I. Introduction to Novo Bank

Overview of Novo Bank and its offerings

Novo Bank is a digital bank that offers a range of modern financial services to small business owners and freelancers. With Novo Bank, customers can easily manage their finances, track expenses, and access various banking services through a user-friendly mobile app. The bank focuses on providing a seamless and efficient banking experience, empowering entrepreneurs to take control of their financial lives.

Novo Bank’s partnership with Middlesex Federal Savings for FDIC-insured deposits

Novo Bank has established a partnership with Middlesex Federal Savings to offer FDIC-insured deposits. This means that customers who hold their deposits with Novo Bank can enjoy the added security and peace of mind knowing that their funds are protected by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor.

Middlesex Federal Savings, as Novo Bank’s partner bank, plays a crucial role in ensuring the safety and security of customer deposits. By leveraging Middlesex Federal Savings’ expertise, Novo Bank can offer this important feature to its customers, giving them confidence in the safety of their funds.

Having FDIC insurance on deposits is a significant advantage for customers, as it provides protection against bank failures and insures their funds in case of any unforeseen events. This partnership between Novo Bank and Middlesex Federal Savings highlights Novo Bank’s commitment to offering secure and reliable banking services to its customers.

With Novo Bank’s focus on simplicity, transparency, and security, small business owners and freelancers can confidently manage their finances and grow their businesses with ease.

II. FDIC Insurance Explained

Explanation of FDIC insurance and its importance

FDIC stands for Federal Deposit Insurance Corporation, an independent agency of the United States government. FDIC insurance provides protection for depositors in member banks, ensuring that their deposits up to $250,000 are fully insured in the event of bank failure. This insurance is crucial because it gives depositors peace of mind and safeguards their hard-earned money. FDIC insurance covers various types of deposits, including checking accounts, savings accounts, certificates of deposit (CDs), and money market accounts. It is essential for individuals to choose banks that are FDIC members to ensure the safety of their deposits.

Details on the coverage provided by FDIC for deposits up to $250,000

The FDIC provides up to $250,000 in coverage per depositor, per bank, for each different account ownership category. Here are the key details of FDIC coverage for deposits up to $250,000:

- Single Accounts: Deposits owned by one person are insured up to a maximum of $250,000.

- Joint Accounts: Deposits owned by two or more people are insured up to a maximum of $250,000 per co-owner.

- Revocable Trust Accounts: Deposits held in revocable trust accounts, such as living trusts or payable-on-death accounts, are insured up to $250,000 per beneficiary.

- Irrevocable Trust Accounts: Deposits held in irrevocable trust accounts, such as trusts created for estate planning purposes, are insured up to $250,000 for each unique beneficiary.

- Retirement Accounts: Deposits held in certain retirement accounts, such as Individual Retirement Accounts (IRAs) and Keogh plans, are insured up to $250,000 per depositor.

It is important to note that coverage is provided on a per-bank basis. If you have deposits in multiple banks, each deposit will have its own coverage up to $250,000. It is recommended to review your account ownership and consult with your bank to ensure that your deposits are properly insured by the FDIC.

For more detailed information on FDIC insurance, you can visit the official FDIC website to understand the ins and outs of this important safeguard for depositors.

III. Middlesex Federal Savings

Overview of Middlesex Federal Savings as Novo Bank’s partner

Middlesex Federal Savings is a partner bank of Novo Bank that offers FDIC-insured deposits for up to $250,000. As a trusted partner, Middlesex Federal Savings ensures the safety and security of Novo Bank’s customers’ deposits. The collaboration between these two institutions provides peace of mind to account holders, knowing that their funds are protected by the Federal Deposit Insurance Corporation (FDIC).

Background and reliability of Middlesex Federal Savings

Middlesex Federal Savings is a reputable bank with a long-standing history of serving customers in the United States. Established in {year}, Middlesex Federal Savings has built a solid reputation for providing reliable and secure banking services to individuals and businesses. The bank’s commitment to customer satisfaction and adherence to regulatory standards make it a trustworthy partner for Novo Bank. With Middlesex Federal Savings as its partner, Novo Bank can ensure that its customers’ deposits are held in a reliable and secure financial institution.

IV. Benefits of FDIC-Insured Deposits

Advantages of depositing funds with Novo Bank through Middlesex Federal Savings

When depositing funds with Novo Bank through its partner bank, Middlesex Federal Savings, customers can enjoy several benefits:

1. FDIC Insurance: Deposits made with Novo Bank through Middlesex Federal Savings are covered by FDIC insurance up to $250,000 per depositor. This provides customers with peace of mind knowing that their funds are protected against bank failures.

2. Security: With FDIC insurance, customers can rest assured that their deposits are backed by the full faith and credit of the United States government. This ensures the safety and security of their funds.

3. Convenience: Depositing funds with Novo Bank through Middlesex Federal Savings allows customers to access their funds through Novo Bank’s digital banking platform. This offers convenience and flexibility, as customers can manage their accounts and make transactions online.

4. Competitive Interest Rates: Novo Bank strives to offer competitive interest rates on its deposits, allowing customers to earn a higher return on their savings.

By choosing to deposit funds with Novo Bank through Middlesex Federal Savings, customers can enjoy the benefits of FDIC insurance and the convenience of digital banking, all while earning competitive interest rates on their deposits.

Security and peace of mind provided by FDIC insurance

FDIC insurance is a crucial component of the banking industry in the United States, providing security and peace of mind to depositors. It ensures that even in the event of a bank failure, depositors are protected and their funds are safe.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that insures deposits in banks and savings associations. The FDIC insures deposits up to $250,000 per depositor, per insured bank, for each ownership category.

Having FDIC insurance means that if a bank fails, depositors will receive their insured funds back, up to the insurance limit. This provides reassurance to depositors that their hard-earned money is protected and allows them to have confidence in the banking system.

It’s important to note that FDIC insurance coverage applies to deposit accounts, such as checking accounts, savings accounts, and certificates of deposit (CDs). It does not cover other financial products, such as stocks, bonds, or mutual funds.

Customers who choose to deposit funds with Novo Bank through Middlesex Federal Savings can take advantage of the security and peace of mind provided by FDIC insurance. Their deposits will be insured up to $250,000, allowing them to bank with confidence and focus on their financial goals.

To learn more about FDIC insurance and its benefits, you can visit the FDIC website.

V. Novo Bank’s Deposit Process

Step-by-step guide on how to open a deposit account with Novo Bank

- Visit the Novo Bank website: Start by visiting the Novo Bank website at www.novobank.com.

- Sign up for an account: Click on the “Sign Up” button and provide the necessary information to create your account. This will include your name, email address, and password.

- Complete the application: Once you have created your account, you will be prompted to complete the application process. This will require providing additional information such as your social security number, date of birth, and address.

- Choose the deposit account option: In the application process, you will have the option to select a deposit account. Novo Bank offers FDIC-insured deposits for up to $250,000 through its partner bank, Middlesex Federal Savings.

- Verify your identity: To comply with regulatory requirements, Novo Bank will ask you to verify your identity. This may involve submitting copies of identification documents such as a driver’s license or passport.

- Fund your account: Once your identity has been verified, you can fund your deposit account. Novo Bank provides various options for funding, including electronic transfers from other bank accounts.

Detailed explanation of the registration and deposit procedures

Novo Bank aims to make the registration and deposit procedures as simple and straightforward as possible. Here’s a closer look at how it works:

- Registration: The registration process starts with creating an account on the Novo Bank website. You will need to provide basic personal information and create a secure password.

- Application: After creating an account, you will be guided through the application process. This includes providing additional details such as your social security number, date of birth, and address. These details are necessary to comply with regulatory requirements.

- Deposit account selection: During the application process, you will have the option to select a deposit account. Novo Bank offers FDIC-insured deposits for up to $250,000 through its partner bank, Middlesex Federal Savings.

- Identity verification: As part of the registration process, Novo Bank will ask you to verify your identity. This is an important step to ensure the security and integrity of the banking system. You may be required to submit copies of identification documents, which can be securely uploaded through the Novo Bank platform.

- Funding: Once your identity has been verified, you can fund your deposit account. Novo Bank provides various options for funding, including electronic transfers from other bank accounts. This makes it convenient for customers to transfer funds and start earning interest on their deposits.

The registration and deposit procedures with Novo Bank are designed to be user-friendly and efficient. By following the step-by-step guide, customers can open a deposit account with ease and start enjoying the benefits of FDIC-insured deposits through Novo Bank’s partner bank, Middlesex Federal Savings.

VI. Interest Rates and Terms

Information on the interest rates offered by Novo Bank

Novo Bank offers competitive interest rates on its FDIC-insured deposits through its partner bank, Middlesex Federal Savings. These interest rates provide an opportunity for customers to earn a return on their deposits while ensuring the safety and security of their funds. The specific interest rates can vary depending on factors such as the term of the deposit and the current market conditions. It is recommended to visit the Novo Bank website or contact their customer service for the most up-to-date information on their interest rates.

Overview of the different terms and options available for deposits

Novo Bank provides customers with a range of options when it comes to the terms and options available for deposits. Some of the common terms and options include:

- Short-term Deposits: Novo Bank offers short-term deposit options, typically ranging from a few months to a year. These deposits are suitable for customers looking for a shorter commitment and potentially higher liquidity.

- Long-term Deposits: Customers who are looking for a long-term investment strategy can opt for long-term deposits, which can have terms of several years. These deposits often offer higher interest rates, allowing customers to earn more over time.

- Certificate of Deposit (CD): Novo Bank also offers certificates of deposit (CDs), which are fixed-term deposits with a specific interest rate. CDs generally have higher interest rates compared to regular savings accounts and may require a higher minimum deposit amount.

- Flexible Deposits: Novo Bank also offers flexible deposit options that allow customers to make additional deposits or withdrawals during the term of the deposit. These flexible deposit accounts provide customers with more control and liquidity.

- Minimum Deposit Amount: Depending on the type of deposit and term, Novo Bank may require a minimum deposit amount. It is recommended to check the specific requirements and details for each type of deposit to ensure compliance with the minimum deposit amount.

By offering different terms and options, Novo Bank aims to cater to a wide range of customers with varying needs and preferences. It is important for customers to carefully consider their financial goals and choose the deposit option that aligns with their objectives.

Overall, Novo Bank offers competitive interest rates and a variety of terms and options for deposits, providing customers with flexibility and potential returns on their investments.

VII. Comparison with Other Banks

Comparison of Novo Bank’s FDIC-insured deposits with offerings from other banks

When comparing Novo Bank’s FDIC-insured deposits with offerings from other banks, it’s important to consider the following factors:

- Deposit Insurance: Novo Bank offers FDIC insurance for up to $250,000 per depositor. This provides a level of security and peace of mind for customers.

- Partner Bank: Novo Bank partners with Middlesex Federal Savings to offer FDIC-insured deposits. Middlesex Federal Savings has a strong reputation and history of providing reliable banking services.

- Interest Rates: It’s crucial to compare the interest rates offered on FDIC-insured deposits by different banks. Higher interest rates can help customers grow their savings faster.

- Account Fees: Some banks may charge fees for maintaining FDIC-insured deposit accounts. Comparing the fees charged by different banks can help customers choose the most cost-effective option.

- Online Banking Experience: Novo Bank offers a seamless and user-friendly online banking experience. This allows customers to easily manage and access their FDIC-insured deposits from anywhere.

Highlighting the unique features and benefits of Novo Bank’s partnership

Novo Bank’s partnership with Middlesex Federal Savings offers several unique features and benefits, including:

- Easy Account Setup: Opening an account with Novo Bank and accessing FDIC-insured deposits through Middlesex Federal Savings is a straightforward and hassle-free process.

- Competitive Interest Rates: Novo Bank strives to provide competitive interest rates on FDIC-insured deposits. This allows customers to earn more on their savings over time.

- Strong Customer Service: Novo Bank and Middlesex Federal Savings prioritize customer satisfaction and provide excellent customer service. Whether customers have questions or need assistance, support is just a phone call or click away.

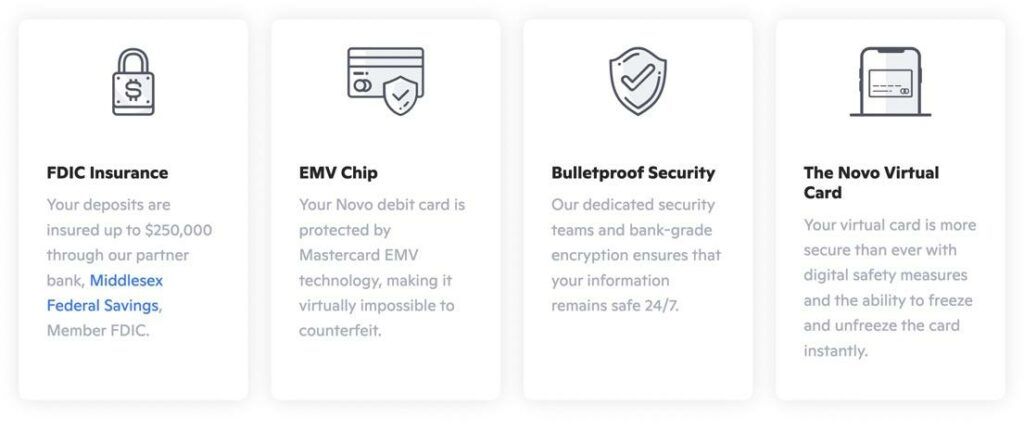

- Secure Online Banking: Novo Bank ensures the security of customer information and transactions through advanced online banking technology and encryption methods.

- Convenience: With Novo Bank’s online banking platform, customers have the convenience of accessing their FDIC-insured deposits 24/7 from their computer or mobile device.

Overall, Novo Bank’s partnership with Middlesex Federal Savings offers a reliable and convenient solution for customers looking to deposit their funds in FDIC-insured accounts. By comparing the features and benefits of Novo Bank with offerings from other banks, customers can make an informed decision about where to keep their savings.

VIII. FAQs about FDIC Insurance and Novo Bank

Commonly asked questions regarding FDIC insurance and Novo Bank’s deposit services

Here are some frequently asked questions about FDIC insurance and Novo Bank’s deposit services:

Answers to queries related to safety, eligibility, and returns

- What is FDIC insurance?

FDIC stands for the Federal Deposit Insurance Corporation, which is an independent agency of the United States government. FDIC insurance provides depositors with protection in case their bank fails or goes bankrupt. It guarantees deposits up to $250,000 per depositor, per bank. - Is Novo Bank FDIC insured?

Yes, Novo Bank is FDIC insured. Novo Bank partners with Middlesex Federal Savings, which is a member of the FDIC. This means that deposits made with Novo Bank are protected by FDIC insurance up to the legal limit. - How does FDIC insurance work?If a bank fails, FDIC insurance ensures that depositors receive their insured funds. In case of a bank closure, the FDIC steps in to pay out insured deposits to depositors, up to $250,000 per depositor, per bank.

- Are all types of accounts covered by FDIC insurance?FDIC insurance covers a variety of deposit accounts, including checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs) held at FDIC-insured banks.

- Is there a fee for FDIC insurance?No, depositors do not have to pay a fee for FDIC insurance. The cost of the insurance is covered by participating banks, and the coverage is automatically provided to account holders.

- What happens if my deposits exceed the FDIC insurance limit?If your deposits exceed the FDIC insurance limit of $250,000, the excess amount may not be insured. It is important to carefully manage your deposits to ensure that you have adequate coverage.

- Is opening an account with Novo Bank safe?Yes, opening an account with Novo Bank is safe. Novo Bank partners with Middlesex Federal Savings, an FDIC-insured bank. This partnership ensures that your deposits are protected by FDIC insurance up to the legal limit.

- What are the returns on Novo Bank’s deposit services?Novo Bank offers competitive returns on its deposit services. The interest rates may vary depending on the type of account and prevailing market conditions. For specific details on the returns offered by Novo Bank, it is best to visit their website or contact their customer support.

For more detailed information on FDIC insurance and Novo Bank’s deposit services, you can visit the FDIC website or reach out to Novo Bank’s customer support.

IX. Customer Reviews and Experiences

Compilation of testimonials and feedback from Novo Bank customers

Novo Bank has garnered positive feedback from its customers, who appreciate the convenience and reliability of its FDIC-insured deposit services. Here are a few testimonials from satisfied customers:

- “I’ve been using Novo Bank for my business banking needs, and I couldn’t be happier. The FDIC-insured deposits give me peace of mind, and the easy-to-use online platform allows me to manage my finances efficiently.” – John D., Small Business Owner

- “Novo Bank has been a game-changer for my personal banking. The fact that my deposits are FDIC-insured up to $250,000 gives me the confidence I need, and their customer service team is always friendly and helpful.” – Sarah W., Novo Bank Customer

- “I was hesitant to switch banks, but Novo Bank made the process seamless. Their FDIC-insured deposit services ensure the safety of my money, and the user-friendly mobile app makes banking on the go a breeze.” – Mark T., Novo Bank Customer

Insights into the satisfaction and reliability of the FDIC-insured deposit services

Based on customer feedback, the FDIC-insured deposit services offered by Novo Bank are highly regarded for their reliability and security. Here are some key insights into the satisfaction of customers:

- Deposits up to $250,000: Customers appreciate the peace of mind that comes with knowing their deposits are protected by the FDIC for up to $250,000, ensuring the safety of their funds.

- Seamless banking experience: Novo Bank’s user-friendly online platform and mobile app make it easy for customers to manage their finances from anywhere, enhancing their overall banking experience.

- Excellent customer service: Novo Bank’s customer service team is highly praised for their responsiveness and helpfulness, ensuring that customers feel supported and valued.

Overall, customer reviews and experiences highlight the satisfaction and reliability of Novo Bank’s FDIC-insured deposit services, making it a trusted choice for individuals and businesses looking for secure and convenient banking solutions.

X. Conclusion

Summary of the advantages of Novo Bank’s FDIC-insured deposits through Middlesex Federal Savings

Novo Bank’s partnership with Middlesex Federal Savings offers several advantages for customers looking for FDIC-insured deposits:

1. FDIC Insurance: Deposits made through Novo Bank’s partnership with Middlesex Federal Savings are FDIC-insured up to $250,000 per depositor, providing peace of mind and financial security.

2. Competitive Interest Rates: Novo Bank aims to provide competitive interest rates on deposits, allowing customers to earn a good return on their savings.

3. Easy Access to Funds: Novo Bank provides convenient access to funds through their user-friendly mobile banking app, making it easy for customers to manage their accounts and make transactions.

4. Simplified Banking Experience: Novo Bank offers a streamlined and modern banking experience, with features like online account opening, expense tracking, and integrations with popular business tools.

Final thoughts on the benefits and value provided by Novo Bank’s offerings

Novo Bank’s partnership with Middlesex Federal Savings brings significant benefits to customers in terms of security, competitive interest rates, and a modern banking experience. By offering FDIC-insured deposits, Novo Bank ensures that customers’ funds are protected, providing them with the confidence and peace of mind they need. With user-friendly mobile banking features and simplified account management, Novo Bank offers convenience and efficiency. Overall, Novo Bank’s offerings provide value and innovation in the banking industry.