMOs play an essential role. These plans garner a lot of buzz due to their unique structure and the advantages they offer.

HMO: Health Maintenance Organization

An HMO is a type of health insurance plan that enables access to a network of healthcare providers and hospitals in exchange for a monthly premium. It works on the premise of coordination between different health care providers and facilities to provide cost-effective care.

How HMO Plans Work

Typically, an HMO plan assigns each member a primary care physician (PCP). This PCP acts as the central point of care, coordinating tests, specialist visits, and hospital admissions, effectively streamlining the healthcare journey. It’s a system that assures that every health need is catered to.

Advantages of HMO Plans

HMO plans come with several benefits: they usually have lower premiums and less paperwork. Also, coordination of care under a PCP helps prevent unnecessary procedures and ensures necessary treatment is provided. For budget-conscious consumers looking for comprehensive care, an HMO plan can be an ideal choice.

Comparing PPO and HMO Plans

Understanding the intricacies of health insurance can be daunting, especially when trying to decipher PPO and HMO plans. While both of these plans serve the purpose of lowering the cost of health care, they function differently.

Differences between PPO and HMO Plans

PPO (Preferred Provider Organization) and HMO (Health Maintenance Organization) plans offer unique features. PPOs allow consumers to see any healthcare provider without a referral even outside their network, yet higher costs are associated. HMOs, on the other hand, limit consumers to providers within their network, saves costs but restricts the flexibility of choice.

Factors to Consider When Choosing Between PPO and HMO

It distills down to individual health needs, budget, and preference. Broadly speaking, if one requires flexibility and wider coverage, PPO might be considered, while HMO could be preferred for cost-effective, streamlined care.

Which Plan is Right for You?

Choosing a plan depends on a multitude of factors including, but not limited to, one’s health, budget, the importance of flexibility, and frequency of doctor visits. Evaluating these elements can help make an informed choice.

Conclusion

Selecting the right health insurance plan might be cumbersome but it’s an essential part of ensuring financial and health security.

Important Tips for Choosing the Right Health Insurance Plan

Understanding an individual’s healthcare needs, budget, and preferred healthcare providers are all essential aspects that should be considered when selecting a health insurance plan. Make sure to review the plan’s network, out-of-pocket costs, and prescription coverage.

Frequently Asked Questions about PPO and HMO Plans

What’s the difference between PPO and HMO? In HMO, one must stick to the healthcare providers in the network, whereas in a PPO plan, one has the flexibility to visit any healthcare provider. Which is cheaper? Generally, HMO plans are less expensive than PPO plans. However, it’s always advisable to thoroughly compare plans to ensure cost-effectiveness.