Society does a great job of making most people feel like they can afford a car. And for the most part, it’s FAKE NEWS!

If you can’t afford a car with cash, you can’t afford it, however most of us will finance the car because the banks will. make it work for us.

And for those of us who live in the states, a study shows that 80% of Americans are in debt.

This is the time to ask yourself, “Is refinancing a car a good idea?”

Banks offer an incredible amount of money for car loans knowing that some people will have a hard time making the payments. However, that doesn’t change the fact that people will go ahead and finance a vehicle for sometimes astronomical amounts.

You may be wondering “is it worth refinancing a car?” Although I hate answers like this… the truth is that it depends.

Like most Americans, I was brainwashed into thinking that being in debt is normal.

I bought my car in 2016 and couldn’t pay cash, so I took out an auto loan and financed it.

What keeps me up to date with my finances is my Annual budget. My budgeting strategy has been very helpful and allows me to see how long it will take me to pay off and how much I would pay in total.

After realizing how much I had actually saved or would have saved at the end of the year, I decided to reallocate those savings to pay down the debt.

Why pay interest if you don’t have to?

I was still paying off my auto loan, so I was wondering, ‘Should I refinance my car?’

After overanalyzing as I always do, the answer was clear. It made sense to me to refinance, so I did exactly that.

If you are in a similar situation, you may want to consider refinancing your auto loan.

Sure, it’s entirely possible that refinancing your car isn’t right for you right now.

But there are a few reasons why you should consider refinancing your auto loan on your journey to financial freedom.

Reasons to refinance your car loan

- Your credit has improved.

- Interest rates have come down.

- Your debt-to-income ratio is lower.

- Lower your monthly payment.

While having a lower interest rate or lower monthly payment when you refinance is tempting, it’s important that you also consider the risks involved in refinancing. Take a careful look at your current auto loan and financial situation to determine if refinancing makes sense for you.

These questions were at the top of my list of concerns when considering whether refinancing my auto loan was a smart move.

- What charges will I be responsible for?

- Is my loan balance greater than the value of my vehicle?

- How old is my car?

- Will refinancing my car improve my cash flow?

- Has my credit improved?

So let’s get into this.

Your credit has improved

One of the biggest weaknesses in getting the best interest rate is based on your credit score.

There are 3 main credit reporting agencies you’ll want to check your scores with: 1) Equifax, 2) Experian, and 3) TransUnion.

Depending on your lender, they may use a different version when you complete your auto loan application.

My favorite company that offers free credit reports and scores is credit karma.

Credit Karma has 2 of the 3 major credit bureaus listed once you create an account; 1) Equifax and 2) TransUnion.

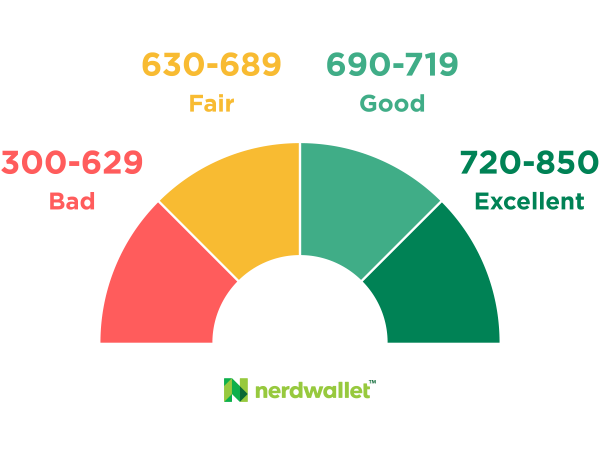

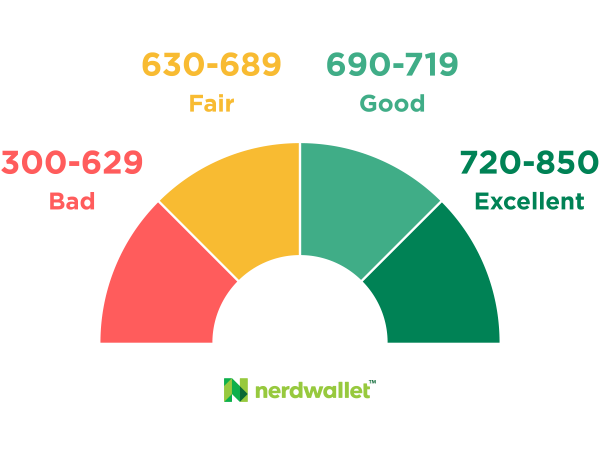

My credit score jumped from 715 (Good) to 790 (Excellent) from the time I bought my vehicle, so when weighing the pros and cons of refinancing, the decision was clear.

The best credit score to refinance a car is when your score is in the “Excellent” range, 720 – 850.

Nerd Wallet has a great article that helps explain “What is a credit score and what are the credit score ranges?”

I started my car loan with a credit score of 715 with 3.99% APR and a monthly payment of $400.46 to a credit score of 790 with a car loan with 2.49% APR and monthly payments of $350.30.

Unfortunately, some people get locked into unreasonable rates due to a lack of knowledge and low credit scores. But the moment that improves, it’s best to consider refinancing high-interest auto loans.

What is a ‘FICO score’?

what score Really it matters is you FICO Score.

There are 5 classifications it could fall into.

| <580 | Poor | Your score is well below the average score for American consumers and shows lenders that you are a risky borrower. |

| 580-669 | fair | Your score is below the average score for American consumers, although many lenders will approve loans with this score. |

| 670-739 | Okay | Your score is close to or slightly above the average for US consumers, and is considered a good score by most lenders. |

| 740-799 | Very good | Your score is above the average for American consumers and shows lenders that you are a very reliable borrower. |

| 800+ | Exceptional | Your score is well above the average score for American consumers and clearly demonstrates to lenders that you are an exceptional borrower. |

Interest rates have gone down

Interest rates fluctuate periodically depending on the economy. And right now we’re seeing interest rates drop like flies.

Interest rates are now historically LOW!

One of the best reasons to refinance a car loan is if you have the opportunity to lower your interest rate. If you previously had no credit or bad credit, it’s worth refinancing your car loan after a couple of years to see if you get better deals. Your credit score may have improved enough to qualify you for a lower interest rate.

With a lower interest rate, you’ll be able to pay off your car loan faster or lower your monthly payment while paying it off at the same rate.

In either case, you’ll pay less over the life of the loan.

Your debt-to-income ratio is lower

When I first heard about the debt-to-income ratio, I immediately wondered how it was calculated.

So what exactly is the debt to income ratio?

Your debt-to-income (DTI) ratio is all of your monthly debt payments divided by your monthly gross income. This number is a way that lenders measure your ability to manage the monthly payments to pay off the money you plan to borrow.

At or below a 36% DTI is considered the ideal relationship to have. 45% is considered a maximum.

If you have student loans in the 5 digits, this can seriously affect your DTI in a negative way.

Lower your monthly payment

For many of us, ‘Life happens’ and we have unexpected expensive responsibilities like having a baby, dental bills and other unexpected medical bills, or maybe even a natural disaster can put you in a situation where you want or need to lower your bills. and monthly expenses.

Refinancing your auto loan could help you significantly lower your monthly bill.

For example, if you owe two more years on your current loan, it is possible to refinance and extend the term to four years.

By adding two years to your loan, that should lower your monthly payment substantially, depending on the interest rate you get.

Although the downside is that you would pay for an additional two years, you would free up more available cash each month to increase your savings and other personal/household needs.

If you can, it’s smart to pay a little more in your monthly payment (if you can) to pay more in principal and less in interest.

Compare prices to get the best deal

Once you’ve done some research and decided that refinancing your vehicle makes sense, you’ll want to make sure you’re getting the best deal.

Credit unions often have some of the best rates. I used the same credit union that I used to get my car loan initially.

I searched for the best rates to refinance, and my credit union still beat the competitive rates in the area.

However, be sure to compare interest rates from multiple lenders, and don’t forget to keep an eye out for fees that may also be added to your new loan.

Whenever you’re ready to start shopping around, try to limit your credit requests to a 14-day window. If a broker tells you that you have a larger window and that it’s okay to run another report on your credit, they’re probably lying.

Trust your gut in those situations, because YOU will be the one affected when it comes to your credit, not the broker.

Credit checks (also called credit inquiries) can potentially lower your credit scores. But if you make sure all credit inquiries happen within that 14-day period, they’ll be combined. These combined inquiries should only affect your credit scores (VantageScore or FICO) once.

When you refinance, the goal is to save as much money as possible. Be sure to set aside plenty of time to do your research to ensure you get the best deal available.

Determine if auto refinancing makes sense for you

Sometimes extending the length of your car loan can lead to paying more – NOT LESS – on your car loan. While lowering your monthly payment may improve your monthly cash flow, that doesn’t mean it will help you save money in the long run.

Depending on what you want to do (pay off your loan faster or lower your monthly expenses), you may end up paying much more for your car than if you had continued with your original loan.

Refinancing is not always free.

Most of the time, you can refinance your auto loan without incurring any additional fees for doing so. Sometimes, depending on the lender, there is a cost to refinance your auto loan. Still, you should always inquire about fees or charges with your chosen lender before pulling the trigger.

I remember seeing a number on my refinance loan documents and calling to speak to the credit union just to fully understand what certain terms meant and why the numbers were different than what I expected.

To get the most out of your refinance, opt for a new loan with a lower rate and an equivalent or shorter payment term. That way, you’ll get the benefit of a lower rate without having to pay off your car loan any longer.

It may also be good to talk to your loan officer in person to feel more comfortable asking questions about loan terms.

If you need to extend the length of your loan to qualify for any reason, you can continue paying the same amount you paid before with the peace of mind that you could make a lower payment one month if money is tight.

When is the best time to refinance a car loan?

The best time to refinance a car loan is right now! – If it makes sense to you.

Interest rates are incredibly low right now, and you don’t want to miss out on this wave.

Are you going to refinance your auto loan?

Let me know in the comments section below, I’d love to know how much you’re saving!