Introduction to Critical Illness Insurance

When it comes to protecting your financial well-being and peace of mind, one insurance policy that you should consider is Critical Illness Insurance. This type of insurance provides a lump sum payment if you are diagnosed with a critical illness covered by the policy. It is designed to help you cope with the financial burden that may arise from medical expenses, loss of income, or other costs associated with a serious illness.

What is Critical Illness Insurance and its purpose

Critical Illness Insurance is a type of coverage that pays out a lump sum benefit if you are diagnosed with a specified critical illness such as cancer, heart attack, stroke, or organ failure. The purpose of this insurance is to provide financial support during a challenging time, allowing you to focus on your recovery without worrying about the financial implications. The lump sum payment can be used for medical treatments, rehabilitation, living expenses, or any other needs that may arise.

The importance of considering Critical Illness Insurance

Considering Critical Illness Insurance is important for several reasons. First and foremost, it provides financial protection in case you are diagnosed with a critical illness. The lump sum payment can help cover medical bills, ongoing treatment costs, and everyday expenses while you are unable to work. Additionally, having this insurance can provide peace of mind knowing that you have a safety net in place during a difficult time. It allows you to focus on your health and recovery without the added stress of financial worries.

In conclusion, Critical Illness Insurance is an essential form of protection that can provide much-needed financial support during a critical illness. It offers peace of mind and allows you to prioritize your health and well-being without the added burden of financial stress.

Understanding Critical Illness Coverage

Types of illnesses covered by Critical Illness Insurance

Critical Illness Insurance is a type of coverage that provides a lump sum payment if the policyholder is diagnosed with a specified critical illness. These illnesses can vary depending on the insurance provider, but common examples include cancer, heart attack, stroke, and organ failure. It is important to carefully review the policy to understand which illnesses are covered and any specific criteria that must be met for a claim to be paid out.

Benefits and limitations of Critical Illness Insurance

The main benefit of Critical Illness Insurance is the financial support it provides during a challenging time. The lump sum payment can be used to cover medical expenses, replace lost income, or make necessary lifestyle adjustments. However, it is essential to consider the limitations of this insurance. Policies may have waiting periods before a claim can be made, exclusions for pre-existing conditions, and specific criteria for each covered illness. It is crucial to thoroughly understand the policy terms and conditions before purchasing Critical Illness Insurance to ensure it meets your specific needs.

Financial Protection and Peace of Mind

When it comes to safeguarding your financial future, one type of insurance that you should consider is Critical Illness Insurance. This coverage provides financial protection and peace of mind in challenging times.

How Critical Illness Insurance provides financial stability in challenging times

Critical Illness Insurance is designed to provide a lump sum payment if you are diagnosed with a covered illness. This payment can be used to cover medical expenses, replace lost income, or even make necessary lifestyle adjustments during your recovery. Having this financial support can alleviate the stress and burden that often accompanies a serious illness.

The psychological impact of having Critical Illness Insurance

In addition to the financial benefits, having Critical Illness Insurance can also have a positive psychological impact. Knowing that you have this coverage can give you peace of mind, knowing that you are prepared for the unexpected. It can also provide a sense of security for your loved ones, knowing that they will be taken care of if something were to happen to you.

In conclusion, Critical Illness Insurance offers both financial protection and peace of mind. It provides a safety net during challenging times and ensures that you and your loved ones are financially secure in the face of a serious illness. Consider this type of insurance as part of your overall financial plan to protect yourself and your family’s future.

Supplementing Health Insurance

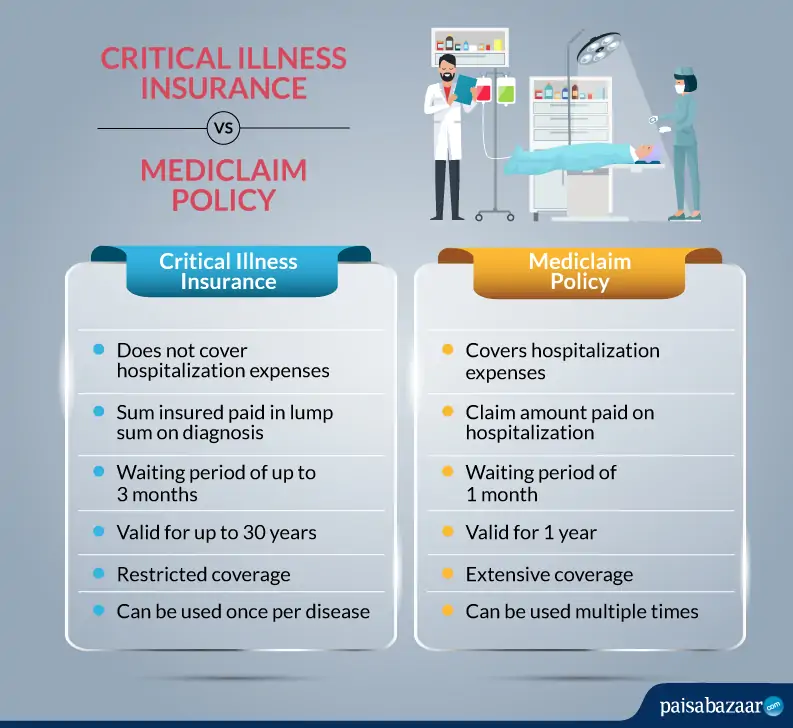

Why traditional health insurance may not be enough

When it comes to protecting your health and financial well-being, relying solely on traditional health insurance may not be sufficient. While health insurance covers medical expenses for illnesses and injuries, it often falls short when it comes to critical illnesses.

The role of Critical Illness Insurance as a supplement to health insurance

Critical Illness Insurance is designed to provide financial support in the event of a serious illness such as cancer, heart attack, or stroke. It offers a lump sum payment that can be used to cover medical expenses, treatment costs, and other financial obligations that may arise during a critical illness.

By considering Critical Illness Insurance as a supplement to your existing health insurance, you can ensure that you are adequately protected against the financial burden that comes with a critical illness. It provides peace of mind knowing that you have additional support during challenging times.

Remember, prevention is always better than cure, but having the right insurance coverage in place can provide a safety net for unexpected circumstances.

Coverage for Medical Expenses

When it comes to protecting your health and financial well-being, critical illness insurance is a valuable consideration. This type of insurance provides coverage for medical costs that may not be covered by your regular health insurance policy.

How Critical Illness Insurance helps cover medical costs not covered by health insurance

While health insurance typically covers a range of medical expenses, there are certain costs that may not be included. Critical illness insurance can help fill in the gaps by providing coverage for expenses such as:

- Experimental treatments

- Alternative therapies

- Home healthcare

- Travel and accommodation expenses for out-of-network treatments

- Rehabilitation services

Examples of medical expenses covered by Critical Illness Insurance

Critical illness insurance can provide financial support for various medical conditions, including:

- Cancer treatments, including chemotherapy and radiation therapy

- Heart surgeries and procedures

- Organ transplants

- Stroke treatments

- Kidney dialysis

By considering critical illness insurance, you can have peace of mind knowing that you are protected financially in the event of a serious illness. It can help alleviate the burden of medical expenses and allow you to focus on your recovery without worrying about the cost.