If you’re considering starting a business, one of the most important decisions you’ll need to make is choosing the right ownership structure. Two of the most popular options are limited liability companies (LLCs) and corporations. Both offer various advantages and disadvantages, and deciding which one is right for your business can be confusing. In this blog post, we’ll take a closer look at LLCs and corporations, and help you understand which one might be the best fit for your needs. Whether you’re a first-time entrepreneur or an experienced business owner, this guide will provide valuable insights into the key differences between these two ownership structures.

1. LLC vs. Corporation: Understanding the Basics

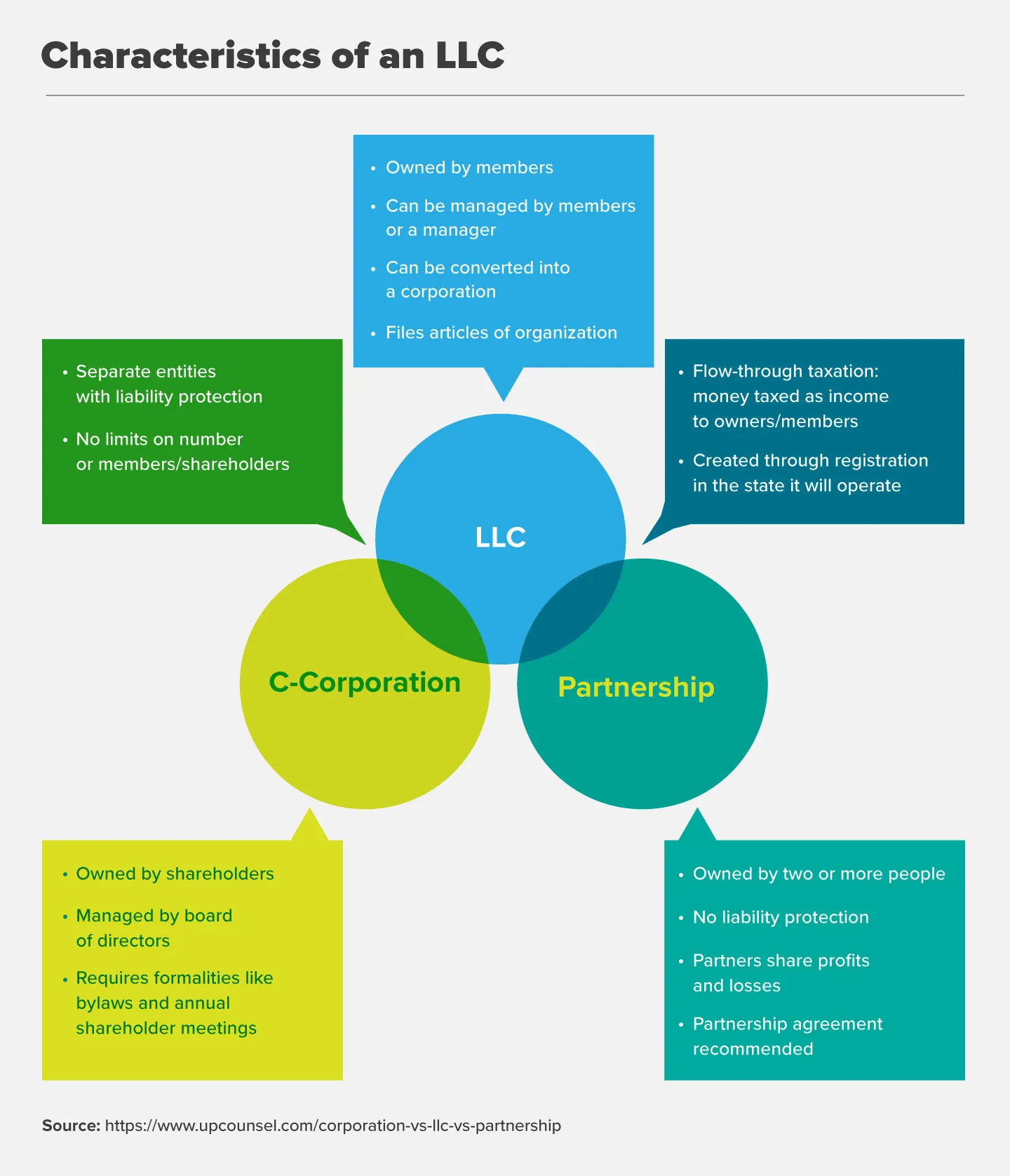

When it comes to choosing between a Limited Liability Company (LLC) or a Corporation, understanding the differences of each business entity is key. Both LLCs and Corporations offer liability protection and credibility for a business. However, there are distinct differences between the two. LLCs offer greater flexibility when it comes to how the business is run and tax options, including the ability to be taxed as a partnership, C corporation, or S corporation. In contrast, Corporations have a more standardized and rigid operating structure and are appealing for business owners looking for outside investors as shares in a Corporation are easier to transfer than ownership interests in an LLC. Additionally, Corporations are required to hold annual shareholder meetings, with strict paperwork and record-keeping requirements. No matter which entity is chosen, both LLCs and Corporations require filing of business formation documents with the state. Ultimately, the decision between an LLC or Corporation as the business structure will depend on the specific needs and goals of the business owner. [1][2]

:max_bytes(150000):strip_icc()/LLC-8e9fabc27dd44aec97ae5c5abb372a3c.jpg)

2. Advantages of Incorporating

Incorporating a business has numerous advantages. Firstly, it provides limited liability protection, which separates personal assets from business debts and obligations. This means that shareholders are not personally liable for the company’s debts and creditors cannot go after their personal assets. This provides a level of security and protection for the business owners. Additionally, corporations have access to a wider range of funding options, such as selling stock or bonds. This can be beneficial for businesses looking to expand or invest in new projects. Furthermore, incorporation provides a more stable management structure, with a board of directors who oversee major decisions and a clear chain of command established for decision-making. Finally, corporations have greater longevity as they can continue to exist even after the original founders pass away or sell their shares. These benefits make incorporating an attractive option for businesses looking to establish a strong foundation and secure future growth opportunities. [3][4]

3. Differences in Legal Structure

Limited Liability Companies (LLCs) and Corporations are two types of legal structures that offer their own strengths and weaknesses. LLCs are more flexible than corporations in terms of the creation and management processes, usually requiring less paperwork. They can be formed under state law and do not require filing with the Internal Revenue Service for tax identification. Additionally, LLCs offer tax flexibility, allowing members to choose how to be taxed such as being treated as a sole proprietorship, partnership, or corporation. An operating agreement is not necessary but it is a recommended practice to define the roles and responsibilities of the members. On the other hand, corporations have a more standardized and rigid operating structure, requiring more reporting and record-keeping requirements than LLCs. The corporate owners, called shareholders, own the company stock and have a stricter management structure, with a board of directors overseeing the business and officers managing daily operations. While shares in a corporation are easier to transfer than ownership interests in an LLC, corporations face the possibility of double taxation. Ultimately, the decision of choosing between an LLC and a corporation depends on the type of business being created, the possible tax consequences, and other considerations. [5][6]

4. Liability Protection for Business Owners

When it comes to starting a business, protecting personal assets is a top priority. Both LLCs and corporations offer liability protection for business owners. This means that in the event of a lawsuit or debt, the business and its assets are separate from the personal assets of the owner. This protection applies to both types of entities, but there are some differences. LLCs, or limited liability companies, offer what’s called a “veil of protection.” This means that creditors cannot go after the owner’s personal assets to satisfy business debts. Corporations, on the other hand, offer what’s called “limited liability.” This means that shareholders are only liable up to the amount of their investment in the company, rather than being personally liable for all of the company’s debts. Ultimately, the level of protection offered may not be the only factor to consider when choosing between an LLC and a corporation, but it is an important one to consider. [7][8]

5. Taxation Options for LLCs and Corporations

Taxation is a significant difference between a Limited Liability Company (LLC) and a corporation. LLCs are taxed as pass-through entities, which means that the business’s profits and losses pass through to the owners, who then report them on their personal tax returns. The IRS does not view an LLC as a separate vehicle for tax purposes, which allows for greater flexibility. Members can choose how they are taxed, such as a sole proprietorship or corporation. In contrast, corporations are taxed as separate legal entities, and profits and losses are taxed at the corporate level. This double taxation is a significant drawback for corporations. However, corporations can adjust their taxation by either electing subchapter S status, allowing the owners to report profits and losses on their personal tax returns, similar to the LLC, and avoid double taxation. Alternatively, they can choose a C corporation status, which is a separate taxable entity from its owners. Thus, both LLCs and corporations offer different taxation options, allowing business owners to choose the one that fits their business needs. [9][10]

6. Requirements for Maintaining Corporate Status

Maintaining corporate status requires strict adherence to certain regulations and formalities. These include holding annual shareholder meetings and maintaining accurate records of such meetings. Corporations must also have a board of directors that is responsible for overseeing major decisions and appointing officers to manage daily operations. Additionally, corporations must file annual reports and pay all required fees to the state in order to remain in good standing. Failure to follow these regulations can result in the loss of limited liability protection and even corporate dissolution. To avoid these consequences, corporations should establish and maintain internal policies and procedures to ensure compliance with all legal requirements. Seeking the guidance of legal and financial professionals can also help corporations stay on track and avoid costly mistakes. Overall, while there are added formalities and regulations to maintaining corporate status, the benefits of limited liability protection and the ability to attract outside investors make it a worthwhile option for many businesses. [11][12]

7. Differences in Ownership and Management Structure

Limited Liability Companies (LLCs) and Corporations differ in their ownership and management structure. LLCs have members who own a percentage of the business, while corporations have shareholders who own shares of company stock. LLC ownership is outlined in the business’s operating agreement, which includes details such as each member’s percentage of ownership and how the business will operate in the case of a new or departing member. On the other hand, for corporations, it is relatively easy to authorize additional shares or transfer ownership shares to someone else.

In terms of management structure, LLCs can be managed by their members, who have more flexibility in how they run the business, or they can be managed by one or more managers with the members acting as passive investors. In contrast, corporations operate with a stricter management structure, with a board of directors overseeing the business and officers who manage daily operations. Shareholders must meet at least annually, and there is more paperwork and record-keeping for shareholder and director meetings. These differences may play a crucial role in deciding which entity structure is best suited for your business needs. [13][14]

8. Formality Requirements for Corporations

Corporations have more formal requirements than LLCs. They are required to hold annual shareholder meetings and are subject to more onerous recordkeeping rules. They must also make annual reports to the state. A board of directors oversees the big picture issues and officers run the company’s day-to-day affairs. Most states require corporations to have at least a president, secretary, and treasurer. Shareholders must also elect the directors and any changes in the corporation’s structure must go through a vote. All of these formal requirements can be time-consuming and costly. However, if you plan to seek outside investors or provide company shares to employees, the structure and predictability of a corporation might be worth the extra work. If your business only has a few owners and you are all active participants, you may prefer to avoid the formality of a corporation and form an LLC instead. [15][16]

9. State Franchise Taxes for LLCs

State franchise taxes are one important consideration for anyone deciding between forming an LLC or a corporation. These taxes are revenue collected by individual states from businesses that operate within their borders. Many states levy franchise taxes on both LLCs and corporations as a way to generate revenue. The amount of the tax varies by state and can be calculated in various ways, such as based on the company’s net worth or income. Some states have a flat fee for this tax, while others use a more complex formula. It is important to research the specific requirements for the state where the business will operate in order to determine the impact of franchise taxes on the bottom line. A benefit of LLCs is that some states do not require them to pay franchise taxes or have lower fees than corporations. These varying fees and taxes can make a significant difference in the overall financial health of a business, so it is important to carefully consider them before deciding between an LLC or a corporation. [17][18]

10. Choosing the Right Entity for Your Business Needs

Choosing the right legal structure for your business can be a daunting task, but it’s an essential step towards success. There are several factors to consider, such as tax implications, liability protection, and paperwork requirements. When deciding between a limited liability company (LLC) and a corporation, it’s important to understand their differences and advantages. An LLC is typically easier to set up and manage, has fewer compliance requirements, and provides more flexibility in terms of taxation. On the other hand, a corporation offers limited liability protection, access to potential investors, and allows for more growth opportunities. Ultimately, the choice depends on the type of business you have, the level of risk involved, and your long-term goals. Seeking guidance from a legal expert or accountant can help ensure you make the right decision for your business. [19][20]