Introduction to Invoice Factoring

Invoice factoring is a financing solution that has gained popularity among businesses looking for alternative ways to manage their cash flow. It is a process where a company sells its accounts receivable (invoices) to a third-party financial institution, known as a factor, at a discounted rate in exchange for immediate cash. This enables businesses to access working capital quickly without having to wait for customer payments.

What is Invoice Factoring and how does it work?

Invoice factoring involves three parties: the business (seller of invoices), the customers (buyers of goods or services), and the factor (financial institution). Here’s how it works:

- The business delivers goods or services to its customers and generates invoices.

- Instead of waiting for payment, the business sells these invoices to a factor at a discounted rate, typically around 80-95% of the invoice value.

- The factor becomes responsible for collecting payment from the customers on behalf of the business.

- Once the customer pays the full invoice amount, the factor deducts its fees and returns the remaining balance to the business.

This allows the business to access immediate cash flow to cover operational expenses, invest in growth opportunities, and manage day-to-day financial obligations.

Benefits of Invoice Factoring for businesses

Invoice factoring offers several advantages for businesses, making it an attractive financing option. Some of the key benefits include:

- Improved Cash Flow: By selling invoices to a factor, businesses can access immediate cash flow, enabling them to meet their financial obligations and grow their operations.

- Quick Funding: Unlike traditional financing methods, invoice factoring provides fast funding within days or even hours after submitting the invoices to the factor.

- No Debt: Invoice factoring is not a loan. It is a cash advance against outstanding invoices, which means businesses don’t accumulate debt in the process.

- Reduced Risk of Bad Debt: The factor assumes the responsibility of collecting payments from customers, reducing the risk of non-payment or bad debt for the business.

- Flexibility: Invoice factoring is a flexible financing solution that can scale with the business’s needs. As the business generates more invoices, it can sell them to the factor to access more working capital.

- Focus on Core Operations: By outsourcing the collection process to the factor, businesses can focus on their core operations rather than spending time and resources on chasing payments.

In conclusion, invoice factoring is a valuable financing tool that can help businesses manage their cash flow effectively. It provides immediate access to funds, reduces the risk of bad debt, and allows businesses to focus on their core operations. By understanding the anatomy of a transaction and the benefits it brings, businesses can make informed decisions when considering invoice factoring

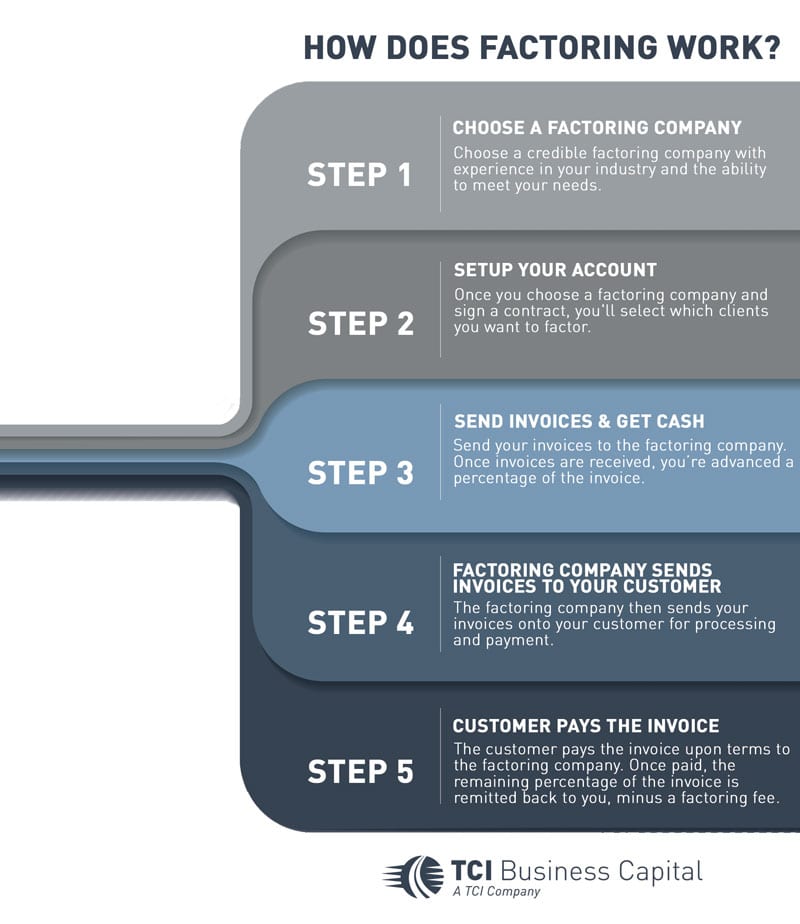

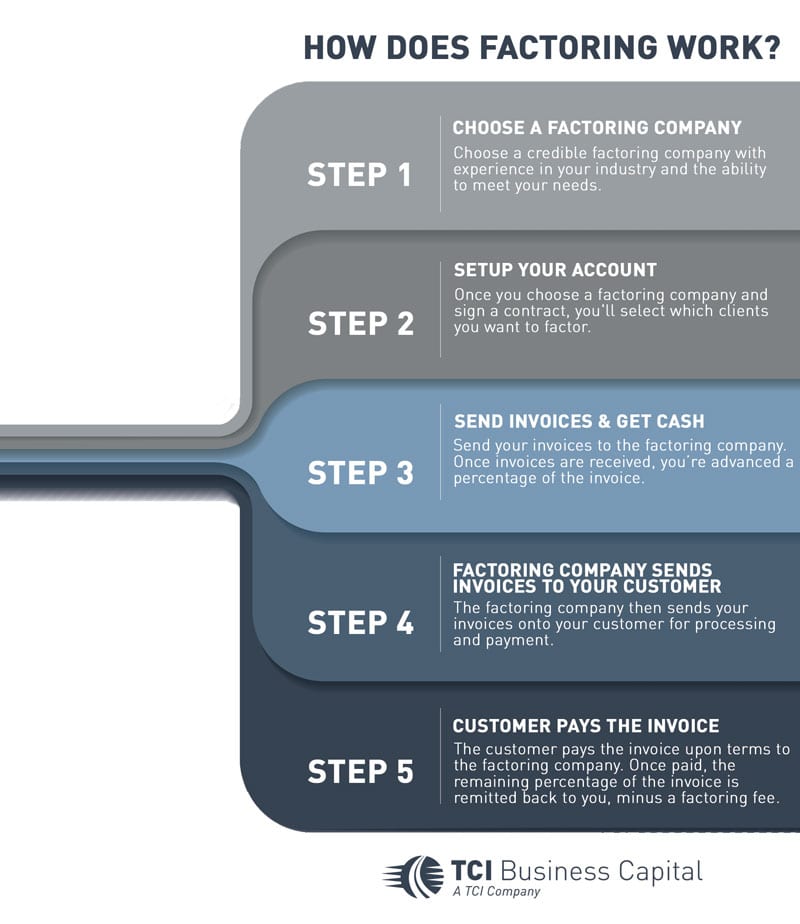

The Invoice Factoring Process

Invoice factoring is a financial solution that provides businesses with quick access to cash by selling their invoices to a factoring company. The process typically involves several steps, each playing a crucial role in completing the transaction successfully.

Step 1: Selling the Invoice

In this initial step, the business sells its outstanding invoices to the factoring company. The factoring company typically advances a portion of the invoice’s total value, known as the “advance rate,” which can range from 70% to 90%. Selling the invoice allows businesses to receive immediate cash flow, rather than waiting for customers to make payments.

Step 2: Verification and Approval

Once the factoring company receives the invoices, it verifies the authenticity and validity of the invoices. This may involve contacting the customers to confirm their agreement and ensuring that the services or products have been delivered satisfactorily. Additionally, the factoring company may evaluate the creditworthiness of the customers to mitigate any potential risks.

Step 3: Funding the Advance

After the verification and approval process, the factoring company funds the advance to the business. The advance is typically transferred to the business’s bank account within 24 to 48 hours, providing immediate working capital that can be used to cover expenses, invest in growth opportunities, or meet other financial obligations.

Step 4: Collection and Repayment

Once the invoices have been sold and funds have been advanced, the factoring company takes over the responsibility of collecting payments from the customers. They handle the collections process, which includes sending payment reminders, follow-ups, and managing any disputes. Once the customers make their payments, the factoring company deducts their fees and returns the remaining portion of the invoice value to the business.

Here’s a table summarizing the invoice factoring process:

| Step | Description |

|---|---|

| Step 1 | Selling the invoice |

| Step 2 | Verification and approval |

| Step 3 | Funding the advance |

| Step 4 | Collection and repayment |

Invoice factoring provides a straightforward and efficient way for businesses to improve their cash flow. By understanding the process, businesses can leverage invoice factoring to access the capital they need to thrive and grow.

Factors to Consider when Choosing an Invoice Factoring Company

When considering invoice factoring as a financing option for your business, it’s crucial to choose the right invoice factoring company. Here are the key factors to consider when making your decision:

1. Experience and Reputation

It’s essential to choose an invoice factoring company with a strong track record and extensive experience in the industry. Look for a company that has been providing invoice factoring services for a significant period and has a solid reputation among its clients. You can check customer reviews and testimonials to get an idea of their reliability and effectiveness.

2. Fees and Rates

Different invoice factoring companies may have varying fee structures and rates. It’s important to understand the fees involved in the transaction and compare them across different providers. Look for a company that offers competitive rates and transparent fee structures. Make sure you are aware of any additional charges or hidden fees that may be associated with the service.

3. Customer Service and Support

Customer service plays a crucial role in the invoice factoring process. Choose a company that provides excellent customer support and is responsive to your queries and concerns. A reliable invoice factoring company should be readily available to address any issues that may arise and provide timely assistance throughout the transaction.

Here’s a table summarizing the factors to consider when choosing an invoice factoring company:

| Factors | Considerations |

|---|---|

| Experience and Reputation | Look for a company with a strong track record and solid reputation in the industry. |

| Fees and Rates | Compare the fee structures and rates of different invoice factoring companies. |

| Customer Service and Support | Choose a company that provides excellent customer service and support. |

By considering these factors, you can choose a reputable and reliable invoice factoring company that meets your business’s financial needs. Remember to thoroughly research and compare different providers before making your decision.

The Role of the Factor in Invoice Factoring

Invoice factoring is a financing solution that allows businesses to convert their unpaid invoices into immediate cash. In this process, the factor plays a crucial role in facilitating the transaction and providing various services to the business.

Responsibilities of the Factor

The factor takes on several responsibilities throughout the invoice factoring process. Here are some key duties performed by the factor:

- Purchasing Invoices: The factor purchases the invoices from the business at a discounted rate, typically around 80-95% of their total value. This provides immediate cash flow to the business, which can be used for various purposes such as paying suppliers or investing in growth opportunities.

- Credit Control: The factor takes on the responsibility of credit control, which involves managing the collection of payments from customers. This relieves the business of the burden of chasing late payments and ensures a steady cash flow.

- Invoice Collection: The factor collects payments from the customers on behalf of the business. This includes sending reminders, following up with customers, and managing any disputes or queries related to the invoices.

- Reporting: The factor provides regular reports to the business, detailing the status of the invoices, collections, and any outstanding payments. This allows the business to stay updated on its cash flow and make informed financial decisions.

Advantages of working with a reputable Factor

Working with a reputable factor offers several advantages to businesses. Here are some benefits of choosing a reliable factor for invoice factoring:

- Immediate Cash Flow: By selling invoices to a factor, businesses can receive immediate cash, enabling them to meet their financial obligations without waiting for customer payments.

- Reduced Administrative Burden: The factor takes care of credit control and invoice collection, saving the business valuable time and resources. This allows the business to focus on its core operations and growth strategies.

- Expertise and Resources: Reputable factors have extensive experience and resources in managing invoice factoring transactions. They have systems in place to efficiently handle collections and credit control, ensuring a smooth process for the business.

- Flexible Financing: Invoice factoring provides businesses with a flexible financing option that grows with their sales. As the business generates more invoices, it can sell them to the factor and access additional cash flow.

In conclusion, the factor plays a vital role in invoice factoring by purchasing invoices, managing credit control, collecting payments, and providing reporting services. Working with a reputable factor offers advantages such as immediate cash flow, reduced administrative burden, expertise, and flexible financing. It’s important for businesses to choose a factor that aligns with their specific needs and provides reliable and efficient services.

Common Misconceptions about Invoice Factoring

Debunking myths about Invoice Factoring

Invoice factoring is a financing solution that has gained popularity among small businesses, providing them with immediate cash flow by selling their outstanding invoices to a third-party company, known as a factor. However, there are several misconceptions surrounding this financial tool. Let’s debunk some of the common myths about invoice factoring.

- Loss of Control: One of the main misconceptions about invoice factoring is that businesses will lose control over their customer relationships. This is not true. With invoice factoring, businesses maintain control over their customer interactions, and the factor acts as a financial partner rather than taking over customer relationships.

- High Fees: Another misconception is that invoice factoring comes with high fees that eat into the business’s profit margins. While factoring fees vary depending on the specific arrangement, they are usually a percentage of the invoice value. It is important for businesses to carefully evaluate and compare fees offered by different factoring companies to ensure they are getting a competitive rate.

- Only for Troubled Businesses: Some believe that invoice factoring is only suitable for struggling businesses that are unable to secure traditional financing. In reality, invoice factoring can benefit any business that experiences inconsistent cash flow due to long payment terms. It provides a proactive approach to managing cash flow and helps businesses maintain steady operations and growth.

Addressing concerns and misconceptions

While it is important to address the common misconceptions surrounding invoice factoring, it is equally important to understand how this financing tool can address the concerns and needs of businesses.

- Improved Cash Flow: Invoice factoring allows businesses to access immediate cash flow by selling their invoices. This can help businesses meet their financial obligations, pay employees, and invest in growth opportunities without having to wait for their customers to pay.

- Flexible Financing: Unlike traditional loans, invoice factoring does not require collateral or financial statements. The approval process is typically faster, making it an attractive option for businesses in need of quick funding. Factoring companies primarily consider the creditworthiness of the business’s customers, rather than the business itself.

- Reduced Credit Risk: By transferring the credit risk to the factoring company, businesses are protected from non-payment or late payment by customers. This can provide peace of mind and allow businesses to focus on their core operations, rather than chasing after payments.

Invoice factoring can be a valuable tool for businesses looking to improve their cash flow and maintain financial stability. It is essential to separate fact from fiction and explore the benefits and drawbacks of invoice factoring to make an informed decision.

Industries that Benefit from Invoice Factoring

When it comes to managing cash flow, invoice factoring has become a popular financing option for businesses across various industries. Let’s take a closer look at some of the industries that can benefit from invoice factoring.

Construction and Contracting

Construction and contracting companies often face long payment cycles that can put a strain on their cash flow. Invoice factoring allows these businesses to convert their outstanding invoices into immediate cash. This can help cover payroll, purchase materials, and fund other expenses to keep projects moving forward.

Manufacturing and Distribution

In the manufacturing and distribution industry, there is often a time gap between production and payment. Invoice factoring provides businesses with a quick infusion of capital, allowing them to meet operational costs, invest in equipment, and expand their operations.

Service-based businesses

Service-based businesses such as consulting firms, healthcare providers, and IT companies can benefit from invoice factoring as well. These businesses often have to wait for extended periods to receive payments from clients. By factoring their invoices, they can access the funds they need to cover expenses, maintain cash flow, and focus on growth opportunities.

Here’s a brief table outlining the industries that benefit from invoice factoring:

| Industry | Examples |

|---|---|

| Construction and Contracting | General contractors, subcontractors |

| Manufacturing and Distribution | Manufacturers, wholesalers, distributors |

| Service-based businesses | Consulting firms, healthcare providers, IT companies |

Invoice factoring is a flexible and convenient financing option that can provide businesses with the necessary funds to stay afloat and grow. Regardless of the industry, invoice factoring offers a solution to cash flow challenges, allowing businesses to focus on what they do best.

Alternatives to Invoice Factoring

When it comes to financing your business, invoice factoring is just one option among many. While it can be a valuable tool for managing cash flow, it’s important to explore other alternatives to see which one best suits your needs. Here are some alternatives to invoice factoring that you may consider:

Traditional Bank Loans

Traditional bank loans: One of the most common ways to finance your business is through a traditional bank loan. These loans typically require collateral and a thorough financial history review. While bank loans offer lower interest rates and longer repayment terms, the application process can be time-consuming and require extensive paperwork.

Lines of Credit

Lines of credit: A line of credit is a flexible financing option that allows you to borrow up to a certain amount within a predefined limit. With a line of credit, you can withdraw funds as needed and only pay interest on the amount you borrow. This option is ideal for businesses that have fluctuating cash flow needs.

Merchant Cash Advances

Merchant cash advances: If your business relies heavily on credit card sales, a merchant cash advance may be a suitable option. With a merchant cash advance, you receive a lump sum upfront in exchange for a percentage of your future credit card sales. This option can be convenient for businesses with seasonal revenue fluctuations.

Here’s a table comparing the features of these alternatives:

| Alternative | Traditional Bank Loans | Lines of Credit | Merchant Cash Advances |

|---|---|---|---|

| Collateral Required | Yes | Yes | No |

| Application Process | Lengthy | Moderate | Quick |

| Interest Rates | Lower | Variable | Higher |

| Repayment Terms | Longer | Flexible | Flexible |

| Credit Score Requirement | High | Moderate | Low |

| Documentation Required | Extensive | Moderate | Minimal |

Each alternative comes with its own set of features and requirements. It’s important to evaluate your business’s financial situation, cash flow needs, and preferences before deciding which financing option is right for you.

Case Study: Successful Implementation of Invoice Factoring

Invoice factoring is a financial solution that can provide immediate cash flow to businesses by converting their unpaid invoices into working capital. To help you understand the process better, let’s dive into a real-life example of a business that successfully implemented invoice factoring.

Real-life example of a business utilizing Invoice Factoring

Company X: Company X is a small manufacturing company that produces customized furniture. They often face cash flow challenges due to the long payment terms of their customers. To overcome this issue, Company X decided to implement invoice factoring.

Step 1: Application: Company X researched different invoice factoring providers and chose ABC Factoring Company. They submitted an application along with their outstanding invoices. ABC Factoring Company reviewed the application and approved the request based on the creditworthiness of Company X’s customers.

Step 2: Verification: Once approved, ABC Factoring Company verified the invoices to ensure their accuracy and authenticity. They cross-checked information with the customers and confirmed the outstanding balances.

Step 3: Funding: After verification, ABC Factoring Company initiated the funding process. They advanced Company X a percentage of the invoice value, typically around 80-90%. This immediate cash injection allowed Company X to meet its immediate financial obligations and invest in new equipment to fulfill upcoming orders.

Step 4: Collections: ABC Factoring Company became responsible for collecting the payment from Company X’s customers. They handled the invoicing and followed up with the customers to ensure timely payments.

Step 5: Settlement: Once the customers made the payments, ABC Factoring Company deducted their fee and any applicable charges. They then transferred the remaining balance to Company X, closing the transaction.

Invoice factoring provided Company X with the necessary cash flow to manage their day-to-day operations, pay suppliers, and pursue growth opportunities. By outsourcing their accounts receivable management, they were able to focus on core business activities while leaving the collections process to the factoring company.

In summary, invoice factoring is a valuable financial tool that can address cash flow gaps in businesses. By converting unpaid invoices into immediate cash, businesses can effectively manage their expenses and invest in growth. It is crucial to choose a reputable invoice factoring provider and fully understand the terms and conditions before entering into a transaction.