Introduction

Navigating the relationship between healthcare and insurance can be a daunting task. With complex policies, jargon, and ever-changing regulations, it’s no wonder many people find it confusing. However, understanding this relationship is crucial for making informed decisions about your healthcare options.

Understanding the complex relationship between healthcare and insurance

Healthcare and insurance go hand in hand, but deciphering their intricate connection is essential. Here are some key points to consider:

- Healthcare Coverage: Insurance helps individuals and families cover the costs associated with medical care, such as doctor visits, hospital stays, and prescriptions. It provides financial protection and peace of mind in times of illness or injury.

- Insurance Options: There are various types of insurance plans available, including private health insurance, employer-sponsored plans, and government programs like Medicare and Medicaid. Each has its own set of benefits, costs, and eligibility requirements.

- Healthcare Providers: Insurance networks consist of healthcare providers and facilities that have agreed to provide services at negotiated rates. It’s important to ensure that your preferred doctors and hospitals are included in your insurance network to avoid unexpected expenses.

- Healthcare Costs: Understanding the costs associated with healthcare services, deductibles, copayments, and coinsurance is crucial for budgeting and planning. Different insurance plans have varying levels of coverage, so be sure to review your policy carefully.

- Healthcare Reform: The relationship between healthcare and insurance has been influenced by healthcare reforms, such as the Affordable Care Act (ACA). These reforms aim to improve access to quality healthcare and protect consumers from excessive costs.

In conclusion, decoding the complex relationship between healthcare and insurance is essential for making informed decisions and ensuring adequate coverage. By understanding the nuances of this relationship, individuals can navigate the healthcare system with confidence and protect their well-being.

Healthcare System Overview

The relationship between healthcare and insurance can be complex and confusing. Understanding how the two interact is crucial for individuals and businesses alike. Here is a brief overview to help decode this complex relationship.

Overview of the healthcare system in the United States

The healthcare system in the United States is a combination of private and public sectors. It can often be fragmented, making it difficult for individuals to navigate. The system is primarily driven by private healthcare providers, insurance companies, and government programs like Medicare and Medicaid. Access to healthcare can vary based on factors such as insurance coverage, affordability, and location.

Role of insurance in the healthcare system

Insurance plays a critical role in the healthcare system by providing financial protection for individuals and businesses against high medical costs. Health insurance helps individuals access medical services by covering a portion of the expenses. It also promotes preventive care and wellness initiatives. Insurance companies negotiate rates with healthcare providers to control costs and ensure a network of healthcare professionals is available to policyholders.

In conclusion, understanding the complex relationship between healthcare and insurance is important for individuals and businesses to make informed decisions about their healthcare needs. By navigating the healthcare system and having appropriate insurance coverage, individuals can access and afford the necessary medical care.

Types of Insurance

When it comes to healthcare and insurance, navigating the complex relationship can be daunting. Understanding the different types of insurance is essential.

Different types of health insurance plans

There are several types of health insurance plans available. These include:

- Preferred Provider Organization (PPO): Offers flexibility to choose healthcare providers within a network or outside of it, but provides higher coverage for in-network providers.

- Health Maintenance Organization (HMO): Requires you to select a primary care physician and get referrals for specialists.

- Point of Service (POS): Combines elements of PPO and HMO plans, allowing you to use in-network and out-of-network providers.

- High Deductible Health Plan (HDHP): Typically associated with a Health Savings Account (HSA), this plan requires higher out-of-pocket costs before insurance coverage kicks in.

Pros and cons of private insurance versus government programs

Private insurance and government programs, such as Medicare and Medicaid, have their pros and cons:

- Private Insurance: Provides more choice and flexibility in terms of providers and coverage options but can be more expensive and have stricter eligibility requirements.

- Government Programs: Offer more affordable options for low-income individuals and seniors but may have limited provider networks and coverage restrictions.

Understanding the pros and cons of each type of insurance can help you make an informed decision that aligns with your healthcare needs and budget. Remember to carefully review the coverage details, costs, and network providers when choosing an insurance plan.

The Cost of Healthcare

In today’s world, healthcare costs continue to rise, leaving many individuals and families struggling to afford the care they need. Understanding the factors that contribute to the high cost of healthcare and the role of insurance in managing these costs is essential for navigating the complex healthcare landscape.

Factors that contribute to the high cost of healthcare

There are several factors that contribute to the high cost of healthcare. Some of the key factors include:

- Advancements in medical technology and pharmaceuticals: While advancements in medical technology and pharmaceuticals have led to improved treatments and outcomes, they also come with a hefty price tag.

- Administrative and overhead costs: The administrative and overhead costs associated with running healthcare facilities and managing insurance claims add to the overall cost of healthcare.

The role of insurance in managing healthcare costs

Insurance plays a crucial role in managing healthcare costs for individuals and families. Here are some ways insurance can help:

- Financial protection: Insurance provides financial protection by covering a portion of the cost of healthcare services. This helps individuals and families avoid high out-of-pocket expenses.

- Negotiating power: Insurance companies negotiate rates with healthcare providers, ensuring that their members receive discounted rates for medical services.

- Preventive care: Insurance plans often cover preventive care services at no additional cost. This encourages individuals to seek preventive care and early detection of health issues, potentially reducing future healthcare costs.

Understanding the complex relationship between healthcare and insurance is crucial for making informed decisions and managing healthcare expenses effectively. By understanding the factors contributing to high healthcare costs and the benefits of insurance, individuals can navigate the healthcare landscape with confidence.

Challenges in the Healthcare System

When it comes to healthcare and insurance, understanding the complex interplay between them can be quite a daunting task. However, by unraveling the intricacies of this relationship, individuals can make more informed decisions for themselves and their families.

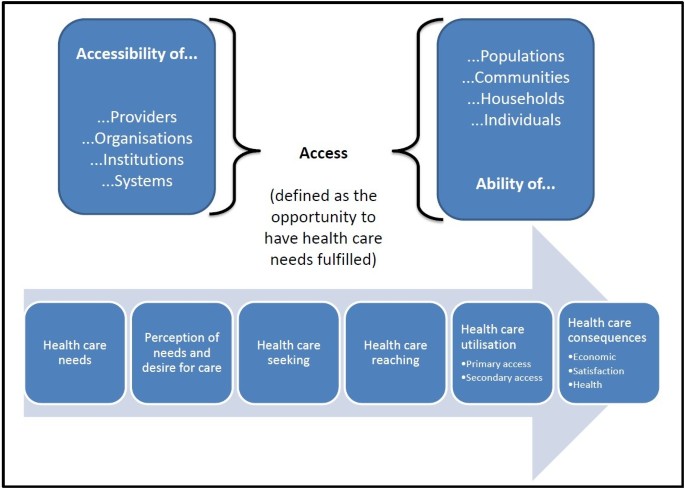

Barriers to accessing affordable healthcare

One of the major challenges faced by many individuals is the difficulty in accessing affordable healthcare. Rising healthcare costs, limited availability of health services in certain areas, and lack of insurance coverage all contribute to this issue. High deductibles and copayments can also strain financial resources, making it harder for people to seek necessary medical care.

Insurance coverage gaps and limitations

Although having insurance offers a sense of security, it is important to be aware of coverage gaps and limitations. Some policies may exclude certain treatments or medications, have restrictive networks that limit access to preferred providers, or impose high out-of-pocket costs. Understanding the specifics of your insurance plan and carefully reviewing the coverage details can help avoid unexpected expenses and ensure sufficient coverage for your healthcare needs.

By recognizing and addressing the challenges within the healthcare and insurance system, individuals can navigate the complexities more effectively and make choices that prioritize their well-being.

The Impact of Insurance on Healthcare

How insurance affects healthcare choices and options

In the complex relationship between healthcare and insurance, the role of insurance cannot be overstated. Insurance coverage plays a crucial role in determining the healthcare choices and options available to individuals and families. Without insurance, the cost of medical treatments and services can be overwhelming, leading to limited access to care. With adequate insurance coverage, individuals have greater flexibility in choosing healthcare providers and treatment options that best suit their needs. Insurance also provides financial protection, reducing the burden of medical expenses. Additionally, insurance networks often negotiate discounted rates with healthcare providers, making care more affordable for policyholders.

The importance of insurance coverage for preventive care

Insurance coverage is particularly important for preventive care. Preventive services, such as immunizations, screenings, and regular check-ups, are essential for maintaining overall health and detecting potential health issues early. Insurance coverage for preventive care ensures that individuals have access to these services without incurring significant out-of-pocket costs. By receiving regular preventive care, individuals can reduce the risk of developing chronic conditions, improve their overall wellbeing, and potentially avoid costly medical interventions in the future. Insurance coverage for preventive care promotes a proactive approach to healthcare and leads to better health outcomes for individuals and communities.

Introduction

As a savvy entrepreneur or marketer, you are probably wondering what can I do to differentiate my brand from an endlessly long list of cutthroat competitors? The short answer is branding!

Whether you are actively managing your brand identity or not, it exists. And the chances of coming out as the ideal choice to your potential clients rests on how strong and reliable your brand is. Creating a logo and that catchy slogan isn’t enough, but just the beginning. To stand out, you need to go beyond these and include essential elements that define your business several years ahead.

Why is it important to brand your business?

Regardless of size, organizations of all kinds need to invest in branding to stay relevant. If you are still wondering why you should brand your business, here are some benefits you stand to gain.

Distinguish your business from competitors

- Be Unique: With the myriad of companies delivering similar services or products, standing out can be challenging. That’s where branding comes in.

- Have Values: Your values, story, brand promise, and other assets provide avenues through which you can showcase your uniqueness. Leveraging on these to create a point of difference could set you apart from your competitors.

Become more recognizable

Get Recognized: Another benefit of investing in a consistent branding effort is to make your brand more memorable. When customers can identify your company based on physical, visual, auditory elements, it breeds familiarity. This fosters trust, which 81% of customers rely on to make a buying decision. Brand recognition could also influence how customers recall and engage with your content, emails, or ads.

Conclusion

Understanding the intricacies of the healthcare and insurance relationship

The relationship between healthcare and insurance is complex and can be difficult to navigate. Insurance plays a pivotal role in making healthcare accessible and affordable for individuals and families. It provides a safety net in case of unexpected medical expenses and helps spread the financial burden across a larger pool of people. On the other hand, healthcare providers rely on insurance reimbursements to cover the cost of providing medical services. Both industries are interdependent and must work together to ensure the best possible outcomes for patients and the sustainability of the healthcare system.

The need for ongoing dialogue and reform

Given the complexities and challenges involved, ongoing dialogue and reform are necessary to improve and streamline the healthcare and insurance relationship. It is crucial for policymakers, healthcare providers, insurers, and patients to come together to address issues such as rising healthcare costs, access to care, transparency in pricing, and the quality of healthcare services. By fostering collaboration and innovation, we can create a healthcare system that is more patient-focused, affordable, and efficient.

Addressing the complexities of the healthcare and insurance relationship requires the collective effort of all stakeholders. By working together, we can strive towards a healthcare system that provides high-quality care, ensures financial protection, and meets the needs of individuals and communities.