In today’s fast-paced world, running a small business is no walk in the park. As an entrepreneur, you have your hands full managing multiple tasks at once – from marketing campaigns, sales strategies, to payment processing, and more. But what if we told you there is a one-stop solution to streamline your workload and enable you to focus on what truly matters – growing your business? Let us introduce you to Novo Bank, the ultimate game-changer that revolutionizes the way you do business. Novo Bank seamlessly connects with over a dozen apps, including Stripe and Shopify, offering you unparalleled business insights and actions right at your fingertips. Read on to discover how this incredible platform can transform your entrepreneurial journey and unlock infinite potential for your success.

1. All-in-one business banking platform with clear financial insights

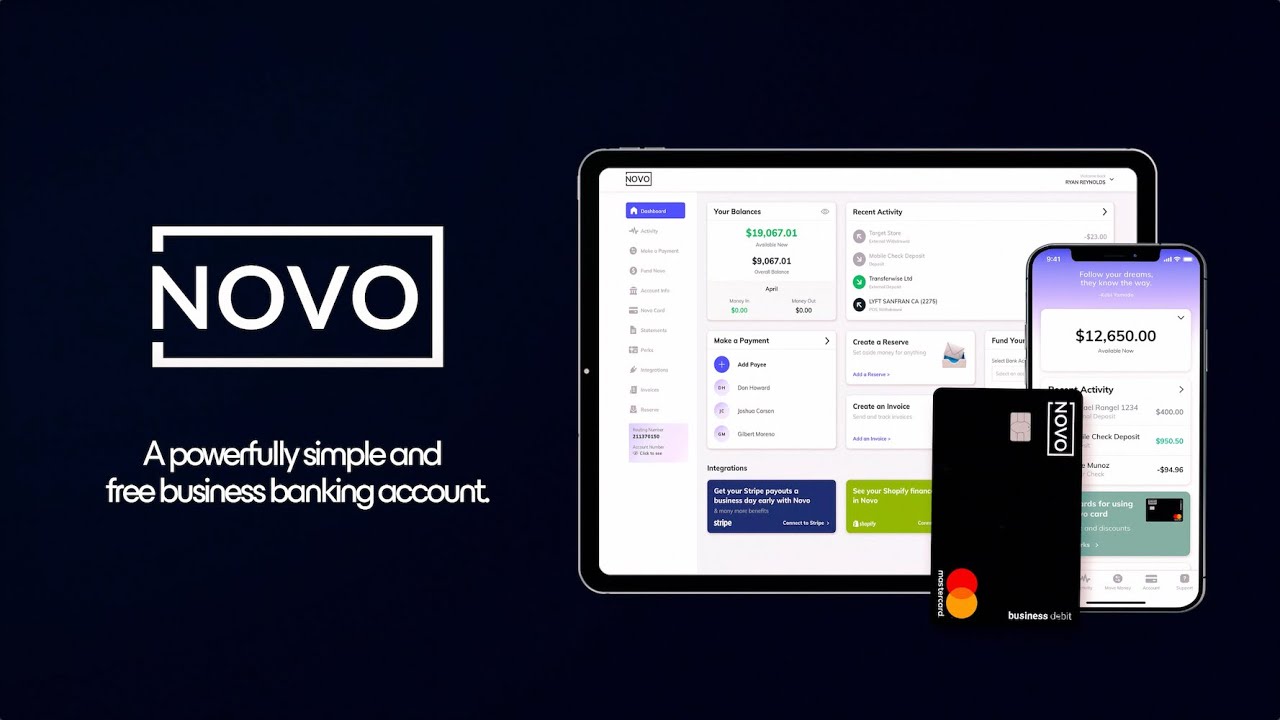

Novo is an all-in-one business banking platform designed to take businesses to greater heights by offering faster cash flow and clear financial insights. This fintech solution aims to simplify banking for growing teams and self-employed individuals alike by providing an easy-to-use, free business checking account that connects seamlessly with popular tools such as Stripe and Shopify.

With its robust features, Novo allows business owners to manage finances on-the-go, send customized invoices, and make payments with ease. The platform also offers automatic budgeting through its Reserves feature, ensuring businesses can efficiently allocate funds for taxes, payroll, and other major expenses. As a secure and award-winning platform, Novo focuses on helping businesses save time on managing finances and focus on growth instead. [1][2]

2. Free physical and virtual debit card for easy access to funds

Novo Bank offers both a free physical and virtual debit card, providing businesses with easy access to their funds. Providing account holders with flexible banking options, they can conveniently access their account through their mobile devices.

These debit cards, tailored for simplicity, allow businesses to seamlessly conduct transactions and manage their finances. With user-friendly technology and accessible customer support, Novo Bank ensures a hassle-free experience for its clients. The quick and smooth access to funds provided by both physical and virtual debit cards makes it a popular choice among small business owners, freelancers, and entrepreneurs. [3][4]

3. Novo Reserves for automatic fund allocation and budgeting

Novo Bank’s innovative feature, Novo Reserves, offers users a convenient way to automatically allocate funds and streamline their budgeting process. This intuitive tool allows businesses to effortlessly separate their finances into different categories, making it easier than ever to manage their budgets and maintain financial control.

Designed with simplicity in mind, Novo Reserves empowers businesses to focus on growth and expansion by reducing the complexities associated with traditional financial management. With this user-friendly platform, business owners can effortlessly balance their financial responsibilities and make well-informed decisions, leading to a more successful and organized operation. [5][6]

4. Multiple options for payments and transfers, including Wise for international payments

Novo Bank provides businesses with multiple options for payments and transfers, catering to different financial needs. Through its platform, users can enjoy free ACH transfers, mailed checks, and incoming wires, allowing companies to pay and receive funds with ease.

For international payments, Novo Bank has partnered with Wise to offer secure and affordable cross-border transactions. Wise offers transparent fees and real-time exchange rates, ensuring users get the best value for their money when making international transfers. By integrating Wise into the Novo platform, businesses can manage their global payments effortlessly and focus on scaling their operations. [7][8]

5. No hidden fees, monthly fees, or required minimum balance

Novo Bank, a fintech company offering a comprehensive business banking platform, ensures a seamless banking experience for small businesses. With no hidden fees, monthly fees, or required minimum balance, entrepreneurs can enjoy hassle-free financial management while focusing on growing their business. This user-friendly approach to banking offers maximum flexibility and transparency, making it an attractive choice for business owners looking for a reliable financial partner.

By providing top-notch digital banking services, Novo Bank empowers businesses in managing their finances effectively. Its integration with popular platforms like Stripe and Shopify allows users to gain valuable business insights and take necessary actions based on their financial performance. Furthermore, the bank’s user-friendly platform enables entrepreneurs to spend less time managing their finances and more time running their business.

Overall, Novo Bank’s commitment to eliminating hidden fees, monthly charges, and minimum balance requirements has made it a popular choice among small businesses. With its innovative approach to banking and seamless integration with various apps, Novo Bank has become a trusted partner for entrepreneurs looking to streamline their financial management and optimize their business growth. [9][10]

6. Bank-grade encryption for secure information storage

Novo Bank emphasizes the importance of data security when it comes to dealing with sensitive financial information. With bank-grade encryption enabled for its platform, users can trust that their personal and business details remain secure throughout their interactions with the application. This high-level data protection method ensures that sensitive information, such as account numbers and payment details, is securely stored and transmitted whenever necessary. By employing cutting-edge security practices, Novo Bank instills confidence in its users, making it a reliable choice for business owners seeking a seamless, efficient, and protected banking experience. [11][12]

7. Invoicing capabilities within the Novo account

Novo Bank has made invoicing simpler for businesses with its built-in invoicing capabilities. Users can create an unlimited number of fully customizable invoices directly within their Novo account, eliminating the need for separate invoicing software. This not only streamlines the invoicing process but also helps businesses spend less time managing their finances and focus on growing their operations. The user-friendly interface and third-party integrations offered by Novo ensure seamless financial management for professionals and businesses alike. [13][14]

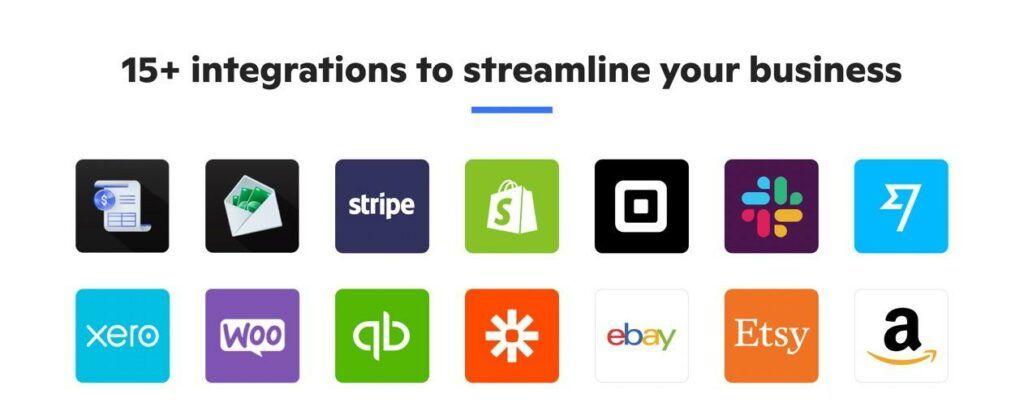

8. Integration with over a dozen business apps, including Quickbooks and Gusto

Novo Bank offers seamless integration with over a dozen business apps, allowing entrepreneurs and small business owners to consolidate their financial data and gain valuable insights. One such integration is with popular accounting software, QuickBooks. By connecting their Novo account to QuickBooks, users can streamline bookkeeping tasks and automate data entry for more accurate financial reporting.

Another useful integration is with Gusto, a payroll and HR management solution. By connecting Novo Bank to Gusto, business owners can efficiently manage payroll, time tracking, and employee benefits in one convenient platform. This integration simplifies administrative tasks and allows entrepreneurs to focus on growing their business.

Overall, Novo Bank’s multitude of app integrations, including QuickBooks and Gusto, work together to provide a comprehensive financial management solution for businesses. This enables users to stay organized, save time, and make informed decisions to drive growth and success. [15][16]

9. Novo Boost for faster access to Stripe payments

Novo Boost is a valuable feature designed for businesses that rely on prompt payments to maintain steady cash flow. It works through the integration of Stripe, a popular payment processing platform, allowing businesses to receive payments within hours instead of waiting for days. By speeding up transfers to the bank, Novo Boost ensures that companies can access their funds much faster, enabling them to move forward with essential business operations and financial activities. Additionally, Novo Boost supports the integration with several other payment tools, making it a versatile and efficient solution for businesses of all sizes. [17][18]

10. Simplified financial management for growing teams and small businesses

Growing a business can be challenging, especially when it comes to managing finances. This is where Novo Bank steps in to offer a simplified financial management solution for not only small businesses but also for growing teams. With their easy-to-use platform, business owners can effortlessly manage their money while staying focused on their core operations.

One of the many advantages of Novo Bank is its seamless integration with over a dozen popular apps, such as Stripe and Shopify. This enables business owners to access critical insights and take action directly from their Novo account, which provides a streamlined financial management experience. Moreover, Novo offers exclusive perks that can save businesses thousands on popular tools such as Quickbooks, Gusto, and Hubspot.

In summary, Novo Bank caters to the financial management needs of growing teams and small businesses through their user-friendly platform and seamless integration with various business tools. By choosing Novo, entrepreneurs can effectively simplify their financial management tasks and focus on what truly matters – growing their business. [19][20]