Introduction

Navigating through your Medicare options can sometimes feel like an overwhelming task with its myriad of choices. But not to fret, this brief guide is here to help you understand some basics.

Understanding Medicare: An Overview

The U.S. Government’s federal insurance program, otherwise known as Medicare, caters to citizens who are 65 years or older, some younger individuals with certain disabilities, and people with End-Stage Renal Disease. The program encompasses different parts, referred to as Part A, B, C, and D, each offering different coverage for hospital stays, medical services, prescription drugs, and more.

Importance of Making Informed Medicare Choices

The key to making the most of your Medicare benefits lies in understanding the different parts and the benefits each provides. Weighing these options carefully, in light of your individual health needs and budget, would ensure the most beneficial decision for your overall wellbeing.

Original Medicare (Parts A and B)

Navigating through Medicare’s various parts, A and B, also known as Original Medicare, is essential for those seeking proper medical coverage. Understanding these parts will allow you to make the best decisions for your health.

Coverage and Benefits of Original Medicare

Original Medicare provides fundamental coverage for a broad array of healthcare services and procedures, including inpatient hospital stays and outpatient care. It offers a solid healthcare foundation, though it may not cover every health need.

Exploring Medicare Part A

Medicare Part A predominantly covers inpatient hospital care, skilled nursing facility stays, hospice care, and some home health visits.

Exploring Medicare Part B

On the other hand, Medicare Part B includes medically necessary services such as doctor visits, outpatient care, preventive services, and medical equipment.

Each part caters to unique health needs, contributing to comprehensive health coverage. By understanding the variances, you can better utilize the services provided.

Medicare Advantage (Part C)

Every step towards your health matters! This is even more critical when it comes to making the right choice for your Medicare plan. Comprehending the basics of Medicare Advantage (Part C) is a good starting point.

Key Features and Benefits of Medicare Advantage

Medicare Advantage is an all-in-one alternative to Original Medicare. This plan includes parts A & B and typically part D coverage too. Some plans may offer additional benefits like vision, hearing, dental, and more health and wellness programs.

Comparing Medicare Advantage Plans

Different Medicare Advantage plans have varying costs and benefits. Make sure to compare the different options that are available and opt for the one that best suits your health needs and budget.

Determining if Medicare Advantage is Right for You

Whether Medicare Advantage is suitable for you depends on various aspects like the network of doctors, out-of-pocket maximums, and other individual healthcare needs. It’s all about striking a balance between affordability and the right kind of coverage.

Consider your options carefully, having the right Medicare plan ensures that you are protected and can enjoy peace of mind when it comes to your healthcare.

Prescription Drug Coverage (Part D)

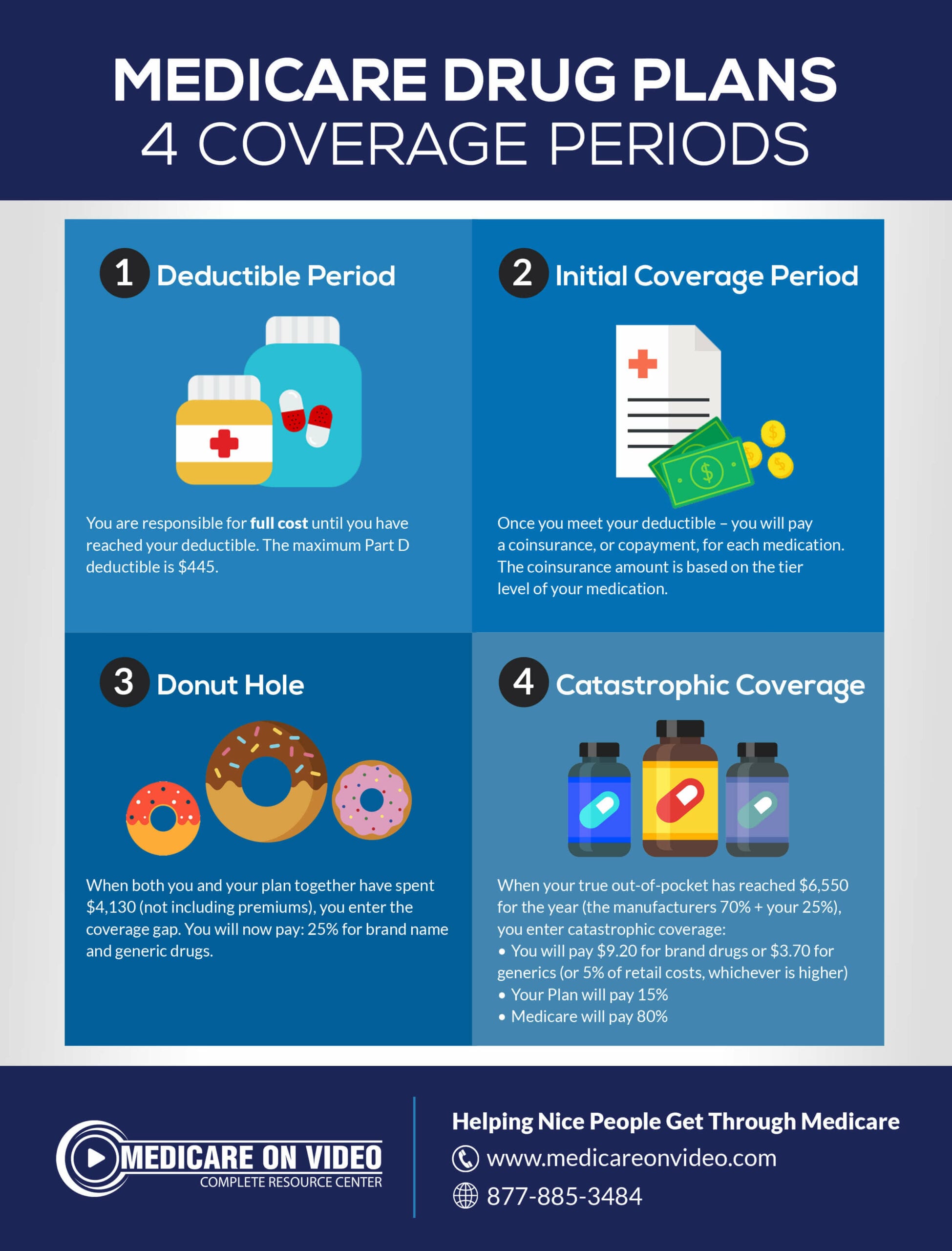

Understanding Medicare Part D

When it comes to understanding your Medicare choices, one important aspect to consider is Prescription Drug Coverage, also known as Medicare Part D. This coverage is designed to help you pay for prescription medications. It is available to everyone who is eligible for Medicare, regardless of income or health status.

Choosing the Right Prescription Drug Plan

Choosing the right Prescription Drug Plan can seem overwhelming, but it doesn’t have to be. Start by making a list of your current medications and estimating your future needs. Then, compare the different plans available in your area, taking into account factors such as monthly premiums, drug coverage, and participating pharmacies. Don’t forget to consider any additional benefits or discounts offered by the plans.

Tips for Saving Money on Prescription Medications

Saving money on prescription medications is important for many Medicare beneficiaries. Here are a few tips to help you save:

- Comparison shop: Compare prices at different pharmacies to find the best deals.

- Ask about generic alternatives: Generic drugs can be significantly cheaper than brand-name medications and are just as effective.

- Explore patient assistance programs: Some pharmaceutical companies offer programs to help eligible individuals access their medications at a reduced cost or even for free.

- Consider mail-order pharmacies: Mail-order pharmacies often offer discounted prices and convenient delivery options.

By understanding Medicare Part D, choosing the right Prescription Drug Plan, and implementing money-saving strategies, you can make the most of your Medicare benefits and ensure affordable access to the medications you need.

Medicare Supplement Insurance (Medigap)

What is Medigap and How Does it Work?

Understanding your Medicare choices is crucial for ensuring you receive the healthcare coverage you need. One option to consider is Medicare Supplement Insurance, also known as Medigap.

Medigap is a private insurance policy that helps cover the “gaps” in Original Medicare, such as copayments, coinsurance, and deductibles. It works alongside your Medicare Part A and Part B coverage, providing you with additional financial protection.

Different Types of Medigap Plans

There are several Medigap plans available, labeled A through N, each offering different coverage levels. These plans are standardized across most states, meaning the benefits will be the same regardless of the insurance company you choose. However, the premium prices may vary, so it’s important to compare options.

Considering Medigap as a Supplement to Original Medicare

If you have Original Medicare and want more predictable healthcare costs, Medigap can be a valuable supplement. Having Medigap coverage can help protect you against unexpected medical expenses and give you peace of mind.

It’s important to note that Medigap policies do not cover prescription drugs, so if you need prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Overall, understanding your Medicare choices and considering Medigap coverage can help ensure you have comprehensive healthcare coverage that meets your needs. Consult with a trusted insurance professional to explore your options and find the best plan for you.

Making Your Medicare Choices

Factors to Consider When Choosing a Medicare Plan

Understanding your Medicare choices is crucial to ensure you get the coverage you need. Here are some factors to consider when making your Medicare plan selection:

- Coverage Needs: Assess your healthcare needs, including prescription drugs, specialists, and hospital stays. Choose a plan that covers the services you require.

- Costs: Consider premiums, deductibles, copayments, and coinsurance when comparing plans. Make sure the plan fits your budget.

Enrollment Periods and Deadlines

It’s important to be aware of the enrollment periods and deadlines for Medicare. These include Initial Enrollment Period, General Enrollment Period, and Special Enrollment Periods. Missing these deadlines could result in penalties or delayed coverage.

Getting Help and Making Informed Decisions

Make sure to gather information and seek assistance when making Medicare choices. Government resources like Medicare.gov and local counseling programs can provide guidance. Consulting family, friends, or insurance professionals can also help you make informed decisions that align with your healthcare needs and budget.

Conclusion

Understanding your Medicare choices is crucial for making informed decisions about your healthcare. By reviewing these options, you can ensure that you have the coverage that best meets your needs.

Reviewing Your Medicare Choices

Take the time to carefully review each Medicare option available to you. Consider factors such as your healthcare needs, budget, and preferences. Compare the different plans, including Original Medicare, Medicare Advantage, and Medicare Supplement, to find the one that aligns with your specific requirements.

Next Steps in Navigating Medicare

Once you have reviewed your Medicare choices, the next step is to enroll in the plan that you have selected. You can do this during the designated enrollment periods or when you are first eligible for Medicare. It is advisable to seek guidance from a Medicare expert or reach out to the Medicare website for detailed instructions on how to proceed.

Frequently Asked Questions about Medicare Choices

- Can I switch Medicare plans at any time?

No, there are specific periods, such as the Annual Enrollment Period, when you can switch or make changes to your Medicare plan. Outside of these periods, you may have limited options to make changes.

- What are the costs involved in Medicare?

Medicare costs can vary depending on the plan you choose. Consider premiums, deductibles, copayments, and coinsurance when evaluating the total cost of your Medicare coverage.

- Will my current doctors be covered under Medicare?

It is essential to check if your preferred healthcare providers accept the Medicare plan you are considering. Network coverage may vary between different Medicare plans.

Remember, understanding your Medicare choices empowers you to make informed decisions about your healthcare coverage. Take the time to explore your options and seek assistance whenever needed.