Introduction

The landscape of insurance fraud continually shifts and evolves in response to emerging trends, technologies, and tactics.

The Growing Problem of Insurance Fraud

Insurance fraud is an intentional deception committed for illegal gain. It is a growing concern and has become increasingly sophisticated with advancing technologies. The advent of digital platforms has not only expanded the opportunities for deceitful activities but also created new challenges for insurance companies that attempt to detect and halt fraud.

The Impact of Insurance Fraud on Individuals and Businesses

Insurance fraud doesn’t only affect insurance companies. It also hits individuals and businesses hard. They face inflated premiums as companies attempt to recoup the losses resulting from deceitful claims. This, in turn, strains their finances and sometimes impacts their capacity to maintain necessary insurance coverage. Thus, the ripple effects of insurance fraud reach far and wide, affecting all stakeholders in the sector.

The Changing Landscape of Insurance Fraud

Insurance fraud is an ongoing issue that has evolved with the advancement of technology and changing criminal tactics. To combat this, insurance companies need to adapt and implement effective strategies to detect and prevent fraud.

Utilizing Data Analytics in Fraud Detection

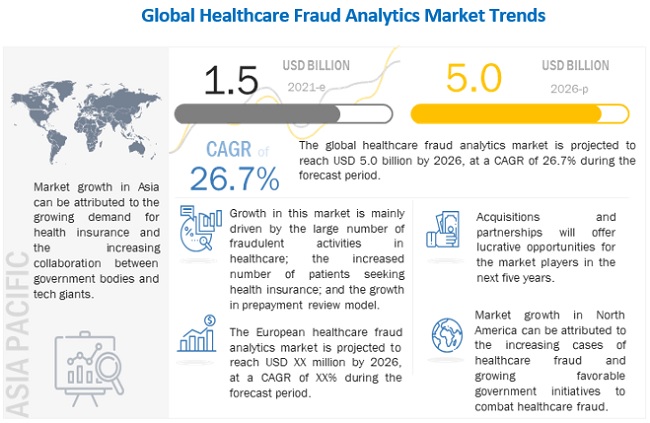

Data analytics plays a crucial role in identifying patterns and anomalies that could indicate fraudulent activities. By analyzing large volumes of data, insurance companies can uncover suspicious claims and take proactive measures to mitigate potential losses.

Enhancing Cybersecurity Measures in Insurance Companies

As insurance transactions increasingly occur online, cyber threats have become a significant concern. Insurance companies must invest in robust cybersecurity measures to protect sensitive customer information and prevent unauthorized access to their systems.

Collaboration between Insurers and Law Enforcement Agencies

To effectively combat insurance fraud, it is essential for insurers to collaborate closely with law enforcement agencies. Sharing information and providing support can lead to successful investigations and prosecutions, deterring criminals from engaging in fraudulent activities.

In conclusion, insurance fraud is an ever-evolving challenge that demands proactive measures from insurance companies. By utilizing data analytics, enhancing cybersecurity measures, and fostering collaboration with law enforcement agencies, insurers can better detect and prevent insurance fraud, safeguarding the interests of both insurers and policyholders.

Consequences and Legal Actions

Legal Consequences for Insurance Fraud

Insurance fraud is a serious offense that can result in severe legal consequences. Those who engage in fraudulent activities can face criminal charges, fines, and even imprisonment. In many jurisdictions, insurance fraud is considered a felony, and convictions can lead to lengthy prison sentences.

Examples of High-Profile Insurance Fraud Cases

There have been numerous high-profile insurance fraud cases throughout history. From staged accidents to fraudulent claims, these cases highlight the lengths some individuals go to deceive insurance companies for financial gain. Notable examples include the case of Martin Frankel, who orchestrated a massive insurance swindle, and the case of Janet Hardt, who faked her husband’s death to claim life insurance benefits.

The Role of Insurance Investigators and Adjusters

Insurance investigators and adjusters play a crucial role in the detection and prevention of insurance fraud. These professionals are trained to identify suspicious claims and conduct thorough investigations to gather evidence. By working closely with law enforcement agencies and utilizing various investigative techniques, they help

Technology and Innovation in Combating Insurance Fraud

Insurance fraud has become an increasingly prevalent problem, costing the insurance industry billions of dollars each year. However, advancements in technology and innovation are revolutionizing the fight against fraud.

The Use of AI and Machine Learning in Fraud Detection

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are being used to analyze vast amounts of data and identify patterns that indicate fraudulent activity. These technologies can detect anomalies in claims, flagging suspicious cases for further investigation. As AI and ML systems learn and adapt, they become more effective at detecting fraudulent behavior, helping insurance companies protect themselves and their customers.

Blockchain Technology for Enhanced Security in Insurance Processes

Blockchain technology offers increased security and transparency by creating an immutable ledger of transactions. This makes it ideal for preventing insurance fraud by ensuring the accuracy and integrity of data. With blockchain, insurance companies can securely store and verify policyholder information, preventing identity theft and fraudulent claims.

Telematics and Usage-Based Insurance to Mitigate Fraud Risks

Telematics, in combination with usage-based insurance, is another innovative approach to reducing fraud risks. By using devices that monitor driving behavior and collect data, insurance companies can accurately assess risk and provide fair premiums. This technology prevents fraud by eliminating the ability to manipulate information, such as mileage or driving habits, which can lead to inflated claims.

In conclusion, the changing landscape of insurance fraud is being shaped by advancements in technology and innovation. AI and machine learning, blockchain, and telematics are powerful tools that insurance companies can utilize to combat fraud and protect both themselves and their customers. By staying ahead of fraudsters, the insurance industry can create a safer and more secure environment for all stakeholders involved.

Future Trends in Insurance Fraud

The Rise of Digital Fraud Schemes

In today’s highly connected world, insurance fraudsters are finding new ways to exploit technology for their gain. Digital fraud schemes, such as fake websites, phishing scams, and identity theft, are on the rise. Insurers need to stay vigilant and adapt their fraud prevention systems to combat these ever-evolving tactics.

The Impact of COVID-19 on Insurance Fraud

The COVID-19 pandemic has created new opportunities for insurance fraudsters. From fraudulent claims related to the virus to scams exploiting the uncertainty and financial hardships caused by the pandemic, insurers are facing increased risks. It is crucial for insurance companies to strengthen their fraud detection capabilities and collaborate with law enforcement agencies to combat these emerging threats.

The Importance of Continued Innovation in Fraud Prevention

As fraudsters become more sophisticated, insurance companies must invest in innovative technologies and strategies to stay one step ahead. AI and machine learning algorithms can help identify patterns and anomalies, flagging potential fraudulent activities. Collaboration between insurers, regulators, and technology providers is vital to developing effective fraud prevention solutions for the future.

Overall, insurance fraud is a dynamic and ever-evolving challenge. By staying proactive, embracing technology, and fostering industry collaboration, insurers can protect themselves and their policyholders against the changing landscape of insurance fraud.

Conclusion

The current landscape of insurance fraud is evolving rapidly, with fraudsters finding new and sophisticated ways to exploit the system for personal gain. It is crucial for insurance companies, law enforcement agencies, and other stakeholders to recognize the urgency of addressing this issue. By implementing collaborative and innovative strategies, the fight against insurance fraud can be more effective.

The Urgency of Addressing Insurance Fraud

Insurance fraud affects not only insurance companies but also policyholders who end up paying higher premiums. It is estimated that insurance fraud costs billions of dollars annually, leading to increased costs for everyone involved.

Collaboration and Innovation as Key Strategies

To combat insurance fraud effectively, a collaborative approach is essential. Insurance companies, law enforcement agencies, and regulatory bodies need to work together, sharing information and resources. Embracing innovative technologies like data analytics and artificial intelligence can also help identify patterns and detect fraudulent activities more efficiently.

Frequently Asked Questions

- What are some common types of insurance fraud?

- How can insurance companies prevent fraud?

- Are there any legal consequences for insurance fraud?

- What role does technology play in fighting insurance fraud?