Introduction

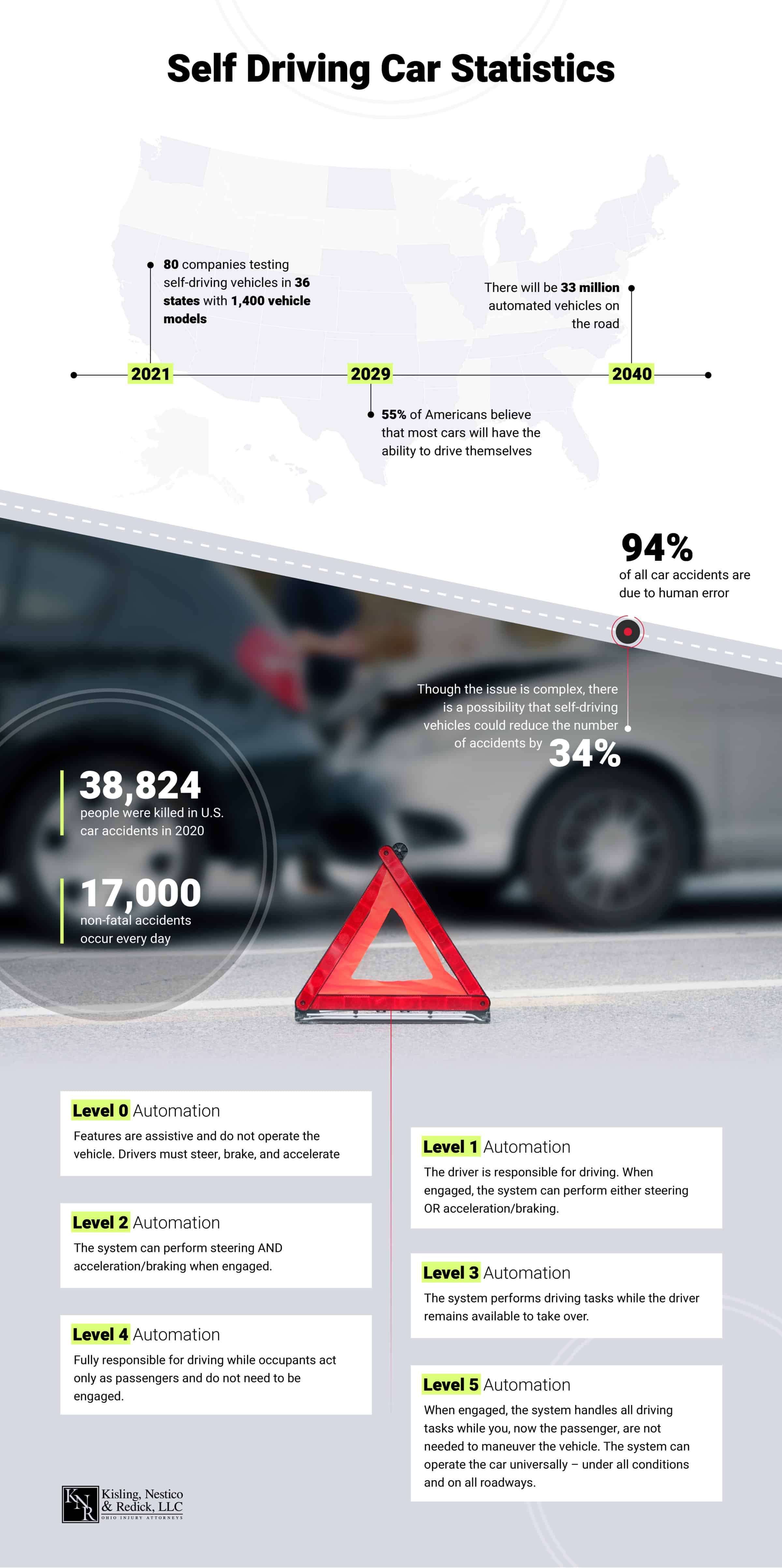

Within the ever-evolving automotive landscape, the presence of self-driving cars is becoming increasingly evident. The prevalence of this technologically advanced mode of transportation is potentially shaping a new era of mobility.

Overview of self-driving cars and their growing presence

Autonomous, self-driving cars, with their promise of enhanced safety and hands-free convenience, are steadily paving the way towards the future of transportation. Technological giants and automotive leaders alike, battle it out in an intense race to achieve full autonomy.

The importance of auto insurance in the context of self-driving cars

However, amidst the plethora of benefits offered by self-driving cars, auto insurance remains a paramount consideration. Even with sophisticated AI technology, the potential for on-road mishaps cannot be ignored. Ensuring appropriate coverage for autonomous vehicles is, therefore, not just prudent, but necessary. As the sphere of self-driving cars expands, so does the need to rethink traditional auto insurance policies, to accommodate this radical innovation.

How Self-Driving Cars Affect Auto Insurance Policies

Self-driving cars present an intriguing shift in the auto insurance industry. They introduce new concepts in liability and coverage that deviate from traditional insurance models.

Changes in liability and coverage requirements

In the world of autonomous vehicles, liability shifts from the individual driver to the vehicle’s manufacturer. This could potentially redefine auto insurance policies, focusing on product liability instead of driver’s insurance.

Incorporating new technologies and data into insurance policies

Furthermore, the availability of in-depth data from self-driving cars can anchor custom insurance solutions. To centralize, such data like vehicle diagnostics, driving habits, and the operational environment could feed into insurance pricing models. Aggregate data could influence coverage parameters, making insurance policies more reflective of each vehicle’s unique risk profile.

Benefits of Self-Driving Cars for Auto Insurance

Embracing technology has led the auto industry to the precipice of a new era, one that is largely influencing auto insurance policies.

Reduction in accidents and safer driving

Autonomous vehicles are designed with complex algorithms and cutting-edge sensors that prioritize safety through controlled and calculated driving. As a result, the human error factor, responsible for a majority of accidents, decreases, leading to safer roads.

Potential cost savings for policyholders

Significantly safer roads, spurred by autonomous vehicle technology, may lead to fewer insurance claims. Consequently, policyholders could enjoy lower premium costs, positioning self-driving cars as an almost irresistible proposition. This advent could possibly spark paradigm shifts in the world of auto insurance policies.

Challenges and Considerations for Auto Insurers

The advent of self-driving cars is set to transform the transportation industry significantly. The change also brings a unique set of challenges for auto insurers.

Adapting underwriting models and risk assessment

Self-driving cars will require auto insurers to adapt their underwriting models and risk assessment protocols. Instead of basing insurance premiums on drivers’ skills and behaviors, insurers will now need to take into account the technology embedded in the vehicle and its potential liabilities.

Addressing privacy concerns and data protection

Another prime concern with self-driving cars is the mass of data they generate. This raises significant issues around privacy and data protection. Insurance companies will need to handle this sensitive data professionally, ensuring maximum security not to breach their customers’ trust and comply with relevant privacy laws.

Future of Auto Insurance in the Age of Self-Driving Cars

Enter the realm of self-driving cars, and you’ll find a rapidly transforming auto insurance landscape.

Emerging trends and innovations in auto insurance policies

As autonomous vehicles grow in popularity, traditional auto insurance polices are evolving, with providers innovating to cover technological risks. Require a tailored policy to cover costly automated components, self-driving software, and potential cybersecurity threats is the need of the hour.

Predictions for the evolution of coverage options

Insurance providers will not lag behind and are seeking ways to adjust their coverage options. They’re likely to offer new policies that cover a blend of traditional and autonomous vehicle risks, focusing on factors like software malfunction or third-party hardware defects. The insurance market, in response to self-driving cars, is shifting towards a more comprehensive and technologically advanced coverage model.

Conclusion

Having analyzed the complexities around self-driving cars and their implications on auto insurance policies, it’s clear their entry into the mainstream will usher in significant changes.

Summary of the impact of self-driving cars on auto insurance

There’s no doubt that autonomous cars will reduce the frequency of accidents, given their sophisticated technology meant to eliminate human error. However, this benefit also shifts liability from drivers to manufacturers, effectively changing the dynamics of auto insurance.

Key takeaways and considerations for policyholders and insurers

The advent of self-driving cars behooves policyholders and insurance companies to adapt to a novel landscape where risk assessment, policy pricing, and claim processes could require considerable modifications. As such, creating policies that are agile, and able to respond to the evolving autonomous car technology, is paramount. Considering aspects like software glitches or cybersecurity threats when devising coverage will become more significant than ever.

So, it’s not just about catching up with technology, but rather, shaping the future of auto insurance with it.###