What are Annuities?

Annuities Definition and Types

Annuities are financial products offered by insurance companies that provide a steady stream of income in exchange for a lump sum payment or regular contributions. There are different types of annuities, including fixed, variable, and indexed annuities, each with its own features and benefits.

Benefits and drawbacks of Annuities

Some of the benefits of annuities include guaranteed income for life, tax-deferred growth, and the option to choose from various payout options. However, there are drawbacks to consider, such as high fees, lack of liquidity, and potential surrender charges for early withdrawals.

While annuities can be a useful tool for retirement planning and generating income, it’s important to carefully evaluate your financial goals and consider the pros and cons before making a decision. Consulting with a financial advisor can help you determine if annuities are the right fit for your specific circumstances.

Remember, understanding the intricacies of annuities is crucial in making informed choices that align with your long-term financial objectives.

Fixed Annuities

Fixed Annuities Explained

Annuities are a type of insurance contract that provide a guaranteed income stream in retirement. Fixed annuities, specifically, offer a fixed interest rate over a specified period of time. This means that you will receive a set amount of money every month, regardless of market fluctuations. Fixed annuities are a popular choice for those who want a predictable and consistent income during their retirement years.

Advantages and disadvantages of Fixed Annuities

Advantages of fixed annuities include guaranteed income, tax-deferred growth, and the ability to customize payment options. With fixed annuities, you can have peace of mind knowing that your income is predictable and will last for the duration of your retirement. However, fixed annuities may have lower returns compared to other investment options, and there may be restrictions on withdrawals or surrender fees if you need to access your funds before the end of the contract period.

It is important to carefully consider your financial goals and retirement needs before deciding to invest in fixed annuities. Consulting with a financial advisor can help you determine if fixed annuities are the right choice for you.

Variable Annuities

Variable Annuities Explained

Variable annuities are a type of insurance contract that offers the opportunity to invest in a variety of underlying investment options. Unlike fixed annuities, which provide a guaranteed payment amount, variable annuities have the potential for higher returns but also come with investment risks. The value of the annuity fluctuates based on the performance of the investments chosen. Variable annuities can offer tax-deferred growth and the option to receive a stream of income in retirement.

Pros and cons of Variable Annuities

Variable annuities have both advantages and disadvantages. Some of the pros include the potential for higher returns compared to conservative investments, the ability to customize your investment portfolio, and the option to receive a regular income stream during retirement. On the other hand, variable annuities come with higher fees, market risks, and limited investment choices compared to other investment options. It’s important to carefully consider your risk tolerance, investment goals, and financial situation before deciding if a variable annuity is right for you.

In conclusion, variable annuities can be a suitable option for individuals looking for potential growth and flexibility in their retirement investments. However, it’s crucial to thoroughly research and understand the features, benefits, and risks associated with variable annuities before making a decision. Consulting with a financial advisor can also provide guidance to ensure the suitability of variable annuities within your overall financial plan.

Index Annuities

Index Annuities Definition and features

Index annuities are a type of insurance product that provide a guaranteed minimum return, combined with the opportunity to earn additional interest based on the performance of a specific stock market index, such as the S&P 500. These annuities offer a level of protection against market downturns, making them a popular choice for individuals looking for a balance between growth potential and security. They usually have a fixed term and are considered a long-term investment.

Benefits and limitations of Index Annuities

One of the key benefits of index annuities is the potential for higher returns compared to traditional fixed annuities, as they allow policyholders to participate in the stock market’s growth. Additionally, index annuities offer downside protection, ensuring that policyholders don’t lose their principal investment even if the market goes down. They also provide tax-deferred growth and a guaranteed income stream in retirement.

However, it’s important to note that index annuities typically come with certain limitations. They often have surrender charges and complex terms, so it’s crucial to understand the fine print before committing. The returns on index annuities may also be subject to caps or participation rates, which can limit the amount of interest earned. Moreover, early withdrawals may result in penalties.

In conclusion, index annuities provide a unique opportunity for individuals to achieve potential growth while protecting their principal investment. However, understanding the features, benefits, and limitations of these annuities is essential to make informed decisions about your financial future.

Understanding Annuity Payouts

Annuity Payout Options

When it comes to annuities, there are various payout options that can determine how and when you receive your money. Some common choices include:

- Lump-Sum Payment: This option allows you to receive the entire amount in one go.

- Life Only: With this option, you will receive payments for as long as you live.

- Joint and Survivor: This option guarantees payments for both you and a designated beneficiary.

Factors influencing annuity payouts

Several factors can influence annuity payouts, including:

- Age: Generally, the older you are when you start receiving annuity payouts, the higher the payment amount.

- Gender: Women tend to receive lower annuity payouts than men due to longer life expectancy.

- Interest Rates: Higher interest rates can lead to higher annuity payouts.

- Payment Option: The payout option you choose can affect the amount you receive.

It’s important to understand the different options and factors that can impact annuity payouts before making a decision. Consulting with a financial advisor can help you navigate the complexities and make an informed choice that aligns with your financial goals. By understanding annuity payouts, you can make the most of this insurance product that pays you back.

Annuity Riders and Options

Guaranteed Lifetime Income Rider

If you’re thinking about purchasing an annuity, you may be curious about the various riders and options available. One popular choice is the Guaranteed Lifetime Income Rider.

With this rider, you can ensure a steady stream of income for the rest of your life, no matter how long you live. It provides peace of mind, especially for those concerned about outliving their retirement savings.

Other popular annuity riders and options

In addition to the Guaranteed Lifetime Income Rider, there are several other riders and options to consider. These include:

- Death Benefit Rider: Provides a payout to your beneficiaries if you pass away before receiving all of your annuity payments.

- Long-Term Care Rider: Offers financial assistance in the event you require long-term care services.

- Inflation Protection Rider: Adjusts your annuity payments to account for inflation, ensuring your income keeps pace with rising costs.

- Withdrawal Benefit Rider: Allows you to access a portion of your annuity funds before the normal payout period.

These riders and options can be tailored to meet your specific needs and financial goals. It’s important to carefully consider each one and consult with a financial advisor to determine which ones are right for you.

Remember, an annuity is a long-term commitment, so understanding the riders and options available is crucial in making an informed decision about your financial future.

Annuities vs Other Retirement Income Sources

Comparison with 401(k) and IRAs

When planning for retirement, it’s important to consider all your options. Annuities offer distinct advantages compared to other retirement income sources like 401(k)s and IRAs.

- Guaranteed Income: Annuities provide a guaranteed income stream for life, ensuring financial security during retirement. Unlike 401(k)s and IRAs, which rely on investment returns and market performance, annuities eliminate the potential for unpredictable fluctuations.

- Tax Benefits: Contributions to 401(k)s and IRAs may be tax-deductible, but withdrawals are taxed as ordinary income. In contrast, annuities offer the potential for tax-deferred growth, with tax obligations deferred until you start receiving payments.

Annuities as a part of retirement income strategy

Diversify Your Income: Annuities can play a vital role in diversifying your retirement income strategy. By combining annuities with other retirement savings vehicles, such as 401(k)s and IRAs, you can create a balanced portfolio that offers stability, growth potential, and guaranteed income.

Longevity Protection: Annuities are particularly valuable in protecting against the risk of outliving your savings. With an annuity, you have the reassurance of a steady income stream, no matter how long you live.

Whether you’re considering retirement savings options or looking for ways to secure your financial future, understanding annuities and their benefits is essential. Consult with a financial advisor to determine if annuities align with your retirement goals and create a comprehensive plan tailored to your needs.

Annuity Tax Considerations

Tax Advantages of annuities

Annuities offer several tax advantages. First, the growth of your investment is tax-deferred, meaning you don’t have to pay taxes on any gains until you start withdrawing funds. This can allow your investment to compound over time. Additionally, annuities can provide a steady income stream in retirement that may be taxed at a lower rate than other income sources.

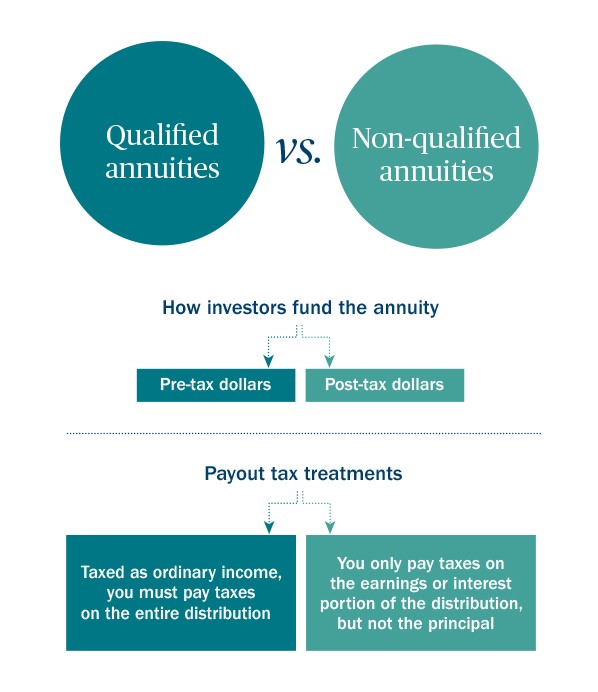

Tax implications of annuity withdrawals

When you start taking withdrawals from your annuity, the tax treatment will depend on the type of annuity you have. If you have a non-qualified annuity purchased with after-tax dollars, only the growth portion of your withdrawal is taxable. On the other hand, if you have a qualified annuity, such as a 401(k) or an IRA annuity, the entire withdrawal is subject to ordinary income tax rates.

It’s important to note that withdrawing funds from an annuity before the age of 59½ may result in a 10% penalty in addition to ordinary income taxes. However, there are exceptions to this rule, such as specific medical expenses or disability. Consulting with a tax professional can help you navigate the tax implications of annuity withdrawals and ensure you make informed decisions.

In summary, annuities provide tax advantages such as tax-deferred growth and the potential for lower tax rates on income in retirement. However, the tax treatment of annuity withdrawals will depend on the type of annuity and your age at the time of withdrawal.

Conclusion

If you are looking for a reliable way to secure your financial future, annuities can be a great option. They provide a guaranteed source of income and offer flexibility in terms of payouts. However, it is important to understand your own financial goals and needs before deciding if an annuity is right for you.

Is an Annuity right for you?

Annuities are suitable for individuals who are seeking a steady income stream during retirement or those who want to diversify their investment portfolio. Before making a decision, it is crucial to assess your financial situation, risk tolerance, and long-term goals. Consulting with a financial advisor can help you determine if an annuity aligns with your needs.

Common misconceptions about Annuities

There are several misconceptions surrounding annuities that need to be addressed. First, annuities are often seen as complex financial products, but with proper guidance, they can be easily understood. Additionally, some believe that annuities are only for the wealthy, but there are options available for individuals of all income levels. Lastly, there is a misconception that annuities have high fees, but this can vary depending on the specific annuity contract.

In conclusion, understanding the basics of annuities and dispelling common misconceptions can help you make an informed decision about whether this insurance product is right for you and your financial goals.