I. Introduction to Invoice Factoring

For small businesses, invoice factoring can be a life-saver. It’s a financial option designed to help companies enhance their cash flow without having to wait for outstanding receivables to be paid.

What is invoice factoring?

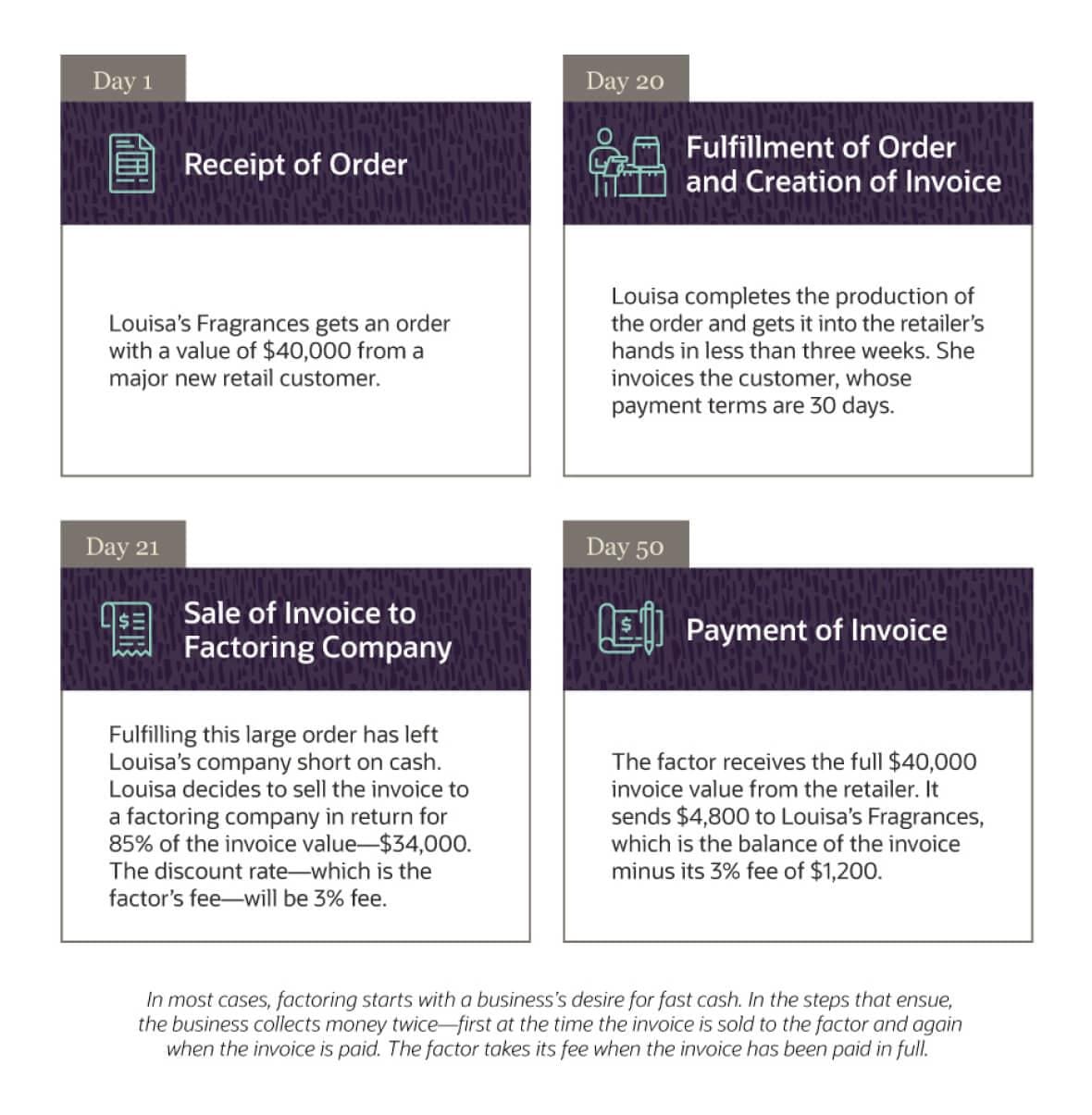

Invoice factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third-party company, called a factor. This is done to improve the business’ cash flow.

With this brief introduction to invoice factoring, we invite you to delve into the next sections for more information on how it works and how it can benefit small businesses.

II. The Process of Invoice Factoring

For many small business owners, navigating invoice factoring can be a daunting task. This section aims to simplify the process and help you understand how invoice factoring works.

Choosing an invoice factoring company

Picking the right factoring company is crucial, as this will significantly impact your business’s financial health. Essential factors to consider include the company’s credibility, funding speed, contract terms, and fee structure. Stay tuned for a comprehensive comparison of top factoring companies in the next section.

III. Fees and Terms of Invoice Factoring

Taking both the financial benefits and obligations into account is essential before engaging in invoice factoring.

Understanding factoring fees

The fees associated with invoice factoring depend on the time it takes your customers to pay their owed invoices. Typically, you’ll face a factor rate of 1-5% per month.

Types of factoring agreements

There are typically two types of factoring – recourse (where you bear the risk of uncollected invoices) and non-recourse (where the factoring company takes on the risk).

Term lengths and renewal options

Contract duration varies between factoring companies, from short-term month-to-month options to longer annual contracts. Renewal terms also vary based on individual company policies and your practices.

IV. Qualifying for Invoice Factoring

When it comes to invoice factoring, it’s critical for small business owners to understand the eligibility criteria. Unlike traditional financing methods, invoice factoring focuses on the following factors.

Criteria for eligibility

First and foremost, Invoice Age. For an invoice to be eligible, it should be due within 30-90 days. Secondly, factoring companies will look if the business has No Legal Problems that could affect its credibility.

Creditworthiness of customers

An essential criteria for invoice factoring is the creditworthiness of the Customer. The factoring company will assess the credit history and reliability of your customer because they will ultimately be the one who will be paying the invoice.

Types of invoices that can be factored

Mostly all types of invoices can be factored, including:

- Sales invoices

- Professional services invoices

- Construction invoices

In conclusion, qualifying for invoice factoring isn’t as stringent as other traditional financing options. But small businesses still have to meet certain requirements to take advantage of this financial tool.

V. Pros and Cons of Invoice Factoring

Invoice factoring can be a powerful tool for small businesses that need to unlock cash flow fast. However, there are both upsides and downsides to this financial arrangement. Let’s dive into the main advantages and potential drawbacks of invoice factoring.

Advantages of invoice factoring

- Fast Access to Cash: Invoice factoring provides businesses with immediate access to cash, enabling them to manage cash flow better.

- Ease of Approval: Compared to traditional loans, invoice factoring can have easier approval processes and requirements.

Disadvantages and potential drawbacks

- Costly: Invoice factoring can be more expensive than traditional lending due to various fees and the factoring company discount rate.

- Potential Impact on Customer Relationships: If a factoring company is responsible for your company’s invoice collection, customer interactions with them could influence your business relationships.

VI. Case Studies and Success Stories

To bring invoice factoring to life, let’s have a look at some real examples.

Real-life examples of small businesses using invoice factoring

Consider the case of a small tech start-up, struggling to stay afloat due to delayed customer payments. They turned to invoice factoring to boost cash flow, selling their invoices to a factor, which provided them instant cash, thus alleviating their financial strain and allowing reinvestment into business growth.

How invoice factoring helped their cash flow and growth

With the help of invoice factoring, the tech start-up was able to manage their cash flow more effectively and even expand their operations, proving that invoice factoring can be a legitimate and helpful avenue for small business financing.

VII. Alternatives to Invoice Factoring

While invoice factoring can be a boon for many businesses, it may not suit every enterprise. Fortunately, there are alternative financing options worth considering.

Other financing options for small businesses

- Bank Loans: Traditional bank loans often offer competitive interest rates but might require robust credit history.

- SBA Loans: The U.S. Small Business Administration (SBA) guarantees loans provided by lenders to small businesses, making it easier for these businesses to secure funds.

- Business Line of Credit: Instead of a lump sum, businesses can access funds as needed, making it more flexible.

Comparison of various financing methods will be discussed in the next section.

VIII. Tips for Choosing an Invoice Factoring Company

Choosing the right invoice factoring company is crucial in securing your business’s financial future. Here are key factors to consider and questions to ask before signing an agreement.

Factors to consider when selecting a factoring partner

– **Reputation**: Check reviews and ask for references.- **Cost**: Understand their fees, interest rates, and any possible hidden charges.- **Contract terms**: Consider the length of the contract, and what happens if you want to terminate early.

Questions to ask before signing an agreement

– What are their terms for approving invoices?- Can they provide a dedicated account manager? – How quickly will you receive funds after submitting an invoice?

Remember, choosing a factoring partner is a significant decision. Do your research to ensure the company is a good fit for your business.